Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 11, 2015

US yields up ahead of Fed meeting, Nigeria slides

This week saw the yield on US treasuries lift off last month's lows ahead of the highly anticipated Fed meeting, while Nigerian bonds sunk to new lows after an index setback.

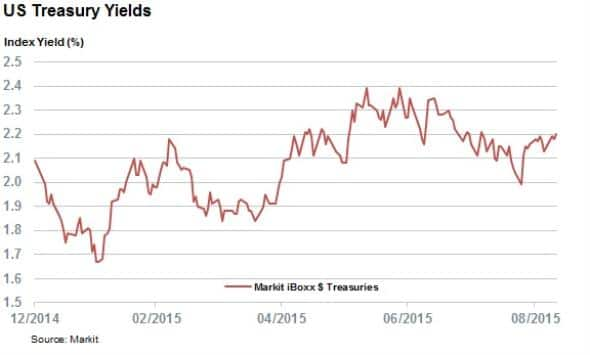

- Markit iBoxx $ Treasuries yield back above the 2.2% mark for the first time in six weeks

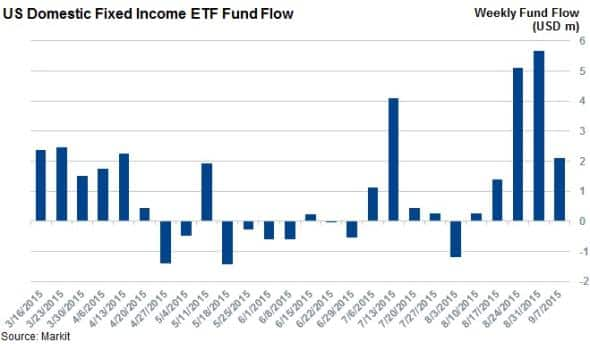

- ETF investors have been actively buying US bond exposure ahead of Fed meeting

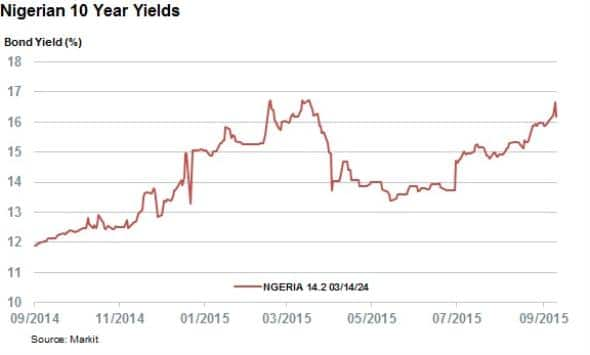

- Nigerian 10 year bonds now back above the 16% mark for the first time since March

Treasury yields up ahead of Fed meeting

The domestic US bond market had a fairly subdued week in the run up to next week's Federal Open Market Committee (FOMC) meeting, which could see benchmark US interest rates rise for the first time since the financial crisis. Although consensus had previously expected an impending policy change, the recent market volatility has seen confidence erode and questions arise on the wisdom of raising rates amid the current uncertain global economic picture.

This uncertainty is reflected in US treasury yields which have been fluctuating in recent weeks. The recent turmoil saw the yield of the Markit iBoxx $ Treasuries index fall back below the 2% mark, after spending four months above that mark.

The market was calmed somewhat by the most recent US jobs report which saw the index's yield rebound 20bps to 2.2%, but it is still 20bps off the levels seen over the summer when the consensus of a September rate rise was much clearer.

ETF investors not giving up

This lack of agreement around the potential Fed rate hike is also reflected in ETF fund flows which have seen investors continue to buy US exposed fixed income ETFs over the last few weeks.

The 271 US listed domestically exposed fixed income ETFs have seen over $12bn of net inflows in the three weeks leading up to the FOMC meeting. The last two meetings saw much more muted investor appetite for fixed income ETFs as investors were wary of being caught on the wrong side of an interest rate hike.

Nigeria keeps sinking

One area of the fixed income market that saw plenty of volatility this week was Nigerian bonds. The asset class saw its yields surge as investors reacted to the news that its local currency bonds will no longer be included in the JP Morgan emerging market bond index.

The resulting selloff was almost universal with all but one of the 17 Nigerian government bonds priced by Markit evaluated bond pricing seeing their yields widen in the last week.

While yields are still not at the highs seen in the depths of the oil price slump, the country's naira denominated 10 year bonds are now yielding over 16%; 2% more than the levels seen three months ago.

Nigeria's US dollar denominated debt has also felt impact of the JP Morgan decision, with the longest dated issuance, the 6.375 note due in 2023 now yielding 7.91%; even higher than the previous highs seen at the start of the year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-Credit-US-yields-up-ahead-of-Fed-meeting-Nigeria-slides.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-Credit-US-yields-up-ahead-of-Fed-meeting-Nigeria-slides.html&text=US+yields+up+ahead+of+Fed+meeting%2c+Nigeria+slides","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-Credit-US-yields-up-ahead-of-Fed-meeting-Nigeria-slides.html","enabled":true},{"name":"email","url":"?subject=US yields up ahead of Fed meeting, Nigeria slides&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-Credit-US-yields-up-ahead-of-Fed-meeting-Nigeria-slides.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+yields+up+ahead+of+Fed+meeting%2c+Nigeria+slides http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-Credit-US-yields-up-ahead-of-Fed-meeting-Nigeria-slides.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}