Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 06, 2016

Following the ETF flows

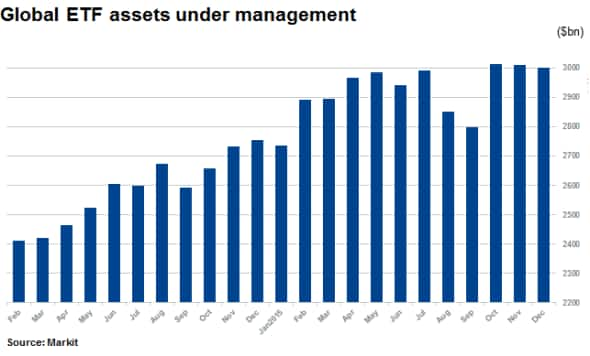

Crossing $3trn in global AUM at the close of 2015, ETFs continue to garner the support of investors however volatility in emerging markets and specifically China have seen sustained fund outflows occur in 2015.

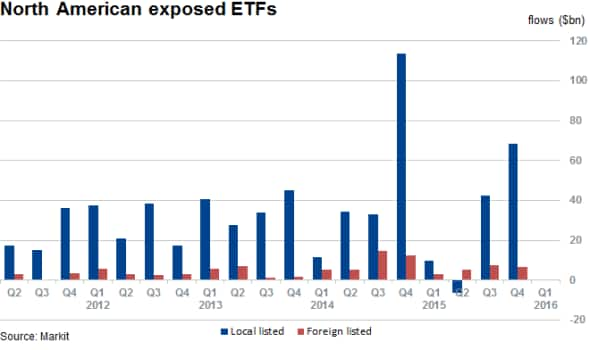

- Fourth quarter of 2015 sees the third largest inflow into ETFs on record, dominated by US

- US attracts strong inflows in second half of the year after single outflow in five years in Q2

- Chinese and overseas listed European ETFs see withdrawals in final quarters of 2015

ETF AUM jumps back above $3trn

Despite an emerging market sell off triggered by plummeting Chinese equity markets during the second half of 2015, ETF AUM once again breached the $3trn dollar mark towards the end of the year.

ETF AUM growth has largely been due to the continued increase in strong net inflows despite general lacklustre market performances and volatility. The asset class continues to attract investors and in the last quarter of 2015, ETF flows were the third highest on record, only superseded by the third quarter of 2015 and the final quarter of 2014.

Strong ETF currents in North America

A large proportion of total global inflows of the final months in 2015 were recorded in the US (the largest ETF market) with ETFs exposed to the region globally recording the second largest quarterly inflow ever of $75bn in the fourth quarter, only beaten by the fourth quarter inflow in 2014 of $126bn.

The only quarterly outflow recorded over the past five years of funds exposed to North America, occurred in the Q2 2015 when domestic listed ETFs recorded quarterly outflows of $6.4bn.

Movements in Asia

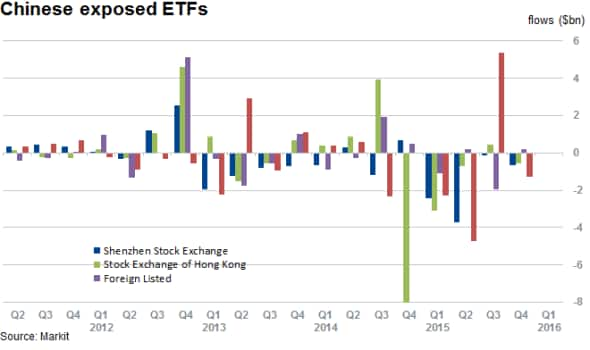

With reports of the Chinese state once again intervening in falling markets this week, ETF flows during 2015 indicate that local and foreign investors have been pulling funds out of ETFs in the region.

Removing the effects of fixed income ETF products (which had significant sporadic inflows during 2015) reveals a strong sell off in local and foreign listed equity funds with a strong spike in inflows during the third quarter (also possibly due to previous market interventions by the state).

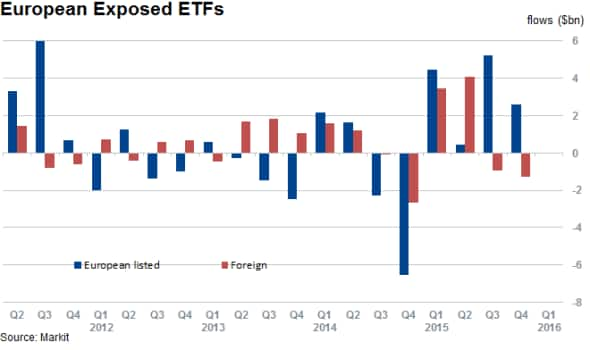

In Europe however, strong inflows during 2015 of almost $13bn into local funds contrast with third and fourth quarter outflows of foreign listed European funds, surpassing $2bn as investors continue to position for the ECB's quantitative easing.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-equities-following-the-etf-flows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-equities-following-the-etf-flows.html&text=Following+the+ETF+flows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-equities-following-the-etf-flows.html","enabled":true},{"name":"email","url":"?subject=Following the ETF flows&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-equities-following-the-etf-flows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Following+the+ETF+flows http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-equities-following-the-etf-flows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}