CREDIT COMMENTARY

Jan 07, 2013

Credit battles to maintain momentum

Risk assets are struggling to maintain the hot pace set by the markets last week, with the major credit and equity indices little changed from Friday's close.

The Markit iTraxx Europe is slightly tighter at 104bps, while the Markit iTraxx Crossover is moderately wider at 434.5bps. Both indices posted strong rallies in the first few days of January, so it is no surprise to see the markets taking stock today.

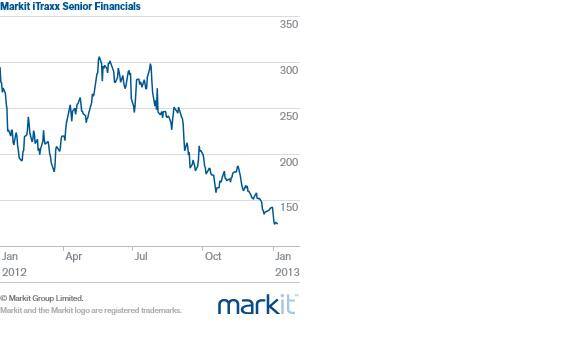

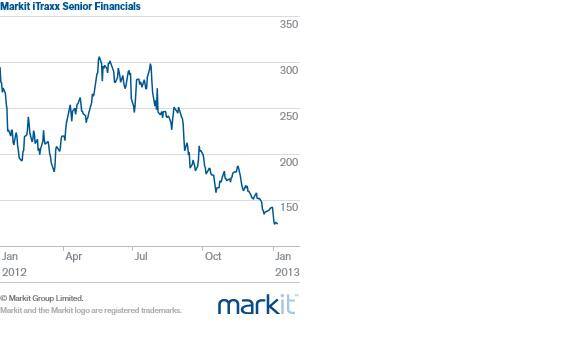

However, banks are outperforming following news that the Basel rules on liquidity will be less stringent than previously announced. The new Liquidity Coverage Ratio (LCR) rule allows a broader range of assets and will have to be fully implemented by 2019. The LCR component of Basel III was of particular concern to banks, so this relaxation is welcome news for the sector.

A strong performance from banks this week could be enough to push the iTraxx Europe through 100bps for the first time since May 2011. A positive start to US earnings season could also fuel bullish sentiment, though there are only five S&P 500 companies reporting this week.

Meanwhile, a Spanish bond auction on Thursday and the monthly ECB and Bank of England policy meetings will be the other key events.

Download full article

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012013044933Credit-battles-to-maintain-momentum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012013044933Credit-battles-to-maintain-momentum.html&text=Credit+battles+to+maintain+momentum","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012013044933Credit-battles-to-maintain-momentum.html","enabled":true},{"name":"email","url":"?subject=Credit battles to maintain momentum&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012013044933Credit-battles-to-maintain-momentum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Credit+battles+to+maintain+momentum http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012013044933Credit-battles-to-maintain-momentum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}