Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 12, 2015

European financials shrug off recent bad news

European financials' credit risk has continued to fall in recent days despite a spate of write-downs and layoffs.

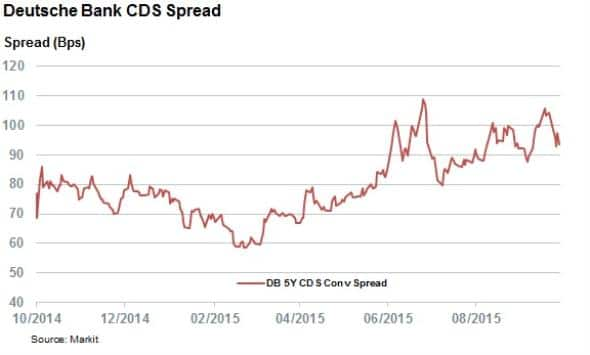

- Deutsche Bank's CDS spread is tighter on the week despite large write-offs

- Markit iTraxx Europe Senior Financials approaching three month lows

- Euro denominated financial bonds have outperformed the corporate field by 15bps

The challenges faced by European banks were highlighted last week when Deutsche Bank, Credit Suisse and Standard Chartered all announced large write-downs, job cuts and strategic realignments. These efforts to adapt to lift profits and increase competitiveness in the current global, highly regulated business environment come in the wake of years of volatility which saw all three firms come under new management.

The news of the write-downs was relatively well received by the equity market as Standard Chartered and Deutsche Bank all saw their shares trade higher in the wake of the developments.

This is particularly interesting for the later as the German bank announced that suspending its dividend was an option going forward. Positive investor sentiment was also reflected in the credit markets, where Deutsche Bank, which also announced that it was forecasting a €6.2bn third quarter loss, saw its 5 year CDS spread fall by a tenth from the level seen at the start of October.

Credit Suisse has also seen its CDS spread fall significantly over the last week, with the latest five year CDS spread nearly 20bps off the yearly highs seen in the closing days of 2014.

Senior financials' credit risk falls

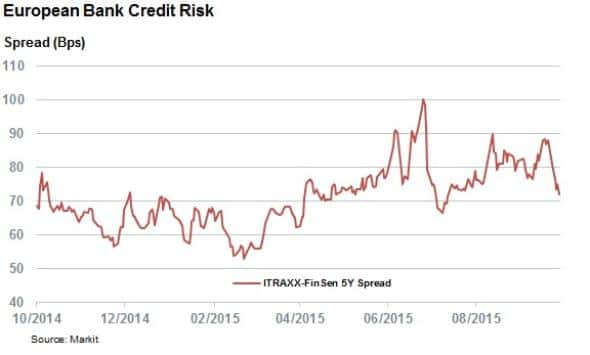

These developments and resulting investor reactions also boosted the rest of the sector as the Markit iTraxx Europe Senior Financials index, which tracks credit risk among European banks, fell from 86bps at the start of October to 72bps as of latest count. This recent fall in credit risk marks the sharpest downward revision for the sector since the resolution of the Greek crisis.

Bonds outperform despite bad news

The positive sentiment felt in the CDS market has also been felt in the cash bond world, where euro listed bank bonds have outperformed the rest of the corporate bond universe in October. So far this month, the Markit iBoxx € Financial index has delivered positive total returns of 69bps, 15 more than the rest of the euro denominated investment grade universe tracked by the Markit iBoxx € Investment Grade index.

This strong performance means that the extra yield required by investors to hold euro denominated financials bonds has fallen from 150bps at the start of the month to 125bps, the lowest level in over six weeks.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12102015-Credit-European-financials-shrug-off-recent-bad-news.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12102015-Credit-European-financials-shrug-off-recent-bad-news.html&text=European+financials+shrug+off+recent+bad+news","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12102015-Credit-European-financials-shrug-off-recent-bad-news.html","enabled":true},{"name":"email","url":"?subject=European financials shrug off recent bad news&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12102015-Credit-European-financials-shrug-off-recent-bad-news.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+financials+shrug+off+recent+bad+news http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12102015-Credit-European-financials-shrug-off-recent-bad-news.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}