Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 14, 2015

European high yield bonds outperform US peers

High yield bonds have provided investors with volatile returns over the past few months, but European investors have still managed to hang on to positive territory for the year.

- European HY bonds has outperformed US HY bonds recently, driven by better rated credits

- US HY is currently trading at a 71bps spread premium to European HY

- The median implied default probability of the CDX HY is 27%, well above current cash default rates

The last few months have proven to be a volatile time for the HY market, highlighting the risks involved in the asset class. But with significant yields on offer and different markets to explore, HY bonds remain a quandary for investors.

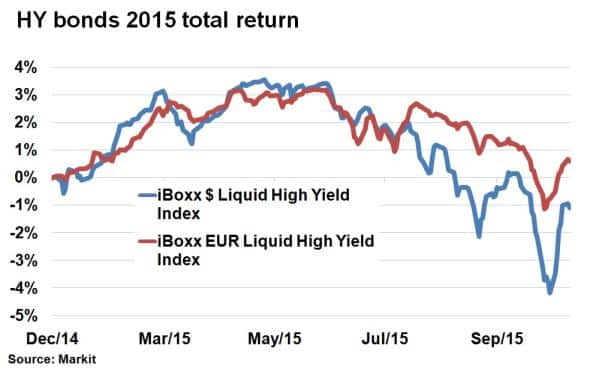

The recent volatility can be illustrated by looking at recent returns. September saw US high yield (HY) bonds, as represented by the Markit iBoxx $ Liquid High Yield (HYG) index, return -3.05%, the worst month since August 2011. It was a similar story in the European HY market, as represented by the Markit iBoxx EUR Liquid High Yield index, which shed 2.5% last month on a total return basis. Both markets have, however, bounced back so far this month with US HY up 2.6% and European HY up 1.7% as investors returned to the asset class.

Overall, 2015 has so far proven better for European high yield investors as the asset class has managed to hold on to a positive total return, largely thanks to coupon returns, while its US peers are in the red for the year despite their recent rebound. While returns have literally fallen off a cliff since March, yields have conversely increased this year with European HY currently yielding 4.94% (up 70bps) and US HY yielding 7.28% (up 93bps). This equates to around 71bps in excess spread (premium) between the two markets.

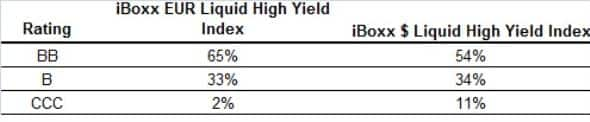

One factor driving the trend is the fact that the European HY market is smaller and relatively composed of higher rated entities. Only 2.5% of the iBoxx EUR Liquid High Yield index is rated CCC compared to more than 10% of the US HY index.

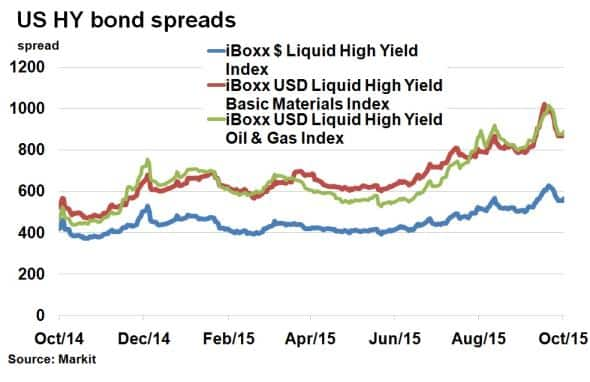

Sectors also played an important role in risk sentiment across both markets. US HY spreads have been largely driven by two sectors, Oil & Gas and Basic Materials, where plummeting commodity prices weighed in on credit risk. Last month US HY spreads tipped over 600bps just as Oil & Gas and Basic Materials sectors spiked to over 1000bps, or 10% extra yield over US treasuries. Both these sectors make up 20% of the iBoxx $ Liquid High Yield index, providing plenty of clout on the US HY market.

In contrast European HY has much less exposure to the energy sector, and credits are much more focused on Financials and large multinationals such as Altice and ThyssenKrupp.

Default question remains

The large question hanging over the asset class still remains the underlying ability of borrowers to meet debt commitments. While actual defaults have so far been well off the worst case scenarios painted by some market observers, CDS investors are still wary, given that the median implied probability of default for the 100 Markit iTraxx CDX HY (current spread is 454bps vs 564bps for HYG) names is 27.35%, well above current prevailing default rates in underlying cash bonds.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102015-Credit-European-high-yield-bonds-outperform-US-peers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102015-Credit-European-high-yield-bonds-outperform-US-peers.html&text=European+high+yield+bonds+outperform+US+peers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102015-Credit-European-high-yield-bonds-outperform-US-peers.html","enabled":true},{"name":"email","url":"?subject=European high yield bonds outperform US peers&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102015-Credit-European-high-yield-bonds-outperform-US-peers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+high+yield+bonds+outperform+US+peers http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102015-Credit-European-high-yield-bonds-outperform-US-peers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}