Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 06, 2014

Bank of England maintains loose policy stance amid signs of slowing economy

The Bank of England's Monetary Policy Committee left interest rates at their record low of 0.5% again at their November meeting. The stock of asset purchases made under the Bank's quantitative easing programme was also left unchanged at "375bn.

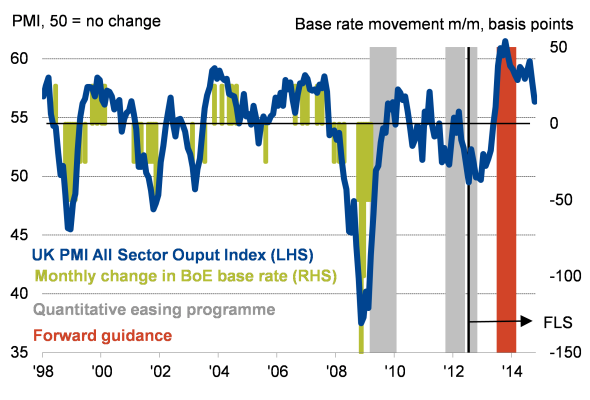

The lack of action had been widely expected. Policy makers have generally grown concerned about the outlook for the UK economy, especially given recent news of ongoing woes in the eurozone. Growth has faltered in the single currency area in recent months, despite recent ECB initiatives to stimulate the economy. The lack of demand in the UK's largest trading partner has hit exports, leading to a down-shifting of growth in the UK's manufacturing sector. At the same time, construction sector activity has likewise slowed, in part due to a cooling housing market (which the MPC will have welcomed), and the rate of service sector expansion has moderated.

BoE policy changes and the PMI

Sources: Markit, Bank of England, Ecowin.

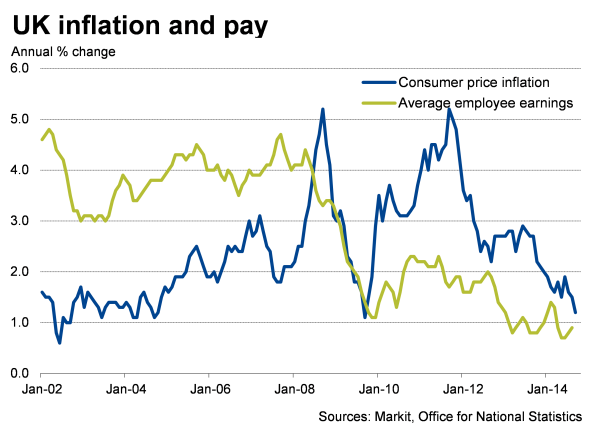

Meanwhile, wage growth has failed to revive to anything like the extent policymakers had been hoping earlier in the year, which had fuelled expectations of higher interest rates at the time, and oil prices have slumped. Inflation is down to a five-year low of just 1.2% compared to the Bank's 2.0% target.

The case for higher interest rates is by no means dead in the water, however. It is highly likely that two of the nine MPC members, Martin Weale and Ian McCafferty, again voted to hike interest rates by 0.25%, citing the fact that the economy continues to grow at a fair clip, and that capacity is being steadily eroded, which adds to the risk of inflation picking up in the medium-term.

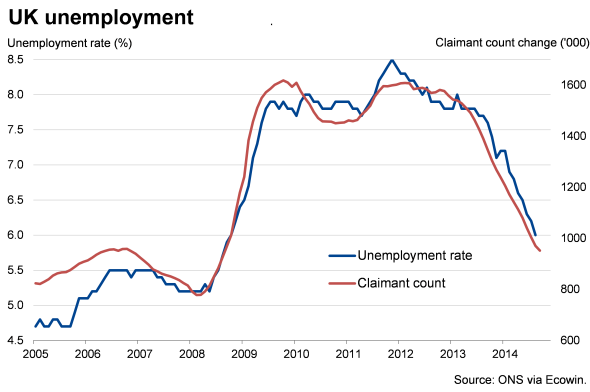

Even with the recent disappointing flow of business survey data, GDP still looks to be rising at a quarterly rate of 0.5%, which is more or less in line with its long term trend, and unemployment has tumbled far faster than expected, down to a six-year low of 6.0% in the three months to August. In forecasts made a year ago, the Bank was expecting unemployment to still be at 7.0% in late 2014.

Pressure to start normalising monetary policy has therefore not gone away, but it seems that the argument to tighten policy is losing ground compared to earlier in the year amid the recent flow of disappointing economic data at home and abroad.

All eyes now turn to next week's Inflation Report, in which a more dovish tone is likely to be seen, with the Bank nudging down its forecasts for economic growth and inflation.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Economics-Bank-of-England-maintains-loose-policy-stance-amid-signs-of-slowing-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Economics-Bank-of-England-maintains-loose-policy-stance-amid-signs-of-slowing-economy.html&text=Bank+of+England+maintains+loose+policy+stance+amid+signs+of+slowing+economy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Economics-Bank-of-England-maintains-loose-policy-stance-amid-signs-of-slowing-economy.html","enabled":true},{"name":"email","url":"?subject=Bank of England maintains loose policy stance amid signs of slowing economy&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Economics-Bank-of-England-maintains-loose-policy-stance-amid-signs-of-slowing-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+England+maintains+loose+policy+stance+amid+signs+of+slowing+economy http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Economics-Bank-of-England-maintains-loose-policy-stance-amid-signs-of-slowing-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}