Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 16, 2015

Micro dominates monthly CDS-bond basis moves

A turn in risk sentiment over the past month has seen individual risks dominate fluctuations in the CDS bond basis.

- Over the past month, positive basis in EUR investment grade corporates has fallen from 46% to 43%

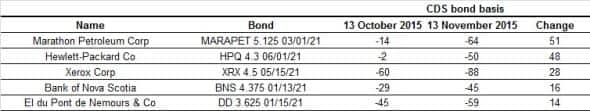

- M&A activity in Marathon Petroleum has seen its basis move 51bps further negative

- ABN Amro's upcoming IPO has led to basis tightening from -94bps to -59bps over the past month

The CDS-bond basis captures the relative value between a cash bond and CDS contract of the same credit entity. Fluctuations in the basis give rise to arbitrage opportunities. It is defined as an entities bond swap spread subtracted from its CDS spread.

CDS-bond basis = CDS spread - cash bond spread

Both spreads measure an entity's credit risk, so theoretically the basis should be zero. In practice other factors such as liquidity and transaction costs come into play. Nevertheless, to take advantage of a positive basis would involve selling the cash bond (paying spread) while selling protection (receiving spread) on the same credit. Conversely, a negative basis trade would involve buying the bond (receiving spread) while buying protection (paying spread) on the same credit.

Dataset

An analysis of investment grade corporate bonds across USD and EUR sees many such discrepancies that could be arbitraged away. The sample of bonds is taken from Markit's iBoxx indices, which incorporates liquid bonds. Since the 5-yr point on a CDS curve is typically the most liquid tenor, only bonds maturing between June 2020 and June 2021 will be taken into consideration to diminish liquidity concerns. This analysis is based on the actual CDS-bond basis (mid) as calculated by Markit's bond pricing service.

After August and September's turbulent fixed income markets, the past month has seen mixed sentiment. October saw a rebound in credit, as idiosyncratic risks subdued, EM concerns diminished and US interest rate risk expectations were pushed into 2016. But the first half of November has seen volatility raise again after a better than expected US jobs report and another downturn in commodity prices, piling pressure on weaker credits.

USD

Using the constituents of the Markit iBoxx $ Liquid Investment Grade index, all but two of the 79 bonds in the sample exhibited a negative basis as of November 13th, down from three one month ago. The negative basis trend is one that has been prevalent in USD for some time, owing to a number of factors such as falling interest rates (many bonds trading above par), an increase in counterparty default risk and relative liquidity.

Marathon Petroleum saw a 51bps swing in its basis from -14bps to -64bps, making it the largest monthly mover. Bond spreads have jumped as the company chases the acquisition of MarketWest Energy, which is likely to be financed part in cash, while CDS spreads have lacked liquidity. Another name whose basis turned further negative is Hewlett Packard, which saw a restructuring plan over the past month, with the market anticipating further growth challenges.

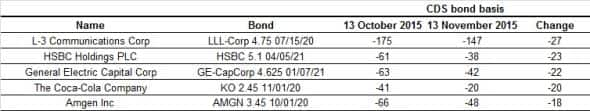

Among the credits that saw the biggest positive monthly change in basis, L-3 Communications tops the list, although it still exhibits a large negative basis. The space communications company posted better than expected Q3 earnings.

EUR

Within the Markit iBoxx € Corporates index, 45 of the 106 eligible bonds currently trade with a positive basis, down from 49 a month ago. Financials largely make up the top names with the widest negative basis, such as Barclays, Macquarie and BNP Paribas, although there has been little change over the past month.

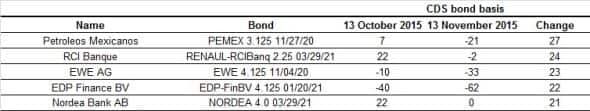

Another downturn in oil prices in November on oversupply concerns saw Petroleos Mexicanos' CDS-bond basis move from positive to negative over the past month. Energy related names followed suit with EWE AG and EDP seeing their CDS-bond basis widen 23 and 22bps, respectively.

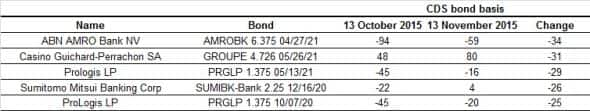

Dutch bank ABN Amro saw its CDS-bond basis tighten from -94bps to -59bps over the past month as the government looks set to privatise part of the bank on the back of a profitable Q3.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112015-credit-micro-dominates-monthly-cds-bond-basis-moves.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112015-credit-micro-dominates-monthly-cds-bond-basis-moves.html&text=Micro+dominates+monthly+CDS-bond+basis+moves","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112015-credit-micro-dominates-monthly-cds-bond-basis-moves.html","enabled":true},{"name":"email","url":"?subject=Micro dominates monthly CDS-bond basis moves&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112015-credit-micro-dominates-monthly-cds-bond-basis-moves.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Micro+dominates+monthly+CDS-bond+basis+moves http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112015-credit-micro-dominates-monthly-cds-bond-basis-moves.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}