Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 17, 2015

South Africa's credit woes deepen

A fear of global growth slowdown and subsequent weaker demand for commodities has seen investors exit South Africa's debt markets.

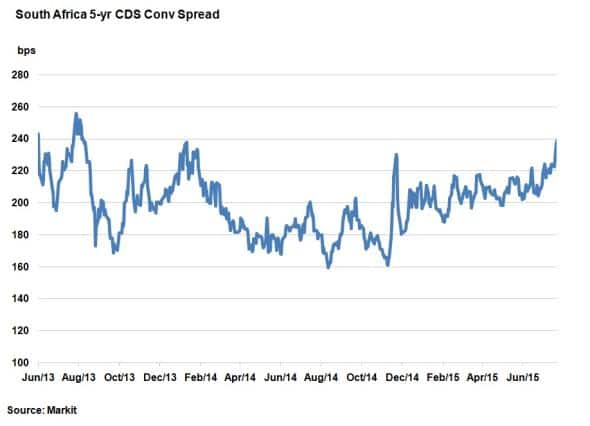

- South Africa's 5-yr CDS spread has hit a new two year high of 239bps

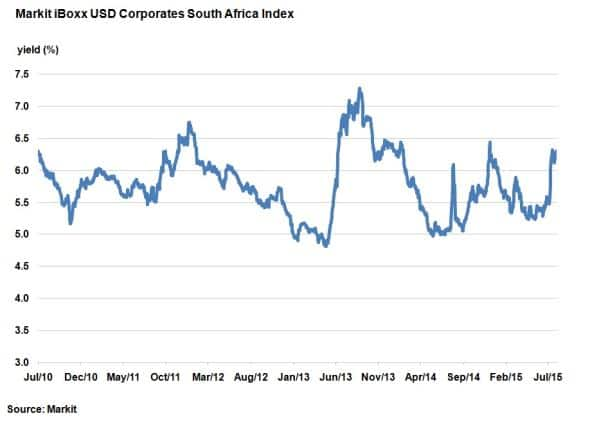

- Markit iBoxx USD Corporates South Africa Index yield has widened 90bps since July 1st

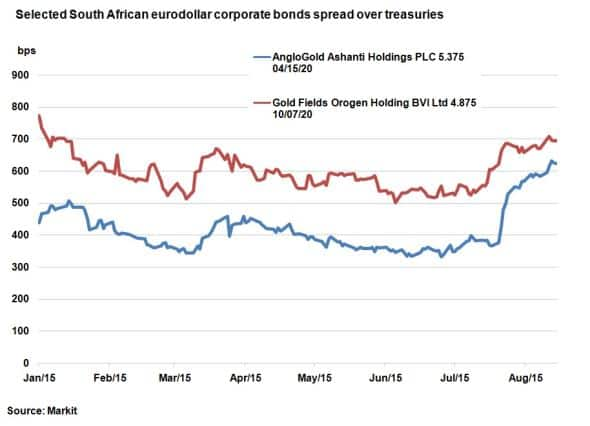

- Gold miners have borne most of the brunt, with AngloGold 5-yr bond spread topping 600bps

Economists' confidence in China's ability to sustain 7% GDP growth levels is beginning to wane, leading investors to believe a subsequent slowdown in global commodities demand is on the horizon. As one of China's key trading partners, the slowdown spells worries for South Africa (SA); a major exporter of gold.

SA's sovereign 5-yr CDS spread, a market gauge of perceived credit risk, has widened 28bps in August alone to hit 239bps; a new two year high. The CDS spread was as low as 160bps last September, just before commodity prices turned for the worse. Commodity prices are now 40% lower.

After years of relying on China as a key gold trading partner, last week's yuan devaluation from the People's Bank of China added to SA's woes. SA, whose currency, the rand, is already at a 14 year low against the US dollar, now faces reduced import revenue from a weaker yuan as well as gold prices already at post financial crisis lows.

A weaker rand, low commodity prices and the expectation of higher borrowing costs due to the US Federal Reserve increasing interest rates further strained SA corporations. The yield on the Markit iBoxx USD Corporates South Africa Index has widened 90bps since June 1st to 6.3%.

Over the last five years, the index has only yielded above 6% for around one fifth of the time. On an income basis the yield now lies between that of US HY (7%) and IG(4.25%). 70% of the Markit iBoxx USD Corporates South Africa Index is rated HY (BB or below).

Looking at the constituents of the Markit iBoxx USD Corporates South Africa Index sheds light on the worst performing credits. Unsurprisingly, gold miners top the list, but the rapid manner in which their credit has deteriorated denotes a frantic selloff. Overall 88% of the index saw their credit spread widen over the period, suggesting that the risk off sentiment was spread across SA corporate credit.

AngloGold Ashanti Holdings, a global gold miner, has seen credit spreads widen sharply since mid-July. Its 5.375% bond due 2020 saw its spread over treasuries, a measure of credit risk, widen over 200bps in the last month, topping 600bps. Gold Fields Orogen Holding experienced a similar trend, seeing its bond due 2020 selloff sharply, with spreads widening close to year to date highs.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082015-Credit-South-Africa-s-credit-woes-deepen.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082015-Credit-South-Africa-s-credit-woes-deepen.html&text=South+Africa%27s+credit+woes+deepen","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082015-Credit-South-Africa-s-credit-woes-deepen.html","enabled":true},{"name":"email","url":"?subject=South Africa's credit woes deepen&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082015-Credit-South-Africa-s-credit-woes-deepen.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=South+Africa%27s+credit+woes+deepen http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082015-Credit-South-Africa-s-credit-woes-deepen.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}