Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 19, 2015

Periphery banks continue to rebound

Bank yields in the European periphery nations have continued to rebound from post crisis lows; a trend that has accelerated in recent months.

- Spreads in Allied Irish Bank bonds maturing in 2019 have tightened by 0.6% over the last 12 months

- Iceland's first bank debt issuance since the crisis is trading above its listing price

- Irish covered bonds trade on a lower yield than the rest of the Euro denominated universe

European periphery credit has been on the rebound ever since the ECB president promised to do whatever it takes to keep the eurozone together. This in turn has had a positive effect on eurozone banks which continue to strengthen with a favourable economic backdrop and tighter regulation.

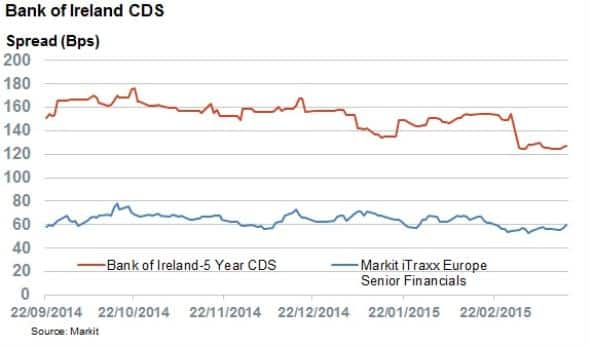

Recent action by the ECB has also taken substantial risk out of the market as evidenced by the Markit iTraxx Europe Senior Financials index which recently traded at 53bps, its lowest level since 2008 and half the level of 18 months ago.

This low risk environment has seen investors eagerly embrace exposure to periphery debt over the last few months.

Irish banks

Irish banks have largely benefited from the recent trend. The country's two largest banks, Allied Irish Bank (AIB) and Bank of Ireland, were both bailed out in 2008 and have seen positive sentiment of late.

Both banks have capitalised on this positivity by issuing five year debt to extend their senior euro curves. AIB's current April 2019 bond trades at 159bps over its benchmark, down from 222bps last April in a sign of investor confidence.

The sentiment was mirrored at the Bank of Ireland, which reported strong profits in February. Its 5-yr CDS spread dropped from 166bps last October to 127bps today. To put this into perspective, the iTraxx Europe Senior Financials remained relatively unchanged in the same period.

Iceland's milestone

Looking across Europe, there have been signs of a broader recovery. Iceland's banking sector was hit hardest during the financial crisis of 2008 when three of its largest banks collapsed, sending the economy into a prolonged recession.

Emerging from the ruins of Kaupting's bankruptcy, Arion Bank has slowly re-entered the capital markets. Earlier this month it issued its first benchmark sized euro denominated bond to strong investor demand, after failing last year due to weak investor appetite.

The improved economic outlook provided the right backdrop for the bank to successfully issue €300m in bonds. The issuance had initial pricing guidance set at 325bps over swaps, but it finally priced at a more advantageous 310bps, bolstered by strong demand. According to Markit bond pricing, the support in the primary market has filtered through into the secondary market with the current asset swap spread 3bps tighter.

Peripheral covered bonds

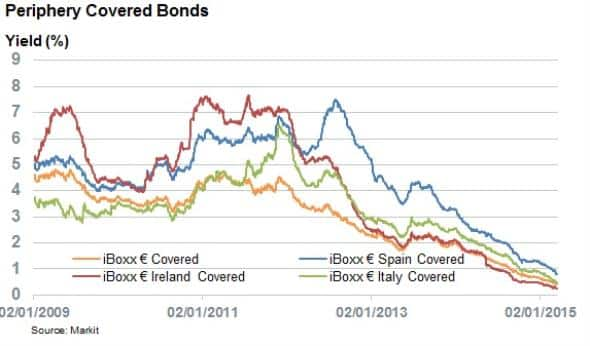

Covered bonds are a type of bank debt which allows recourse on the lenders assets in case of default. They also illustrate how the periphery nations have caught up with the core of Europe with yields having compressed since 2011.

Irish spreads have tightened against the broader covered bonds universe with the iBoxx € Ireland Covered index yielding 16bps less than the iBoxx € Covered. Back in 2011 the spread was greater than 200bps. The index includes names such as the Bank of Ireland and AIB. The performances of Italian and Spanish indices have mirrored the stability and growing optimism around peripheral banks.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-credit-periphery-banks-continue-to-rebound.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-credit-periphery-banks-continue-to-rebound.html&text=Periphery+banks+continue+to+rebound","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-credit-periphery-banks-continue-to-rebound.html","enabled":true},{"name":"email","url":"?subject=Periphery banks continue to rebound&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-credit-periphery-banks-continue-to-rebound.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Periphery+banks+continue+to+rebound http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19032015-credit-periphery-banks-continue-to-rebound.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}