Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 21, 2017

UK inflation jumps to highest since 2013, breaching Bank of England target

UK inflation surged above the Bank of England's 2.0% target for the first time in over three years in February, underscoring how consumer spending is likely to be increasingly squeezed by higher prices in 2017.

The Bank of England still looks likely to look through the upturn in inflation, but much will depend on the extent to which consumer spending and wage growth will be dampened this year.

Inflation breaches Bank's target

Official data show inflation rising to its highest since September 2013. Consumer prices rose 2.3% on a year ago, according to the Office for National Statistics, with the rate of inflation picking up from 1.8% in January and just 0.3% this time last year.

Further upward pressure on consumer prices looks almost certain as firms pass rising costs onto customers in coming months. Recent PMI survey data show companies' input costs increasing at a rate not exceeded since before the global financial crisis, due mainly to import costs surging higher as a result of the weakened pound. The same survey data indicate that average prices charged for goods and services are meanwhile rising at the fastest rate for almost six years.

Given the recent upturn in firms' costs, we would expect to see inflation edge above 3% by the end of the year.

Inflation and producer prices

Policymaker dilemma

The upturn in inflation will lead to increased speculation that the Bank of England will turn more hawkish. One member of the Monetary Policy Committee has already voted to raise interest rates.

However, it remains likely that policymakers will adopt an increasingly dovish tone in coming months, despite the rise in inflation, as the economy slows due to consumers being squeezed by low pay and rising prices.

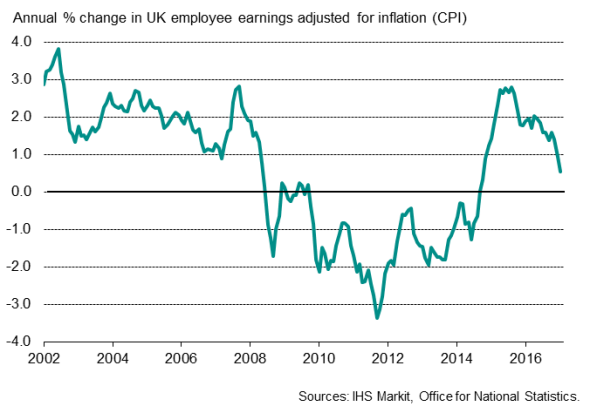

Pay squeeze

With employee total pay growth having slowed to 2.2%, or 2.3% excluding bonuses, real pay is likely to start falling at an increased rate in the coming months as inflation lifts higher. Underlying pay growth has likewise slowed, down to 0.4% once inflation is taken into account. Recent survey data have already shown household finances being squeezed to one of the greatest extents for over two years in February amid low pay and rising prices.

Real employee pay growth

It's wage growth and consumer spending rather than headline inflation that will therefore be important indicators of Bank of England policy. For interest rates to remain on hold, we need to see consumer spending growth wane in coming months and wage growth to remain subdued. Any surprise resilience of consumers and feed-through of rising inflation into wage pressures will likely result in increased speculation that the next move by the MPC will be a rate hike.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032017-Economics-UK-inflation-jumps-to-highest-since-2013.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032017-Economics-UK-inflation-jumps-to-highest-since-2013.html&text=UK+inflation+jumps+to+highest+since+2013%2c+breaching+Bank+of+England+target","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032017-Economics-UK-inflation-jumps-to-highest-since-2013.html","enabled":true},{"name":"email","url":"?subject=UK inflation jumps to highest since 2013, breaching Bank of England target&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032017-Economics-UK-inflation-jumps-to-highest-since-2013.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+inflation+jumps+to+highest+since+2013%2c+breaching+Bank+of+England+target http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21032017-Economics-UK-inflation-jumps-to-highest-since-2013.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}