Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 04, 2015

Bonds jump on ECB comments, US jobs report

Market volatility and inflation concerns have opened the door for the ECB to do more quantitative easing (QE), while the latest US jobless claims data indicates a September rate hike.

- European sovereign bonds and corporate credit reacted positively to dovish ECB comments

- A mixed jobs report increases likelihood of a September hike , but inflation expectations are close to 5-yr lows

- The ETF HYG, which tracks the Markit iBoxx $ Liquid High Yield index, saw minimal change in tracking error amid volatility and asset outflows

Draghi dovish

The ECB left interest rates and its QE programme unchanged yesterday. Growth and inflation expectations were revised down amid global slowdown and market volatility. ECB President Mario Draghi hinted during his press conference that he is ready to ease monetary policy (expand QE) if the economic situation deteriorates further.

Credit markets reacted positively to the dovish tones. The Markit iTraxx Europe index, consisting of 125 investment grade corporate single name CDS, tightened 3% to 72bps. Its high yield counterpart the Markit iTraxx Europe Crossover index tightened 3% to 330bps.

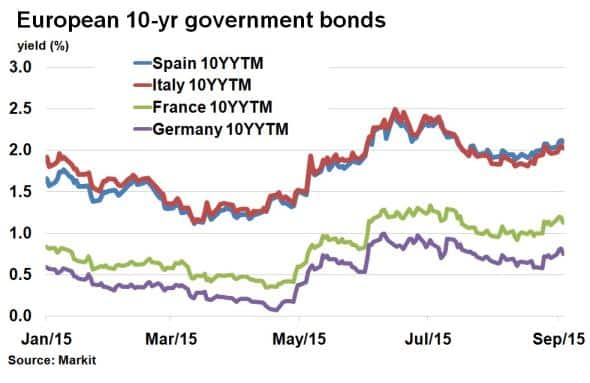

Peripheral sovereign bond yields tightened. The Spanish 10-yr bond rate tightened 2bps to 2.1%, while the Italian 10-yr rate closed in 3bps to 2.02%, according to Markit Bond Pricing. It was the first time in five trading sessions that bond yields tightened as investors remained firmly risk off after the "Black Monday' market turmoil.

Safe haven core European sovereign bonds tightened to a greater degree. Both German and French 10-yr rates were down 6bps on Thursday.

For the month of August, French government bonds returned -1.3% compared to -0.9% for German and Spanish and -1.0% for Italian government bonds, according to Markit iBoxx indices. France's relative underperformance was surprising since it is usually seen as one of the safer core European nations, but got caught up as risky assets were sold.

Hike remains open

In one of the most anticipated jobs reports this year, US non-farm payrolls for August came in at 173k, while unemployment dipped to 5.1%. Despite the numbers being slightly below consensus, on the whole it was positive and may force the Fed's hand in raising interest rates in a couple of weeks.

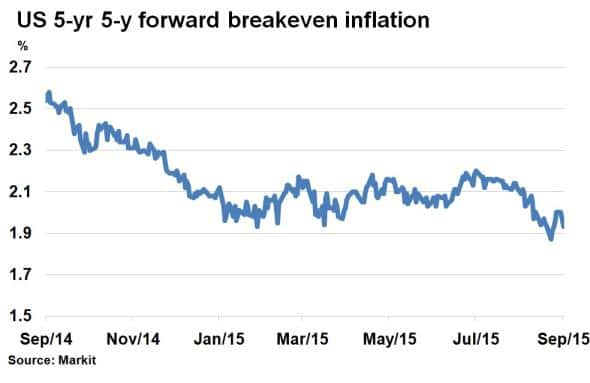

The Fed faces an issue with inflation which has been on a downward trend since July. The five year forward inflation expectation rate, calculated using TIPS, recently hit a low and remains below the Fed's 2% target.

In theory an economy gearing towards full unemployment should kick start inflation as wage pressures rise, but so far that has not occurred. . Also, the impact of slowing Chinese demand and weak commodity prices (which have yet to establish a bottom) have contributed to the uncertainty.

ETFs hold up

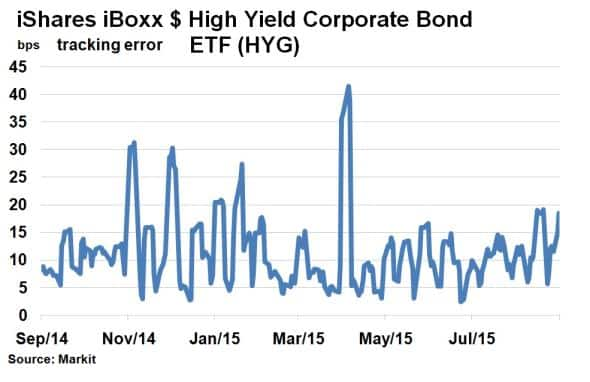

Fixed income ETFs have enabled investors to gain exposure to otherwise difficult to trade OTC securities such as corporate bonds. As they have become more popular questions have been raised about the assets class' resilience when face with volatility and liquidations.

The iShares iBoxx $ High Yield Corporate Bond ETF (HYG), with over $12bn of AUM, saw heavy outflows over the past few weeks. Trading volumes also increased according to Markit ETP but HYG's tracking error remained relatively range bound as it has during previous bouts of volatility. In fact the tracking error was higher on four previous occasions in 2015 alone and hasn't surpassed 20bps since April.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-credit-bonds-jump-on-ecb-comments-us-jobs-report.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-credit-bonds-jump-on-ecb-comments-us-jobs-report.html&text=Bonds+jump+on+ECB+comments%2c+US+jobs+report","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-credit-bonds-jump-on-ecb-comments-us-jobs-report.html","enabled":true},{"name":"email","url":"?subject=Bonds jump on ECB comments, US jobs report&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-credit-bonds-jump-on-ecb-comments-us-jobs-report.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bonds+jump+on+ECB+comments%2c+US+jobs+report http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-credit-bonds-jump-on-ecb-comments-us-jobs-report.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}