Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 07, 2016

Fog in Spain as Italy kicks it up a gear

Strong PMI data indicates that Eurozone economic recovery is starting to take hold led by a resurgent Italian economy but its southern Spanish peer is being held back by political uncertainty.

- Italy registers the strongest PMI numbers seen since 2011

- ETF Investors rotate out of laggard Spain into Italian exposed funds in the last two quarters

- Average short interest of IBEX constituents doubled over 2015 to pass the 3% threshold

Europe struggling to breakthrough

Global markets are facing renewed pressure in 2016 with Chinese stocks again leading a selloff in emerging markets and commodities. The recent turbulence dampens the ECB's hopes of targeting near term inflation reaching ~2%, especially as oil prices narrow in on $30 a barrel.

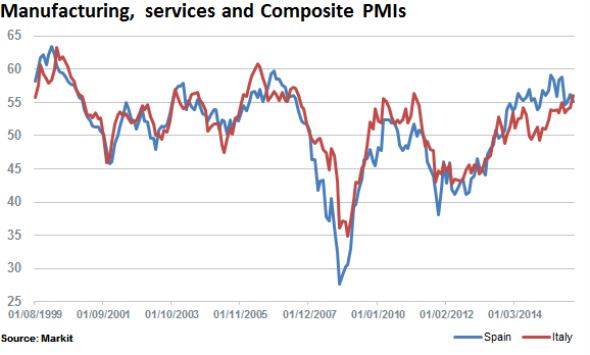

The weakness comes as strong PMI data released for Europe indicates that Eurozone economic activity did in fact pick up during the last quarter of the year. While PMI data continued to register growth for the region, the pace did slow dragged down by France and Spain. Meanwhile Italy's economy has seemingly taken the lead in the region.

Once a laggard

Italy's economic recovery has been slower off the mark compared to Spain's, owing to factors such as long-standing political uncertainty and slow progress on labour market reforms, but the economy is now starting to gather momentum.

The most recent PMI numbers of (56 composite figure) for output based on Manufacturing and services for December are the best seen since 2011, overtaking activity in Spain.

PMI surveys were conducted in Spain prior to an inconclusive election held in December 2015 with a political stalemate which currently may force the need to hold fresh elections. The political stalling has slowed Spanish manufacturing firms and service providers who had continued to record sharp increases in output in the run-up to the general elections.

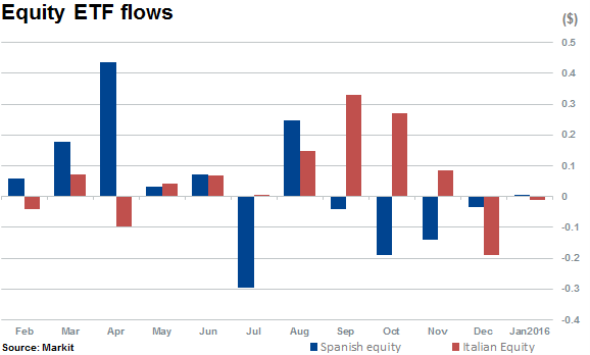

ETF flows

In the last quarter of 2015, ETFs with equity exposure to Spain saw $362m of consecutive outflows occur. This was while ETFs with equity exposure to Italy, despite a large outflow of $190m in December, had net inflows of $167m over the same period.

Investors who followed this rotation would have already benefited, even just two weeks into the year. While both regions have fallen along with global markets, Spanish equities have underperformed by 1.9% year to date compared to the Italian Index.

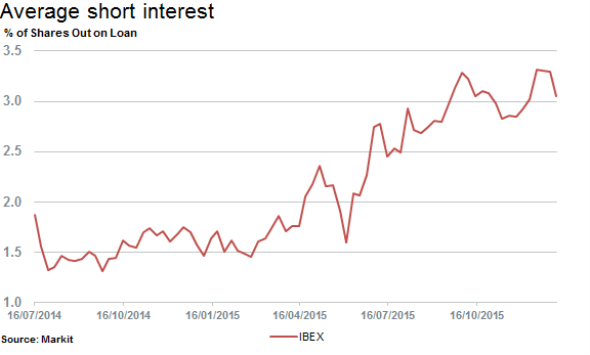

Short tide rises in Spain

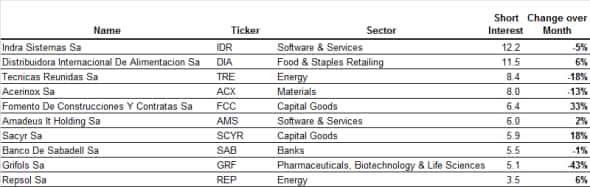

Average short interest for constituents of the Spanish IBEX Index spiked higher during 2015, reaching a high of 3.3% and is currently hovering near 3.0%.

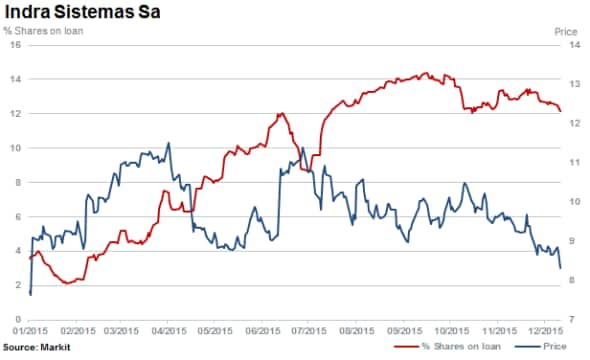

The level of short interest is a marked increase from November 2016 when levels averaged half of this. Currently the most shorted constituent of the IBEX is Indra Sistemas with 12.2% of shares outstanding on loan.

The technology and outsourcing group is the largest IT services provider in Spain with more than 50% of revenues derived from the Spanish economy. The company has been battling sluggish economic growth and austerity locally and is in cost cutting mode to improve cash generation.

Recent political uncertainty has continued to impact on local economic growth prospects which are also impacting similar Spanish firms exposed to local spend such as Sacyr and construction company FCC. Both feature in the top ten most shorted stocks in the IBEX 35.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012016-Equities-Fog-in-Spain-as-Italy-kicks-it-up-a-gear.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012016-Equities-Fog-in-Spain-as-Italy-kicks-it-up-a-gear.html&text=Fog+in+Spain+as+Italy+kicks+it+up+a+gear","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012016-Equities-Fog-in-Spain-as-Italy-kicks-it-up-a-gear.html","enabled":true},{"name":"email","url":"?subject=Fog in Spain as Italy kicks it up a gear&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012016-Equities-Fog-in-Spain-as-Italy-kicks-it-up-a-gear.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fog+in+Spain+as+Italy+kicks+it+up+a+gear http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012016-Equities-Fog-in-Spain-as-Italy-kicks-it-up-a-gear.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}