Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 19, 2016

Brazil leads as credit risk in Latam region recedes

As momentum has gathered around the impeachment of Brazilian President Dilma Rousseff, credit risk in largest Latam economy has been falling.

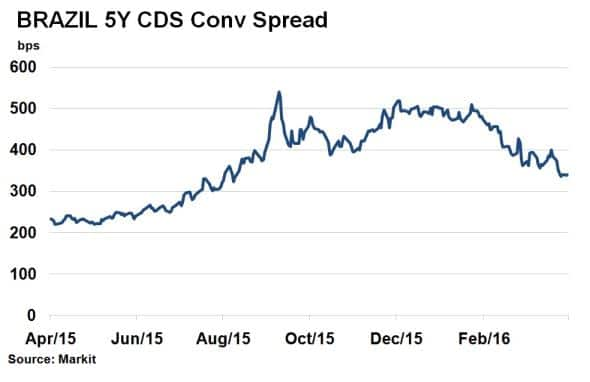

- Brazil's 5-yr sovereign CDS spread has tightened to its lowest level since last August

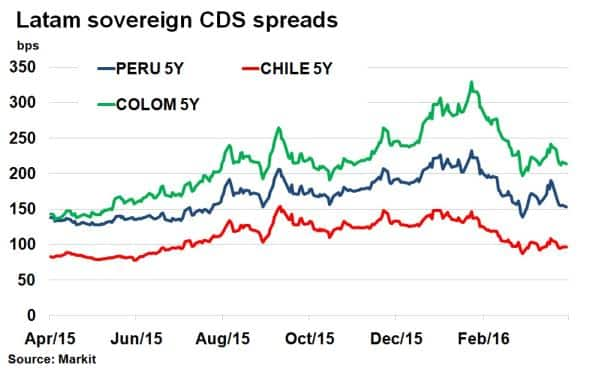

- Peru, Chile and Colombia have all seen a 35% tightening in sovereign credit spreads

- Markit iBoxx USD Emerging Markets Corporates LatAm Index has returned 7.7% this year

Credit markets reacted positively after Brazil's congress voted in favour of impeaching President Dilma Rousseff on Sunday.

Spurred on by Brazil and stronger commodity prices, the past couple of months have also seen perceived credit risk in the wider Latam region tumble. The buoyant mood in the region was confirmed by the strong investor demand for Argentina's comeback bond issue.

Brazil's falling credit risk

It's been a tough past year for Brazil's economy, battered by weak commodity prices, slowing global trade and significant political risk.

Brazil's economy shrank 3.8% in 2015 and this year's IMF forecasts looks just as bleak. Scandal and corruption surrounding Brazil's state controlled oil company Petrobras and economic mismanagement over the years has dented investor confidence. Markets see the ousting of Rousseff as a path that will ultimately lead to reforms needed to get the country out of recession.

The heightening prospect of a new government to tackle Brazil's economic woes was enough to send Brazil's 5-yr CDS spread to its lowest level since last August. Spreads had reached as high as 500bps in January but have since tightened 159bps to 341bps, according to Markit's CDS pricing service.

A buoyant region

The optimism in Brazil has also spread to the wider Latam region with Peru, Chile and Colombia all seeing a 35% tightening in sovereign credit spreads since January's highs.

The improved sentiment has much to do with stronger commodity prices, which have gained 3.76% so far this year. Colombia (Oil, Coffee), Peru (Copper, Oil) and Chile (Copper) are all heavily reliant on commodities through export revenues.

The Latam region also welcomed the return of Argentina to international bond markets after a fifteen year hiatus, to strong investor demand.

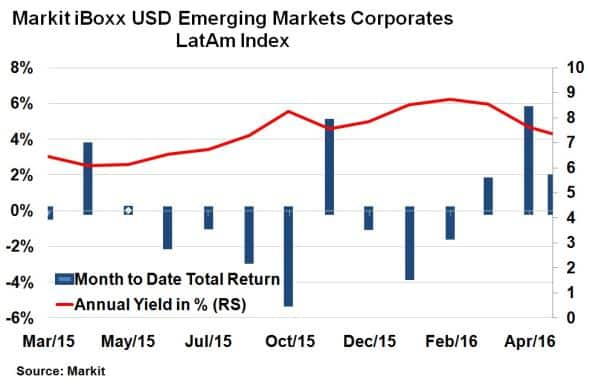

From an investor's standpoint, bond performance in the region has been strong so far this year. US dollar denominated corporate bonds, as represented by the Markit iBoxx USD Emerging Markets Corporates LatAm Index, have returned 7.7% in 2016, with March proving particularly lucrative. This has meant yields (which move inversely to price) in the sector have dropped below 7.5% for the first time in six months.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042016-Credit-Brazil-leads-as-credit-risk-in-Latam-region-recedes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042016-Credit-Brazil-leads-as-credit-risk-in-Latam-region-recedes.html&text=Brazil+leads+as+credit+risk+in+Latam+region+recedes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042016-Credit-Brazil-leads-as-credit-risk-in-Latam-region-recedes.html","enabled":true},{"name":"email","url":"?subject=Brazil leads as credit risk in Latam region recedes&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042016-Credit-Brazil-leads-as-credit-risk-in-Latam-region-recedes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brazil+leads+as+credit+risk+in+Latam+region+recedes http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19042016-Credit-Brazil-leads-as-credit-risk-in-Latam-region-recedes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}