Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 20, 2015

Tesco's CDS tightens ahead of index inclusion

Embattled UK supermarket, Tesco has joined the Markit iTraxx Crossover index in the semi-annual roll, having seen its credit worthiness improve; shrugging off January's concerns.

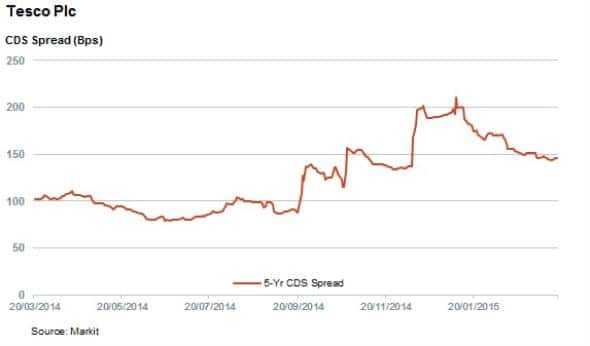

- Tesco 5-Year CDS spreads are over 60bps tighter than the high seen in January

- The iTraxx Europe Crossover has tightened by nearly a quarter since the start of the year

- Rival J Sainsbury has also seen its spread tighten

UK grocer Tesco lost its investment grade status in the opening week of January. The downgrade capped a tumultuous 12 months for the retailer which ceded market share and became embroiled in an accounting scandal, which led to the ousting of its chief executive.

The company has since announced plans to shutter underperforming stores and close its corporate headquarters. These steps have been well received by the market and the company's CDS spread is now much lower than at the start of the year.

Spreads tighten since downgrade

The days leading up to Tesco's downgrade marked a low water mark for the market's assessment of Tesco debt, when its 5 year CDS spread briefly surpassed 210bps. This occurred on January 8th, the day Moody's revoked the firm's investment grade status.

While the ratings agencies cited the long term nature of Tesco's turnaround strategy as a rationale for the downgrade, credit investors look be increasingly bullish about the company's prospects. CDS spreads have tightened steadily since January and are now trading 30% off the early January highs.

The latest spreads are still nearly twice the levels seen in June last year, however the tightening indicates that the market is putting increased faith in the company's recent actions.

Equity investors have also rallied behind the company and Tesco shares are up sharply from their lows at the start of the year.

iTraxx tightens

Despite the company's roller-coaster quarter, Tesco has joined the constituents of the Markit iTraxx Europe Crossover index. The index has also tightened by almost a quarter since the start of the year as European QE continues to boost risk assets across the region. It currently trades at 263bps.

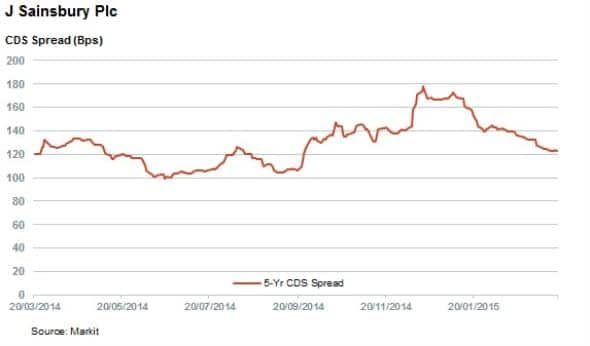

J Sainsbury

Tesco's recent operating headwinds were largely mirrored by peer, J Sainsbury. The grocer which also joins the iTraxx Crossover index in the current roll, has seen its spreads tighten in over the last three months after a spike in the closing weeks of last year. This indicates that at least some of Tesco's recent tightening could be attributed to the improving consumer sentiment across the UK.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032015-Credit-Tesco-s-CDS-tightens-ahead-of-index-inclusion.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032015-Credit-Tesco-s-CDS-tightens-ahead-of-index-inclusion.html&text=Tesco%27s+CDS+tightens+ahead+of+index+inclusion","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032015-Credit-Tesco-s-CDS-tightens-ahead-of-index-inclusion.html","enabled":true},{"name":"email","url":"?subject=Tesco's CDS tightens ahead of index inclusion&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032015-Credit-Tesco-s-CDS-tightens-ahead-of-index-inclusion.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tesco%27s+CDS+tightens+ahead+of+index+inclusion http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032015-Credit-Tesco-s-CDS-tightens-ahead-of-index-inclusion.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}