Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Dec 16, 2016

Emerging markets set for a bumpy 2017

It's that time of year when analysts dust off their crystal balls and make predictions for the next 12 months. In December 2015 not many were forecasting that Britain would vote to leave the EU, and even fewer were betting on a Donald Trump presidential victory, so investors would be wise to treat such missives with caution. Political risk is a capricious beast, even for the most seasoned market observers.

But, caveats aside, there seems to be a consensus forming that 2017 will be tough year for one particular asset class: emerging market debt. A Trump presidency will usher in a new era of lower taxes - especially for high earners - and expansionary fiscal policy. Trump has also promised to introduce a more protectionist trade regime. Given that the US economy is growing above its probable trend rate, these policies are likely to result in higher inflation and higher interest rates. Indeed, the Federal Reserve raised rates this week by 0.25% and expects three additional hikes next year.

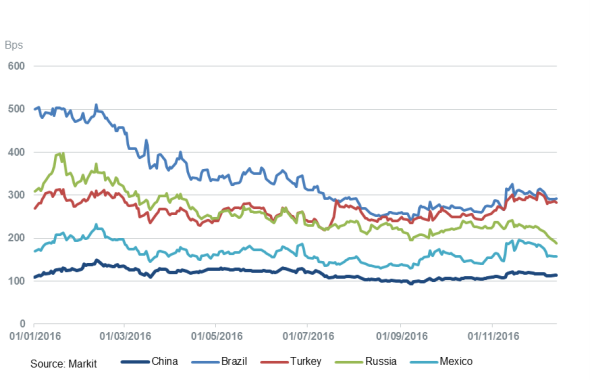

An appreciating US dollar and higher treasury yields usually spell trouble for emerging market bonds. But the CDS market is giving little indication that investors are unduly concerned about this 2017 scenario. Mexico, perhaps the country most disadvantaged from Trump's proposals, saw its five-year spreads widen from 146bps to 195bps in the days following the election result. But by mid-December spreads had recovered to 152bps, tighter than where they started the year. China, another country on the receiving end of Trump's ire, saw only modest credit deterioration and is now trading at 114bps, just 6bps wider than pre-election levels.

Most of the major emerging market sovereigns are slightly wider, with one important exception: Russia. Trump's foreign policy appears to be aimed at better relations with Russia, and could see an easing of sanctions against Putin's government. Along with the recent rise in the oil price, this is positive for Russia's CDS spreads, which at 188bps are now over 30bps tighter than pre-election levels. The basis between China and Russia CDS is now at its lowest since January 2014.

It should be noted here that, unlike the wider CDS market, emerging markets saw a rise in net notional outstanding over recent years, particularly in the larger sovereigns such as China, Brazil and Turkey. These are among the most liquid names in the CDS universe, a status that is unlikely to change.

So, emerging market investors appear to be relatively sanguine about the prospect of a Trump presidency. This may change when the policies become reality and the dollar appreciates. There may be a herd mentality when the tide turns and investors treat emerging market credit as a homogeneous asset class. Recent history tells us that, though the macro outlook will be unfavourable for EM credit, some sovereigns will be in better position to weather the storm than others. This will be reflected in CDS spreads when the panic subsides. But maybe the futurologists will be mistaken, and events will take the markets in an unexpected direction. The post -crisis epoch has been unpredictable, and 2017 will probably be no different.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-Credit-Emerging-markets-set-for-a-bumpy-2017.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-Credit-Emerging-markets-set-for-a-bumpy-2017.html&text=Emerging+markets+set+for+a+bumpy+2017","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-Credit-Emerging-markets-set-for-a-bumpy-2017.html","enabled":true},{"name":"email","url":"?subject=Emerging markets set for a bumpy 2017&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-Credit-Emerging-markets-set-for-a-bumpy-2017.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+markets+set+for+a+bumpy+2017 http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-Credit-Emerging-markets-set-for-a-bumpy-2017.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}