Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 16, 2014

A hard look at soft investment

In the run up to what looks set to be a record corn harvest in the states, we review how investors have positioned themselves in agricultural ETFs.

- Investors have pulled money from the 254 agricultural products for the third year in a row, with AUM now sitting at a three year low

- Broad based funds, which invest in a basket of commodities, are the most products for ETF investors

- Livestock ETFs have seen investors full fund in the wake of recent strong runs

A banner summer looks set to make the upcoming harvest a bumper one according to a recent US Department of Agriculture (USDA) report. Ideal growing conditions have multiplied the number of corn ears grown in a stalk which has pushed yields to 172 bushels per acre, beating 2009's record by over 4%. Combine this with the large acres planted by US farmers in the spring, and the forecasted harvest is forecast to be the largest on record with over 14 billion bushels expected to come in with the harvest. The soybean harvest is also set to beat the previous record by over 10%. This has the USDA predicting that this harvest will see the highest amount of surplus stock in years.

All these factors have seen the price of commodities fall in recent months, as evident by the fact that the PowerShares DB Agriculture Fund, which tracks a basket of agriculture commodities, has seen its net asset value fall by 13% in the last five months since planting started.

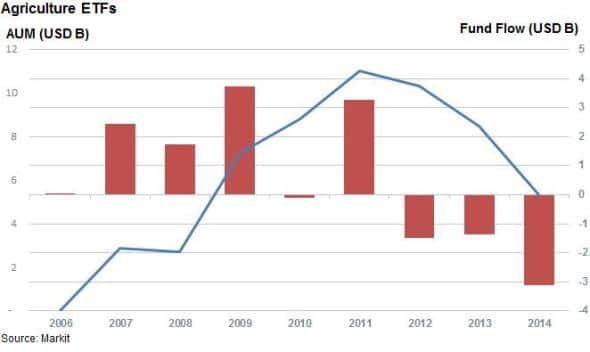

Agriculture ETFs continue to lose favour

ETF investors don't seem to have faith in any broad based price reversal, demonstrated by the fact that Agriculture ETFs have seen investors redeem funds for 11 of the last 12 months. This has ensured that agriculture ETFs are on track to see their third year of consecutive outflows. This steady outflow, combined with the recent weak commodity prices, has seen assets managed by the 254 agriculture ETFs halve from the amount managed at the end of 2011.

Interestingly, investors have been pulling assets from funds which track commodities, such as the previously mentioned PowerShares DB Agriculture Fund as well as funds which track equities with large exposure to the agriculture industry such as Market Vectors Agribusiness ETF. In fact, the latter fund, which counts such firms as Monsanto, Syngenta and Deere among its investments, has seen the lion's share of outflows in the agriculture space with $2.9bn of redemptions since the start of the year.

Softs losing ground

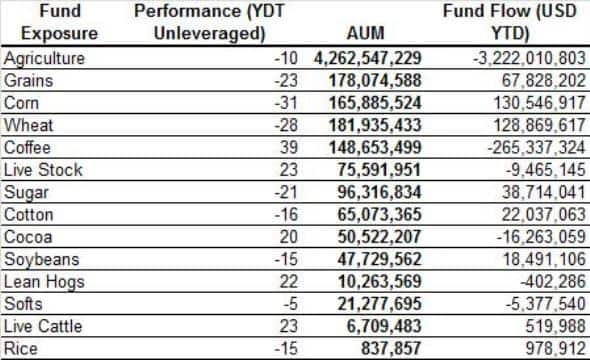

Looking beyond broad basket investments, which hold 80% of all agriculture assets, we do see some price rebound expectations as the funds which track single commodities have seen fund inflows since the start of the year.

Corn and wheat funds, the two most popular agricultural asset class, have seen just under $150m of inflows since the start of June, which may hint that investors have started to become more tactical with their asset allocation, choosing to focus on specific commodities.

This tactical asset allocation seems to be momentum driven as Coffee and Chocolate funds, which have performed strongly since the start of the year, have seen investors withdraw funds.

Livestock ETFs see profit taking

Livestock funds, which invest mostly in cattle and hogs, have seen outflows in the wake of recent strong performance. The 22 livestock funds, which have returned 20% on average since the start of the year, have seen investors pull $93m of assets.

Market dynamics are at play here as farmers had actively trimmed their herds in recent years in the face of rising costs, which has led to herd levels standing at recent lows. With the costs of feed commodities falling, many are expecting farmers to raise production, which is expected to ease the recent tight supply.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092014-A-hard-look-at-soft-investment.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092014-A-hard-look-at-soft-investment.html&text=A+hard+look+at+soft+investment","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092014-A-hard-look-at-soft-investment.html","enabled":true},{"name":"email","url":"?subject=A hard look at soft investment&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092014-A-hard-look-at-soft-investment.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=A+hard+look+at+soft+investment http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16092014-A-hard-look-at-soft-investment.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}