Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 11, 2015

ETF stock lending revenues surge on volatility

ETF securities lending revenues for 2015 to date are up by a quarter year on year, despite flat demand to borrow.

- The securities lending industry has generated $214m of revenues lending ETFs ytd

- Revenue surge largely driven by increased pricing power as balances have stayed flat

- Over a third of all ETFs by value were trading special over this summer's volatility

The ETF industry breached the $3 trillion threshold this year as investors ploughed over $310bn of new assets into the 6,200 products currently listed. 2015's strong inflows, which are on track to beat last years' record haul, take the industry's AUM grown for the last three years past the 40% mark.

The rising popularity of ETFs has been mirrored in the value of ETF assets currently sitting in lending programs, which has jumped from $116bn at the start of 2013 to an all-time high $160bn as of latest count. This growth in lending program inventory has just managed to keep up with the wider asset class, which means that the proportion of all ETF assets available to lend has stayed flat at the 5.3% mark.

While the supply side of ETF securities lending has been relatively flat in real terms, the demand to borrow ETF assets has proved much more resilient. The balance of ETF assets out on loan has jumped by over 60% since the start of 2013 to settle at the $50bn mark for the last two years. Interestingly, this demand to borrow ETFs has been relatively flat in the last 24 months, which runs contrary to the popularity of the asset class form an investor point of view.

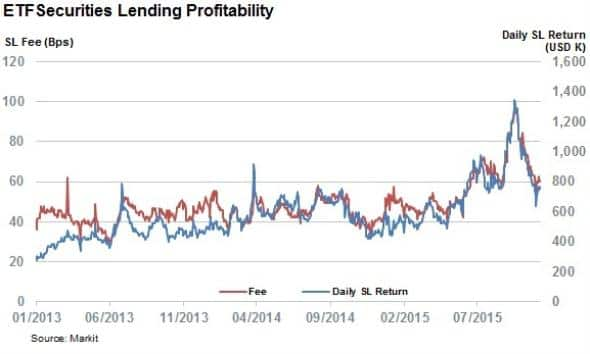

The flat balances do not look to have affected the industry's profitability in the last few years however as revenues generated by lending out ETFs have grown significantly in the year to date compared to the two previous years. Revenues generated by ETFs so far in 2015 total $214m which represents a 26% improvement on aggregate revenue figure at the same point last year.

his surge was entirely driven by the fact that the fees commended by ETF loans have surged ahead in recent weeks, given the fact that balances have been flat over the last two years. The weighted average fee for ETF loans has surged ahead from 50bps mark seen over 2013 to 70bps seen over recent weeks. This summer's volatility delivered a brief bumper haul for lenders as the ETF stock loan fee surged above the 100bps mark during the middle of September.

Fees over this period were largely driven by specials as over a third of ETF loans were lent out for a fee greater than 100bps over the volatility, which shows that lenders were able to hold pricing power over the worst of the market's swings, despite the fact that demand to borrow stayed relatively muted. This pricing power has also continued despite the recent market rally seen since the start of October.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-equities-etf-stock-lending-revenues-surge-on-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-equities-etf-stock-lending-revenues-surge-on-volatility.html&text=ETF+stock+lending+revenues+surge+on+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-equities-etf-stock-lending-revenues-surge-on-volatility.html","enabled":true},{"name":"email","url":"?subject=ETF stock lending revenues surge on volatility&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-equities-etf-stock-lending-revenues-surge-on-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ETF+stock+lending+revenues+surge+on+volatility http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112015-equities-etf-stock-lending-revenues-surge-on-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}