Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 10, 2016

European rally hits shorts hard

The recent rally in European equities has cut short sellers' winning bets down to size but on average short sellers continue to hold onto positions with marginal covering.

- Rally wipes out profits across top 60 shorts of the Stoxx 600, outperforming the index

- Average short interest remains at high levels as shorts hold their ground

- Select high conviction names see shorts add to positions as shares surge

The Stoxx 600 bounce of 2016

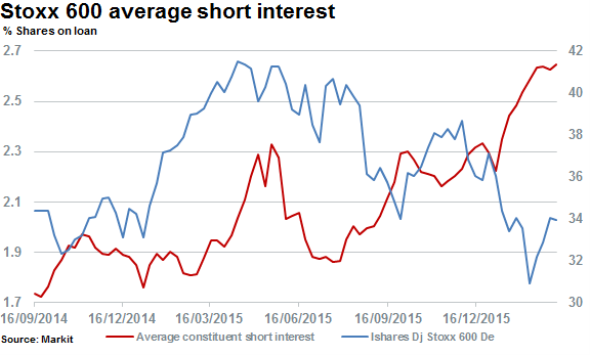

After declining some 24% in the past year and reaching a 52 week low on February 11th 2016, the Stoxx 600 index has subsequently bounced higher by an impressive 12% in the past month. Year to date however, the Stoxx 600 is still down over 6% and despite the recent rally hurting short sellers average short interest of Stoxx 600 constituents remains at the highest levels seen in over two years.

Top 60 shorts outperform

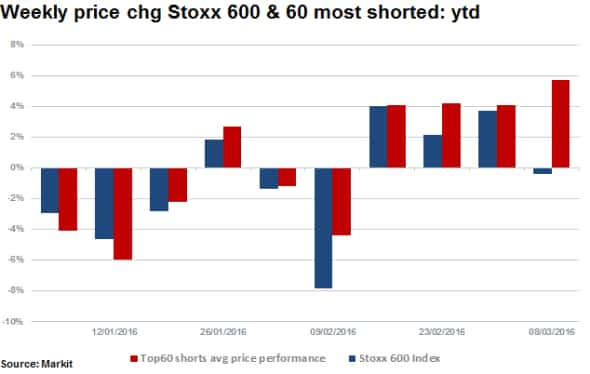

The top 60 most shorted names across the Stoxx 600 have in fact outperformed the overall index for eight consecutive weeks (as measured by the iShares Stoxx 600 ETF). The main concern for shorts though is that in the past four weeks, the outperformance posted by the most shorted stocks has been net positive and seems to be gaining momentum.

Despite the recent rally, short sellers have been hesitant to cover positions. Average short interest across the 60 most shorted names has only declined marginally from highs, down by 3.2% to 11.7% of shares outstanding on loan on average. This compares to the wider index average of 2.7%.

Shorts barely cover

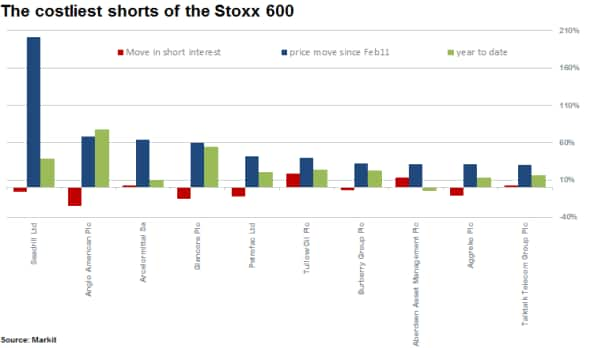

The top ten rising stocks in recent weeks across those top 60 most shorted in the Stoxx 600 reveal that short sellers have not only been hesitant to cover in the face of spiking prices but in some cases they haveincreased positons.

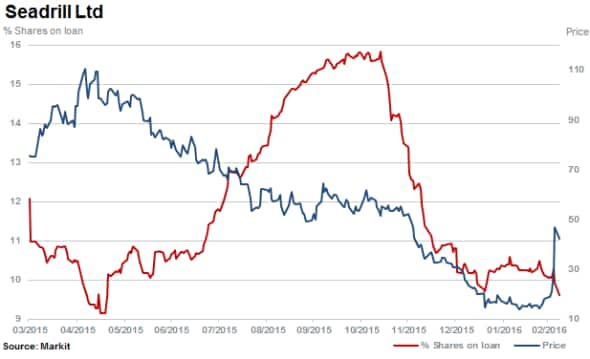

Since Feb 11th 2016 (Stoxx 600 bottom) the most costly absolute to short position would have been in Seadrill. Shares in the firm have risen 202% with short sellers only covering 6% of positions.

With a longer term perspective however, shorts have been profitable on Seadrill. Having consistently reduced short positions by a cumulative 35% in the last 12 months, short sellers have taken profits, while the stock has fallen 25% over the same time and this includes the recent two fold spike.

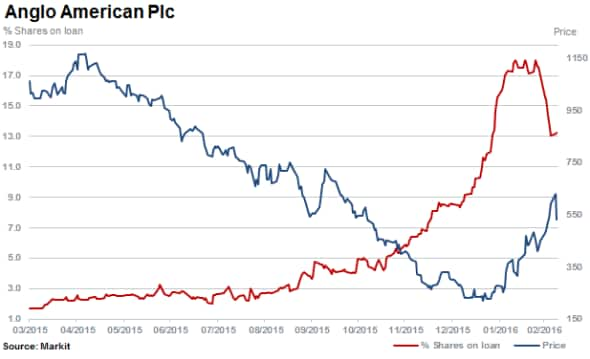

Short sellers have covered positions in Anglo American and Glencore as shares have surged significantly by 77% and 54% respectively year to date. The rise in shares has been supported by a recovery in iron ore prices and outlook in resources but both stocks are still lower however, by over 50% on a 12 months basis.

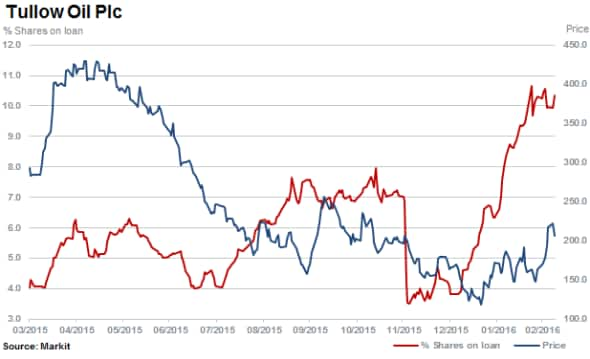

Shares in Tullow Oil have rallied by almost a quarter year to date but short sellers have accelerated increases in short positions. Shares outstanding on loan have increased by a fifth year to date with 10.3% of shares outstanding on loan currently.

Aberdeen Asset Management has also seen an increased appetite from short sellers in the past month with shares spiking some 14%, while short interest has been driven higher to 9.3%.

The rally in Tesco shares continues to attract further interest from short sellers. Despite its stock rising some 31% year to date, shorts have increased positions to reach 6.9% of shares outstanding on loan which is the highest level seen in 12 months.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-Equities-European-rally-hits-shorts-hard.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-Equities-European-rally-hits-shorts-hard.html&text=European+rally+hits+shorts+hard","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-Equities-European-rally-hits-shorts-hard.html","enabled":true},{"name":"email","url":"?subject=European rally hits shorts hard&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-Equities-European-rally-hits-shorts-hard.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+rally+hits+shorts+hard http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-Equities-European-rally-hits-shorts-hard.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}