CREDIT COMMENTARY

Jun 10, 2013

Credit gives back gains

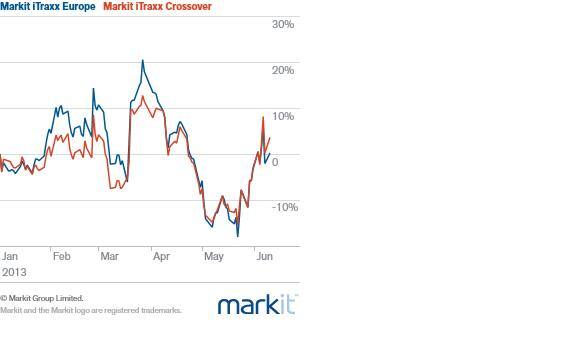

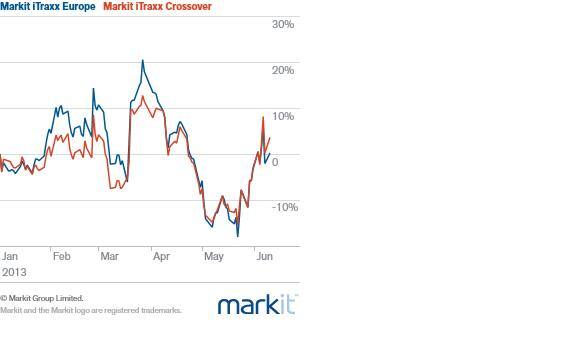

Credit underperformed equities on Monday giving back some of the gains triggered by last week's better than expected US jobs report.

The Markit iTraxx Europe was 3bps wider at 107.25bps, while the Markit iTraxx Crossover was 14.5bps wider at 451.25bps. The latter index has lagged behind its investment grade counterpart since the beginning of the year, though the two indices have been closely correlated in recent weeks.

Mixed signals from Asia had an effect on western markets. Chinese trade, inflation and industrial production datasets all undershot expectations. Disappointing export and import figures were a particular concern.

However, the negative sentiment was tempered by an upward revision to Japanese growth numbers. First-quarter GDP rose by an annualised 4.1%, up significantly from the initial estimate of 3.5%.

Japan has been the source of the bulk of recent market volatility, and the outcome of tomorrow's Bank of Japan policy meeting will help determine spread direction.

US sovereign CDS spreads were unchanged at 28bps, with a positive move from S&P having a negligible impact in the CDS market. The agency lifted its outlook on the country's AA+ rating to stable from negative, citing the strong economic performance of the US in comparison to its peers.

Download full article

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062013120209Credit-gives-back-gains.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062013120209Credit-gives-back-gains.html&text=Credit+gives+back+gains","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062013120209Credit-gives-back-gains.html","enabled":true},{"name":"email","url":"?subject=Credit gives back gains&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062013120209Credit-gives-back-gains.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Credit+gives+back+gains http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062013120209Credit-gives-back-gains.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}