Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 05, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to the companies due to announce earnings in the week to come.

- Retailers continue to attract short sellers, making up ten of the 17 most heavily shorted companies announcing earnings this week

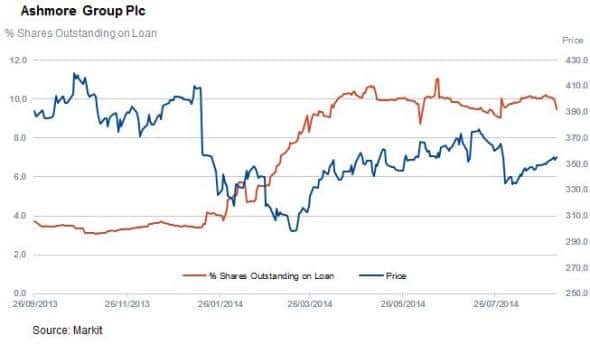

- Ashmore Group sees heavy short interest after disappointing investors last time it announced results

- Department store firm Mayer Holdings is the most shorted company announcing results in Asia, although it has seen shorts cover in recent weeks

North America

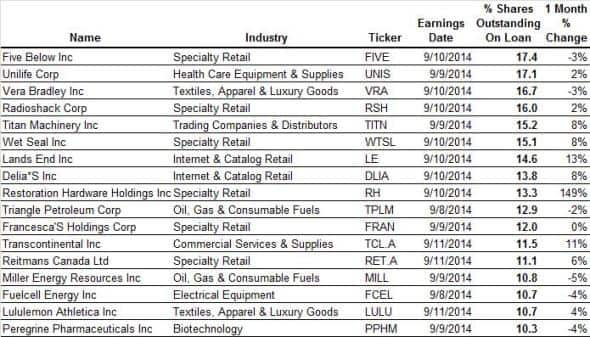

After taking a shortened week hiatus last week owing the tail end of the second quarter, earnings season continues this week. On the bearish side of the upcoming earnings announcements, there are 17 firms announcing results with more than 10% of their shares out on loan.

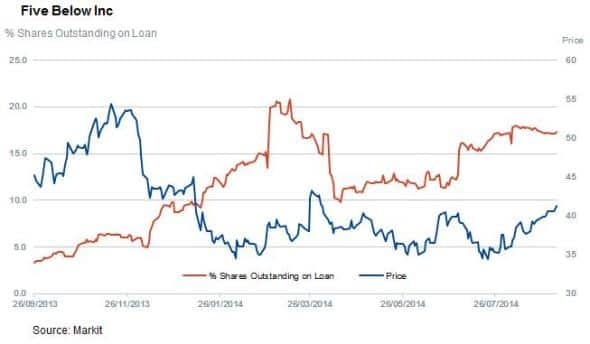

Short sellers continue to disproportionately target retailers and consumer focused companies this earnings season. To this end, ten of the 17 heavily shorted firms announcing earnings this week are from the retail universe. This behaviour will no doubt be encouraged further if the latest US Commerce Department figures are anything to go by as US consumer spending fell in July.

Also heavily shorted in the pure retail space is RadioShack which has seen its shares fluctuate over the last couple of weeks as investors speculate about the firm's eminent survival prospects. Wet Seal comes sees itself as the third most shorted firm after its ceo stepped down after its shares fell by over 60% since January.

Retailers are not the only firms with heavy exposure to consumer spending targeted by short sellers. To this end, we see heavy, although falling, demand to borrow shares in both Vera Bradley and LuluLemon Athletica.

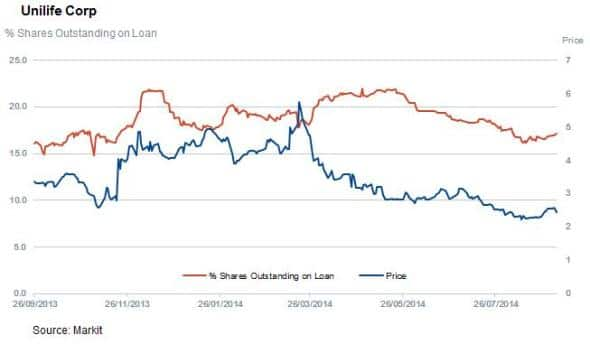

Looking beyond retail, Unilife, which is looking to develop new drug delivery systems and which was tagged with a "going concern" flag by its auditor last year, sees the second largest proportion of shares out on loan ahead of earnings. Unilife shares have halved since the start of the year and though shorts look to have taken some profit off the table in the last couple of months, the firm still sees over four fifths of all available shares out on loan to short sellers.

Europe

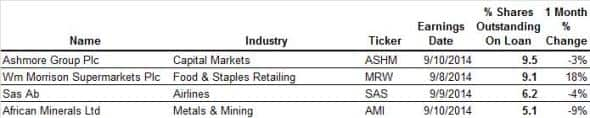

Europe sees light earnings activity next week with only four firms seeing 3% or more of their shares out on loan ahead of results.

UK fund manager Ashmore group sees itself as the most shorted European company announcing results next week with 9.5% of shares out on loan. The company has seen shorts circle since January after it announced large redemptions in its emerging market exposed funds.

UK firm Morrison's has also seen a large surge is shorts over the last few weeks as industry heavyweight Tesco announced its intention to aggressively compete on price in order to win back market share. Morrison's shares have also taken a hit in the wake of these developments, falling by over 5%.

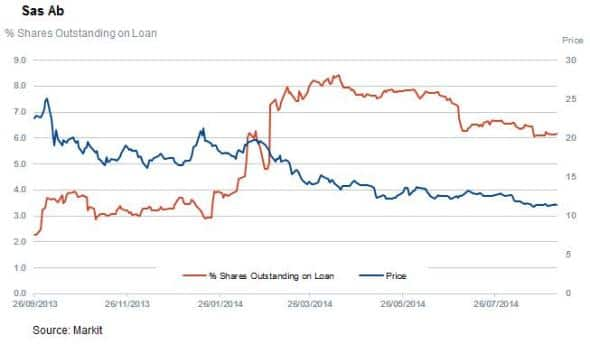

Outside of the UK, Scandinavian airline SAS continues to see heavy short interest as its current competitive joust with regional upstart Norwegian Air Shuttle (NAS) has forced it to cut fares in order to compete with NAS's lower cost offering.

Asia

Asia also sees relatively low earnings activity with seven firms seeing more than 3% of shares out on loan ahead of earnings.

Retailer Myer Holdings comes in as the most shorted company in the region with 11.4% of shares out on loan, over twice that of the second most borrowed name announcing results next week. This heavy demand to borrow shares in the retailers comes as the broader Australian retail sector suffers from gloomy consumer sentiment which has the company set to post a fall in revenue from last year's total, according to analyst estimates.

Singapore firm Liongold comes in as the second most shorted company in Asia with 4.7% of shares out on loan, a figure not seen since its shares tumbled a year ago.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092014Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}