Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 11, 2015

Overseas investors exit US despite rising dollar

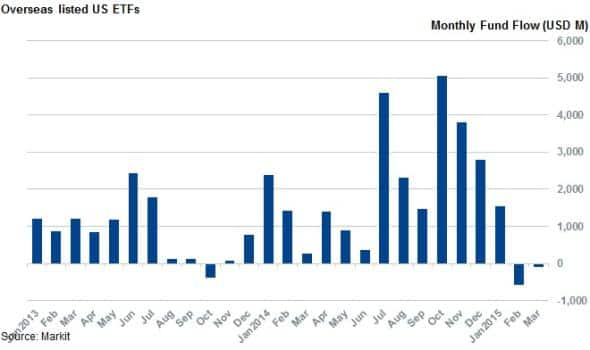

Overseas ETF investors have pulled over $650m out of US equity products over the last six weeks; a trend that has continued despite the recent dollar strength.

- Overseas listed US exposed equity funds saw their first monthly outflow in over 18 months in February

- European investors have driven the recent exodus from US focused products

- European shares which benefit from the rising dollar have outperformed the market in the opening week of March

The once unforeseen, now hotly tipped euro parity trade appears to have re-emerged during the last couple of trading days. The dollar recently hit a 12 year low against the euro when it crossed the 1.05 mark against the dollar. The onset of the ECB QE program is likely to further encourage this trend; correctly predicted by Markit's chief economist Chris Williamson back in December.

While the strong dollar reflects the fact that the US economy is by and large in better shape than the rest of the world, the rising currency has caused problems for corporates with large overseas revenue streams which may lose ground to overseas competitors. Yesterday's surging dollar coincided with a fall in US equity values, which will no doubt weigh heavily on the US Federal Reserve ahead of the FOMC meeting next week.

Overseas US equity investors look torn between the rising dollar and its impact on US shares as evidenced by the recent outflows seen in offshore listed equities funds.

Overseas investors pull assets

Overseas investors, who have been actively investing in US benchmarked funds in recent years, have taken a step back from in last couple of months as the strong dollar, which boosts the value of US benchmarked products overseas, puts a damper on equity returns.

February saw the 300 plus overseas listed US exposed equity ETFs experience their first monthly outflow in over 18 months.

European investors, who have enjoyed buoyant returns in their domestic markets, were eager to pull money out of US exposed ETFs in February with 207 US exposed European listed ETFs seeing $960m of total outflows.

This switch comes in the wake of strong returns in domestic European markets since the start of the year. The largest European listed US equity ETF (iShares S&P 500 UCITS ETF (Inc)) has underperformed the largest European listed European focused fund (Lyxor UCITS ETF EURO STOXX 50) by over 2% in March.

While the recent strong dollar has helped the iShares S&P 500 fund claw back some of that lost ground, European investors have shown no signs of returning to US equities. $146m has been withdrawn so far this month from European listed US focused funds.

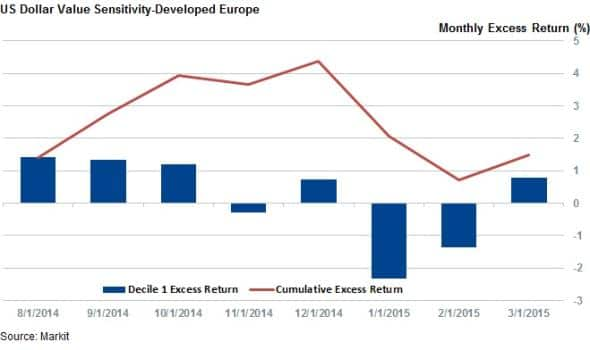

Strong dollar helps European shares

Back in Europe, the 10% of European shares in the Markit Developed Europe Universe, a universe of Europe wide equities, whose shares benefit from a rising dollar have continues to outperform the rest of the market. The constituents of this universe whose shares have historically performed the best in the wake of rising dollar - as measured by the US Dollar Value Sensitivity factor - have outperformed the rest of their European peers by just under 1% in the opening week of March as the dollar strengthened against the euro.

These shares have outperformed the wider Markit Developed Europe universe for five of the last eight months as the dollar appreciated in earnest.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-equities-overseas-investors-exit-us-despite-rising-dollar.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-equities-overseas-investors-exit-us-despite-rising-dollar.html&text=Overseas+investors+exit+US+despite+rising+dollar","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-equities-overseas-investors-exit-us-despite-rising-dollar.html","enabled":true},{"name":"email","url":"?subject=Overseas investors exit US despite rising dollar&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-equities-overseas-investors-exit-us-despite-rising-dollar.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Overseas+investors+exit+US+despite+rising+dollar http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-equities-overseas-investors-exit-us-despite-rising-dollar.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}