Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 15, 2014

Shorting UK consumer sentiment

Despite an indicated boost in wages and flat inflation, the Markit UK Household Finance Index marked its lowest reading in a year. This lack of financial confidence has seen shorts circle around UK retailers in recent months.

- UK consumer focused shares have seen the highest average short interest in over a year

- Retailers, both staples and discretionary, attract the most short sellers with Sainsbury's leading the way

- Services firms see little appetite from short sellers after seeing sustained covering

The idea of a "squeezed middle" in the UK, which has largely been left behind in the recovery, has been at the heart of the UK political debate for in recent years. The latest data from the UK Office for National Statistics indicate that wages in the three months to August only rose by 0.7% from the previous year, which was a full half a percentage point below the rate of inflation and well below the 4.3% average run rate seen in the seven years leading up to 2008.

The erosion of UK consumer spending power has seen consumer-focused companies targeted by shorts sellers as fierce competition for a share of the UK wallet disrupts the established landscape.

Household finances under pressure

The recent trend shows no signs of abating any time soon if the Markit Household Finance Index is anything to go by. The latest release of the survey, which queried 1500 UK adults on their financial situation, indicated that UK households felt increasingly wary of their current financial situation with the index reading falling from the previous month to the lowest level of the year.

The survey did have a silver lining however, as respondents indicated a strong lift in income in October which could signal an end to the lacklustre wage growth seen over the last few years.

Shorts circle consumer shares

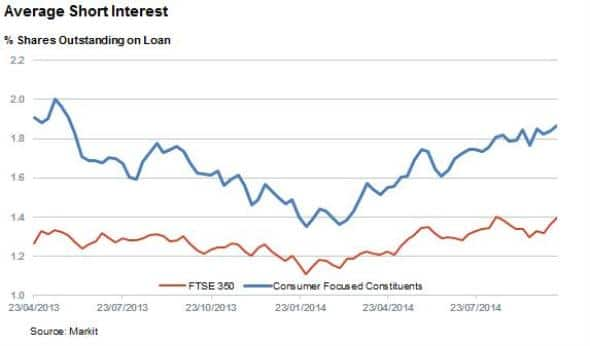

The country's weak household confidence has seen shorts circle the companies which cater to consumers, with short sellers' appetite growing in recent months. The average demand to borrow shares in FTSE 350 constituents which operate in consumer focused sectors such as retail and consumer services has jumped by nearly a quarter since the start of the year and now stands at the highest level since April of last year.

While overall shorting activity across UK stocks has also grown (by 15% year to date), the extra average short interest seen among consumer focused share has more than doubled since the lows earlier in the year as UK households continued to feel the pinch.

Retailers targeted

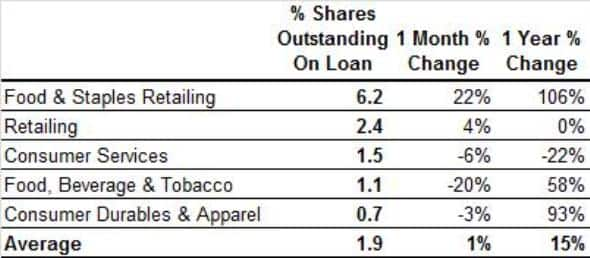

Retailers have been at the forefront of the current wave of shorting activity with Food and Staples retailers currently seeing 6.2% of their shares out on loan. That number has doubled in the last year, and increased by a fifth over the last month as continuing struggles in the supermarket space saw shorts add to one of their favourite trades of the year.

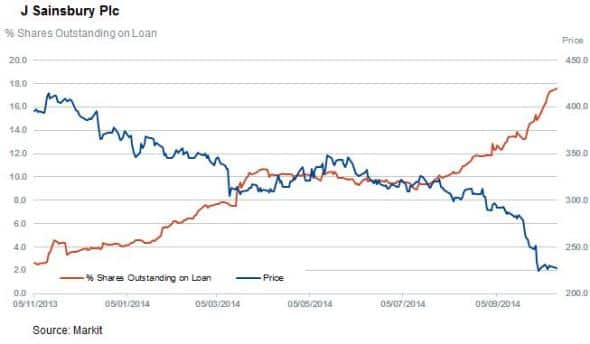

Sainsbury's has seen its demand to borrow jump to 17.5% to make it the most shorted constituent of the FTSE 350 index. This marks an all-time high demand to borrow after its shares fell by 38% since the start of the year.

Non-staples retailers, which have also come under pressure from falling wages, also see above average short interest with 2.3% of shares out on loan on average; a quarter more than the rest of the consumer focused sectors. The companies seeing the most shorting activity in that space are Ocado and N brown Group which have both seen large surges in demand to borrow in the last few weeks.

Services see covering

One part of the sector not seeing an increase in bearish sentiment has been services firms such as restaurant and travel firms. These companies used to see above average shorting activity compared to the rest of the sector, but the last few months have seen shorts cover a fifth of their positions in the last year.

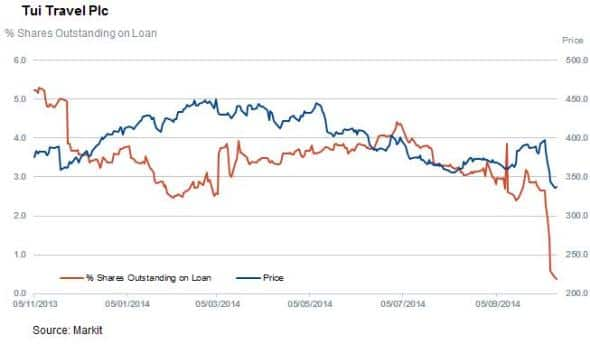

Travel firms have led the covering in this space, with TUI and Carnival both seeing shorts cover to new annual lows.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-equities-shorting-uk-consumer-sentiment.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-equities-shorting-uk-consumer-sentiment.html&text=Shorting+UK+consumer+sentiment","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-equities-shorting-uk-consumer-sentiment.html","enabled":true},{"name":"email","url":"?subject=Shorting UK consumer sentiment&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-equities-shorting-uk-consumer-sentiment.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorting+UK+consumer+sentiment http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-equities-shorting-uk-consumer-sentiment.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}