The great value investing rotation

ETF investors have been actively shifting their style based strategies in US Equities over the last few months to take a more cautious view after recent market uncertainty.

- Value investing has outperformed growth seeking since the start of the year

- Low growth shares have outperformed the market by a wide margin from the January lows

- Growth ETFs have seen $3bn of outflows since Jan; value funds have seen steady inflows

Value investing has been edging out growth in the recent months. This has seen US ETF investors actively increasing their holdings of value focused funds to gain exposure to the fundamental investment strategy's recent outperformance.

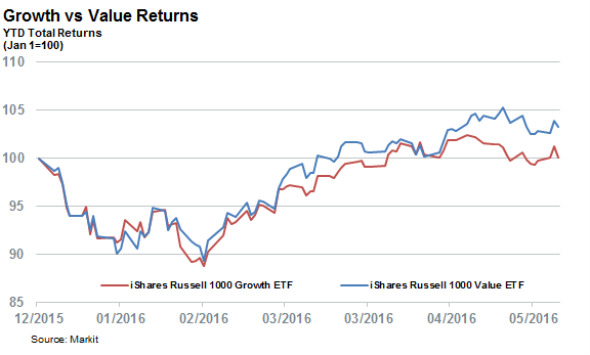

Value ETFs, which aim to focus their investments towards shares offering relatively attractive fundamental valuations by eschewing those with relatively racy positions, have proved a winning bet since the start of the year. The largest value ETF, the iShares Russell 1000 Value ETF, has managed to outperform the raw Russell 1000 index by over 1% ytd as investors sought the safety of shares with strong fundamentals in the wake of the recent volatility.

The other fundamental style strategy, growth investing, has not fared as well as seen by the fact that the iShares Russell 1000 Growth ETF has trailed both its value peer and the Russell 1000 ytd. While not spectacular, 2.5% ytd, this relative strong performance of shares with good fundamental appeal shows that the current market is more focused on finding intrinsic value than chasing growth.

Low growth name rebound from lows

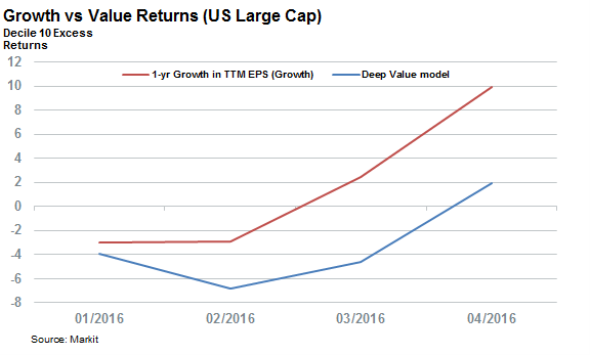

The Markit Research signals platform shows that the outperformance delivered by value ETFs over their growth peers is driven by the minority US shares which these funds tend to steer clear of.

The 10% of US large cap shares which have offered the worst growth, as tracked by the 1 yr Growth in TTM EPS factor, have in fact outperformed those with the worst fundamental value tracked by our Deep Value Model. Most of outperformance was driven in the last two months as the market rebounded from the lows. Essentially, the fact that low growth names have rebounded more strongly than their low value peers in the last few months have proved a drag on strategies that aim to steer clear of such shares.

Investors load up on value

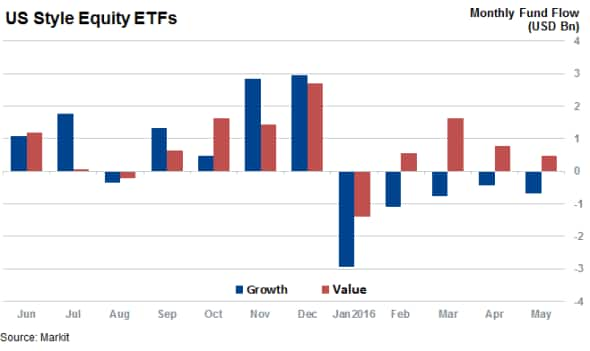

Investors have picked up on the recent trend and have actively been shifting assets between the two fundamental strategies since the start of the year. Growth ETFs have now seen $5.9bn of outflows ytd as investors have withdrawn funds out of the strategy for every month so far this year.

Value ETFs have seen the opposite trend as the asset class recovered from the outflows seen in January with four straight months of consecutive inflows. Net, net, investors have added $2bn of exposure to value investing.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.