Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 09, 2014

US driving global real estate

A closer look at this month's release of the Markit sector PMI data sees US real estate firms driving the sector to the forefront. Despite this, investors seem to be favouring international exposure.

- US exposed Real Estate ETFs have seen AUM surge to all-time high levels

- Despite lagging behind their US peers, non US exposed real estate ETFs have been able to attract more inflows over the last few months

- Led partly by US investors seeking international diversification

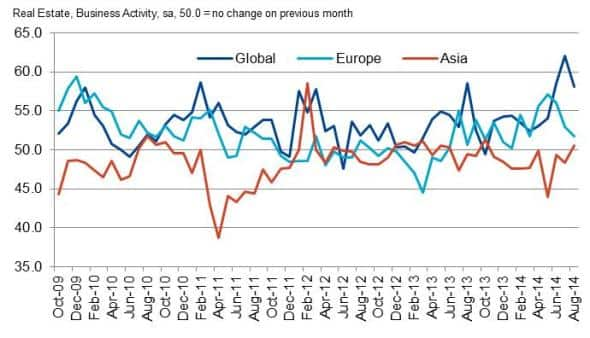

Global real estate firms had another strong month in the latest Markit Sector PMI survey. The August survey saw the sector post the fourth largest increase in month on month output out of any sector after leading the previous month's survey.

However, the headline number does hide some regional differences as the global sector survey came in way ahead of the readings for the Europe and Asia. This infers that US firms, which make up the largest proportion of the global survey, powered much of the growth in business activity, and have done so for the last couple of months.

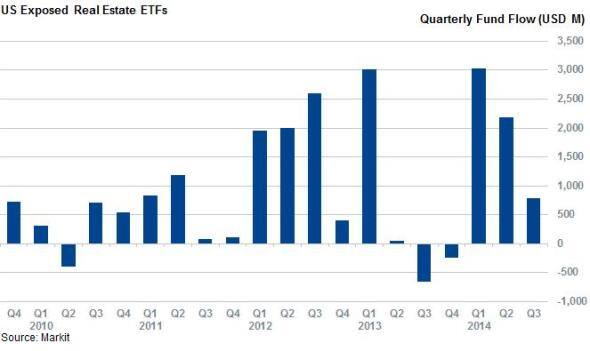

US flows strong

The last two and a half months of strong US real estate PMI survey results have seen US ETF investors increase their exposure to the sector. Net inflows have amounted to $782m into the 30 products which track the US real estate sector taking aggregate assets to an all-time high. These positive inflows have built on the strong performance seen in the opening half of the year when investors added $5.2bn to their exposure.

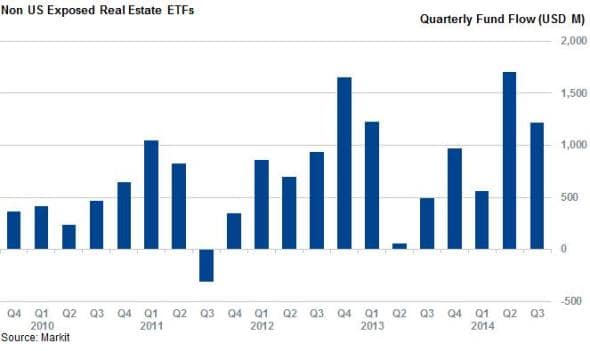

International flows outpace US

While the US has so far proven to be the market of choice for ETF investors, evidenced by the fact that US exposed real estate funds manage 65% of current global real estate sector exposure, the US's dominance has slipped over the last few years. This trend looks set to continue despite the recent strong PMI performance.

So far this quarter, investors have added $1.2bn of non US real estate exposure, outpacing flows into US exposed funds by $435m. This marks the first time that US funds lagged behind their international peers this year.

While this trend is driven by new listings in international locations, it is also attributable to US thirst for international diversification. To this end, three of the five real estate products seeing the largest inflows are US listed products with international exposure. This has been led by the Vanguard Global ex-US Real Estate ETF, which has seen its asset base surge by over 75% since the start of the year, with just under $840m of inflows.

Interational investors have also been keen to utilise ETFs to gain exposure to the real estate market with the likes of the iShares European Property Yield UCIT ETF attracting strong inflows.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092014-US-driving-global-real-estate.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092014-US-driving-global-real-estate.html&text=US+driving+global+real+estate","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092014-US-driving-global-real-estate.html","enabled":true},{"name":"email","url":"?subject=US driving global real estate&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092014-US-driving-global-real-estate.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+driving+global+real+estate http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092014-US-driving-global-real-estate.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}