Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 19, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings in the week to come.

- Arc Group is the most shorted company after surging eight fold in the last year

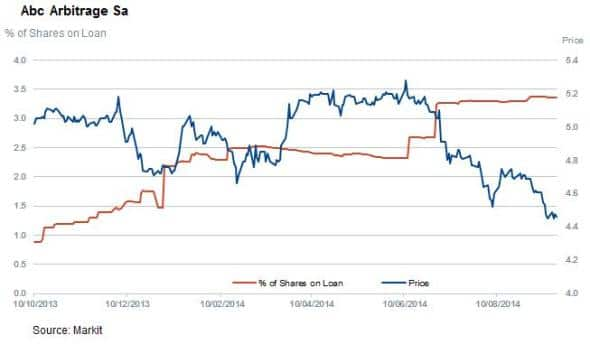

- Abc Arbitrage in France is the only European firm with any significant short interest reporting next week

- Materials firms make up two of the four most shorted companies in

Asia

North America

The second quarter earnings season continues to wind down next week with 192 companies announcing results across North America. Of these, there are 17 companies announcing earnings with more than 3% of their shares out on loan.

Arc Group World Wide is the most shorted company announcing results this week with 21% of its shares out on loan. This heavy demand to borrow comes after the firm, whose shares has been languishing in the $2 mark for the last four years, saw itrise by ten fold after reinventing itself as a 3D printing and prototyping company. Shorts don't seem sold on the recent reinvention as short interest has surged in step with shares.

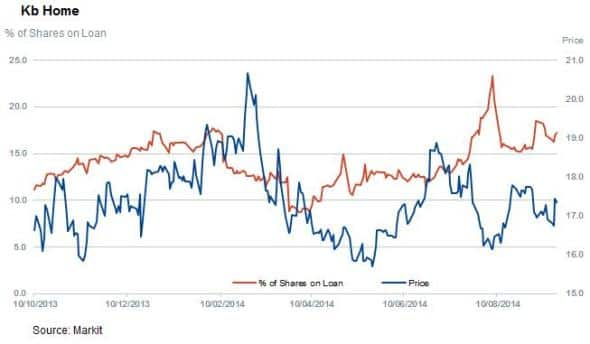

Second most shorted is homebuilder Kb Home which has seen demand to borrow jump by over 10% in the last four weeks. This looks to have been badly timed however as the firm's shares spiked in the last couple of days after fellow builder Lennar reported better than expected results which sent the sector up higher.

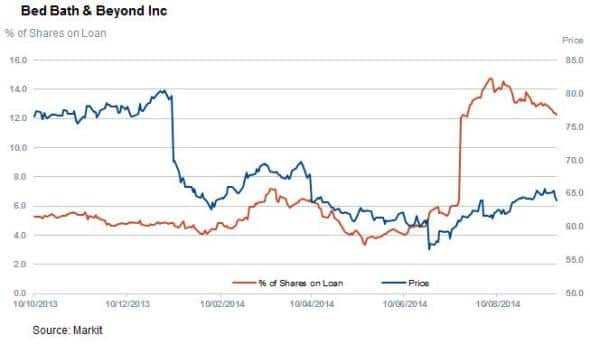

Sector wise, retailers continue to make poplar shorts, though this week's crop of popular shorts don't look to have been profitable of late, as all four firms currently see their shares trade near annual highs.

The most shorted firm in the retail space announcing results this week is Bed Bath & Beyond which has 12.2% of its shares out on loan. It's worth noting that the firm's current shorting activity seems to be driven by its recent buyback announcement which the firm aim to fund by issuing new debt.

The other retailers seeing heavy short interest are car firms Autozone and Carmax and sports apparel retailer Finish Line.

In the tech space, Blackberry continues to see heavy short interest. Interestingly, the firm's shares have proven buoyant despite the fact that it hasn't had a profitable quarter in over a year.

Europe

Light earnings flow next week only has one company announcing results with more than 3% of shares out on loan. This honour goes to French trading and asset management firm Abc Arbitrage which has 3% of its shares out on loan. The smallcap share has seen short interest triple in the last year as its shares fell by over 10%.

Asia

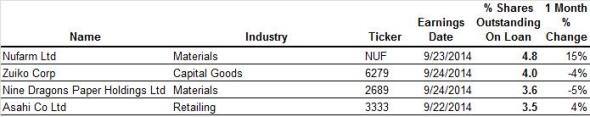

Asia also sees relatively low earnings activity with five firms seeing more than 3% of shares out on loan ahead of earnings.

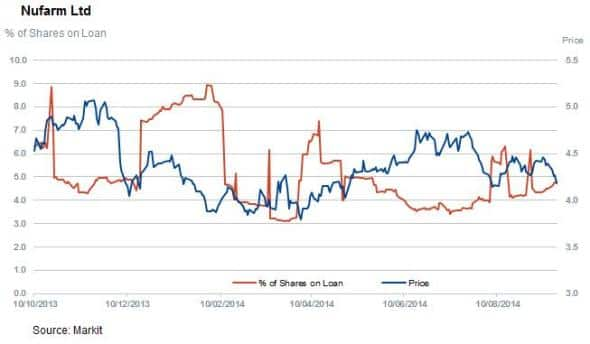

Materials continue to feature high amongst short seller's targets this week, with two of the four firms seeing heavy short interest ahead of imminent results coming from the sector.

Toping this week's list is pesticide and seed firm Nufarm Limited which has just under 5% of its shares out on loan. Analysts are expecting the firm to post a lower year on year profit in the coming earnings despite a 5% rise in revenue.

Also shorted in the space is Chinese paper firm Nine Dragon Paper Holdings which has 3.6% of shares out on loan.

Another interesting short target announcing result this week is Japanese Retailer Asahi which has 3.5% of shares out on loan. That number is three times higher than a year ago as short sellers zeroed in on Japanese retailers after recent price rises saw Japanese customers cut spending.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19092014-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19092014-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19092014-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19092014-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19092014-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}