Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 16, 2015

US banks bullish after stress tests

The results of the Fed's stress tests have seen US bank CDS spreads tighten, but they still lag their European peers.

- Four of the five global US banks have seen their CDS tighten following the stress tests

- CDS spreads in US banks are lower than at any point since the Fed started stress testing

- US bank CDS have widened when compared to their European peers over the last year, but the stress test has seen this trend revert

Stress tests

Round two of the Fed's 'Comprehensive Capital Analysis and Review' - or stress tests - yielded positive approvals for the proposed capital distributions of the major US banks.

Having scraped through round one, which focused primarily on bank capitalisation, Goldman Sachs and Morgan Stanley had to resubmit their proposals for round two. This focused more on the banks' ability to withstand crisis net of planned capital returns. JP Morgan, the biggest US global bank, also had to resubmit. Citigroup, which failed last year, came through without any hiccups.

Spreads tighten

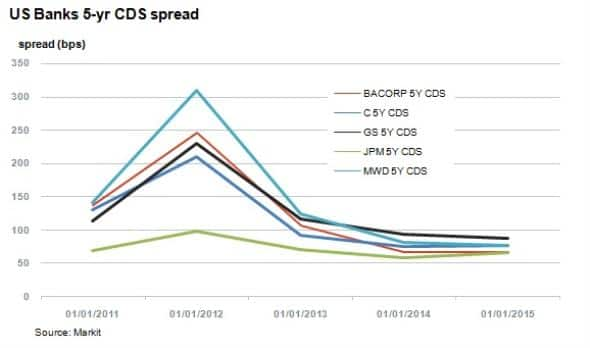

Credit markets reacted positively with all five major US banks experiencing a fall in 5-yr CDS spreads, implying that market makers are willing to offer protection on bank default at a cheaper price. This is a continuation of a trend which has seen the US stress tests having been largely positive for US banks in the past.

Credit spreads across this group have shown a consistent decline since 2012, no doubt in part a response to the heavy regulation and controls placed upon banks that pose a systemic risk. In fact, the average CDS spread across the five global US banks is now at the narrowest level since the Fed started its stress test policy. Four of the five bank's CDS spreads are either trading flat of narrower relative to the same point last year.

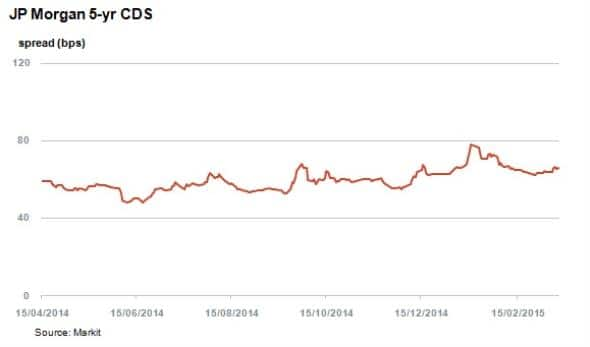

The only exception is JP Morgan. Its CDS is trading 7bps wider at 66bps, but despite this, the banks still trades tighter than its peer group whose average spread is 75bps.

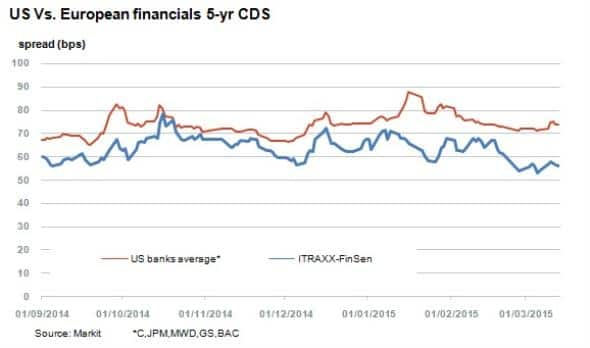

US, Europe divergence

The US still lags its European counterparts when it comes to perceived safety. A comparison of the five global US banks average CDS spreads with the Markit ITRAXX-Financials Senior shows that spreads were at parity last October but have since diverged. This was due to US banks having suffered from a profitability setback earlier this year and European banks benefiting in anticipation of the impending ECB QE programme.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-credit-us-banks-bullish-after-stress-tests.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-credit-us-banks-bullish-after-stress-tests.html&text=US+banks+bullish+after+stress+tests","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-credit-us-banks-bullish-after-stress-tests.html","enabled":true},{"name":"email","url":"?subject=US banks bullish after stress tests&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-credit-us-banks-bullish-after-stress-tests.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+banks+bullish+after+stress+tests http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-credit-us-banks-bullish-after-stress-tests.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}