Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 18, 2014

Shorts return to Turkey after elections

Short sellers have returned to the county in the wake of its recent ground breaking presidential election. We review the sectors targeted in the recent wave of negative sentiment.

- Average short interest is up by 24% in the last six weeks

- Materials firms have seen shorts jump as the lira plunges

- Both domestic and foreign ETF investors have continued to trim their exposure to the country in the last few weeks

Turkey's recent presidential election was greeted with caution by many, who saw it as another power grab by Prime Minister, now President, Tayyip Erdogan. Erdogan, who was barred from another term as prime minister due to term limit laws, has recently been criticised for cracking down on political rivals and limiting free speech. He has also used his new platform as head of state to threaten to cut ties with ratings agencies, which he accused of trying to undermine the country.

The increasingly aggressive rhetoric has not sat well with the FX market, as the Turkish lira has weakened 3.6% against the dollar, taking it to the lowest level since March.

Investor sentiment in the country's equity has also taken a turn for the worst as the country has seen a surge in short interest, while ETF investors have continued to pull funds from funds exposed to the country.

Shorts pile in

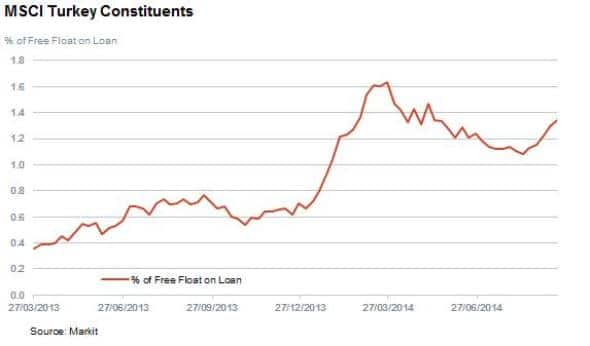

Short interest across constituents of the MSCI Turkey index has surged in the wake of the recent developments as investors took heed of the increasingly belligerent rhetoric and falling value of the lira. Average demand to borrow across the 83 constituents of the index has jumped by 24% since the August 10th election and now stands at 1.3% of free float. While the current average short interest has not reached the peaks seen in March of this year, the current spike in short interest does show that investors are increasingly wary of the latest developments.

Materials most shorted

Materials firms are currently the most targeted firms in the country with three firms among the fourteen companies seeing more than 3% of free float out on loan. This comes as the falling lira sees their business model disrupted.

Top among short targets in that space is mining and power plant builder Park Elektrik Uretim Madencilik Sanayi Ve Ticaret As, which has seen demand to borrow triple in the last month, and miner Koza Altin Isletmeleri As.

Utilities firms, another sector heavily dependent on the value of the lira, have also been targeted in recent weeks with Akenerji Elektrik Uretim As seeing shorts double in the last month to make it the most shored company in the country by far.

Banks also feature among the companies targeted by shorts with Yapi Ve Kredi Bankasi As and Tekstil Bankasi As both making the heavily shorted list.

Another firm to prove exposed to the lira is the country's largest manufacturing group, Koc Holding which sees 4.4% of its shares out on loan.

ETF investors continue to flee

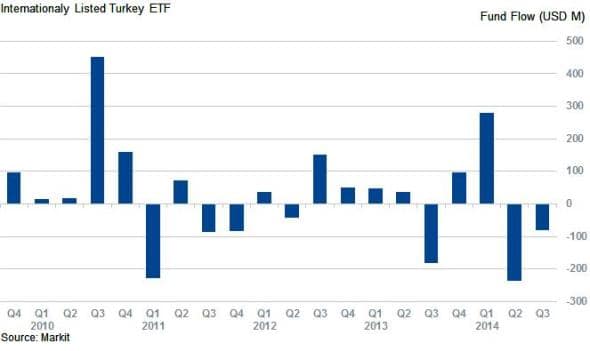

ETF investors have also been unsettled by the recent developments as both domestic and internationally listed Turkey exposed ETFs have continued to see outflows in the wake of the election, continuing a trend started at the beginning of the year. International investors have been the most eager to trim their Turkey exposure with the 10 non turkey listed funds seeing just under $80m of outflows since the start of July, extending a slide which started in the second quarter when investors pulled $236m from these funds.

Turkish investors have pulled $6.5m over the same period which represents roughly 8% of the assets managed by domestic ETFs.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092014-shorts-return-to-turkey-after-elections.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092014-shorts-return-to-turkey-after-elections.html&text=Shorts+return+to+Turkey+after+elections","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092014-shorts-return-to-turkey-after-elections.html","enabled":true},{"name":"email","url":"?subject=Shorts return to Turkey after elections&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092014-shorts-return-to-turkey-after-elections.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+return+to+Turkey+after+elections http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092014-shorts-return-to-turkey-after-elections.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}