Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 04, 2015

Puerto Rico misses payment, GO bonds selloff

A missed payment over the weekend leaves Puerto Rico's General Obligation bonds in a perilous situation, but the wider muni market remains stable.

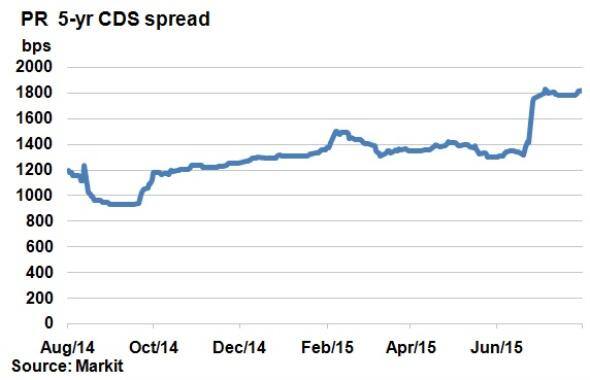

- Puerto Rico's 5-yr CDS spread has widened back to 2015 highs; GO bonds get cheaper

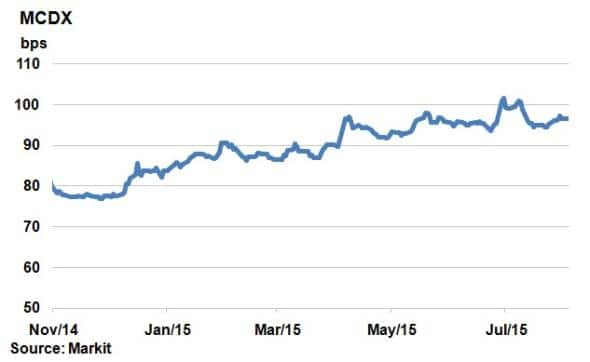

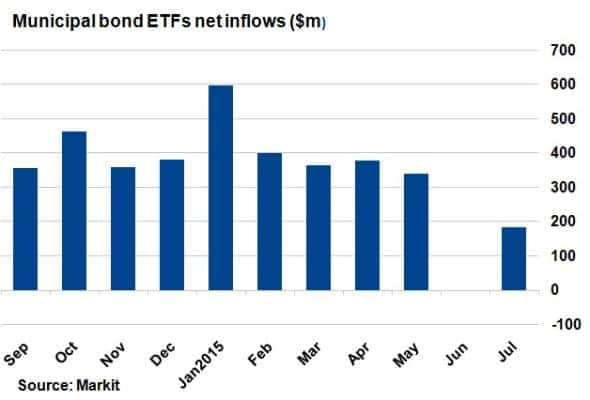

- MCDX has remained flat, while ETF investors have returned to munis after June outflow

- Chicago's 2040 GO bond saw its yield spike 13bps over the weekend

The inevitable was confirmed yesterday as Puerto Rico (PR) became the first US commonwealth to default on its debt obligations.

The US territory failed to make the full $58m payment due August 1st on one of its Public Finance Corporation (PFC) bonds. It was only five weeks ago that PR's governor said that its debt burden was unsustainable and that the only viable option would be to restructure the $72bn debt load.

Credit markets have been factoring in the heightened probability of default since the end of June. PR's 5-yr CDS spread peaked at a record 1830bps on July 8th before tightening 51bps in the subsequent week as it scrambled to make repayments. The weekend's missed payment on the PFC bond has seen PR's credit spread to widen 26bps over the last three days; only 5bps short of the peak 1830bps level.

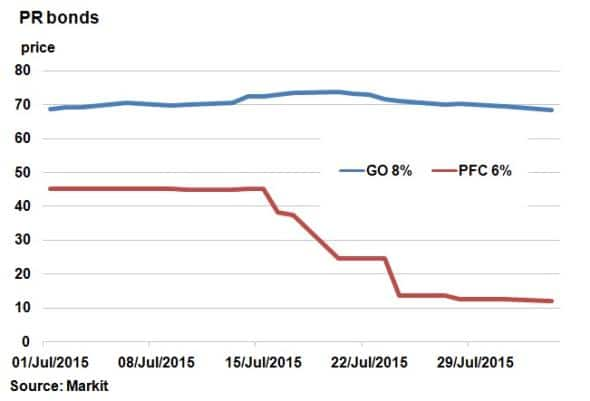

The missed payment would put PR into default according to rating agencies even though the PFC bonds have looser covenants than the General obligation (GO) bonds. This can be seen by looking at the credit risk associated with the bonds.

The price of PR's 8% GO bond due 2035 has seen minimal movement compared to the sharp drop seen in the 6% PFC bond due 2024. The PFC bond now trades at 12 cents to the dollar (an all-time low), according to Markit's municipal bond pricing service.

The GO bond is however 1.75 cents cheaper than it was one week ago and has dipped below 70 cents for the first time in four weeks. This is tied to the fact that the commonwealth released a notice yesterday stating that it has temporarily suspended monthly deposits to the GO redemption fund.

The consequences of further credit deterioration remain uncertain, but since PR is a commonwealth and not a state, it remains restricted to certain bankruptcy filings that states can use.

Investors remain firm

In bond markets, the news of default had a very minimal effect on the overall muni market, which has remained steady, especially on the long end of the curve.

The Markit MCDX, a credit index made up of investment grade municipal CDS spreads, has remained flat, highlighting the wider market's insulation from PR; possibly one of the reasons why federal government has so far stayed on the side lines.

ETF investors have also returned to the asset class after showing little demand in June. July saw $183m flow into ETFs tracking munis; bouncing back from June's outflow.

Possible risks

Risks do however remain. Many Puerto Rican residents hold the debt and any haircut would result in individual losses. Many bond funds in the US also hold PR debt. A worsening situation could potentially lead to a government stepping in by changing bankruptcy legislation.

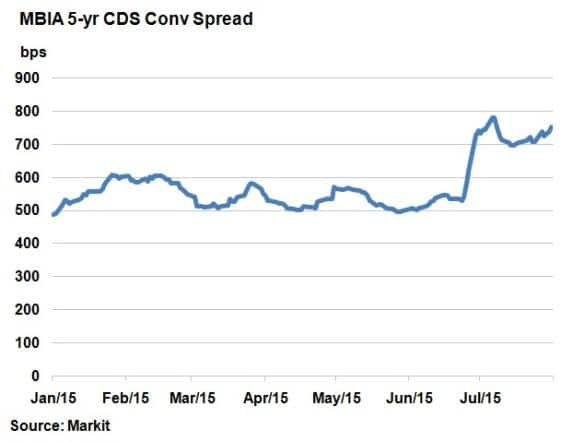

In corporate credit, monoline insurer MBIA has seen its 5-yr CDS spread widen 37bps over the last three days to 772bps; back to levels seen at the start of July as the credit comes under renewed pressure.

More vulnerable issuers such as Chicago, whose credit rating was downgraded to junk in May, saw its 2040 GO bond yield spike 13bps over the weekend. The yield is however still under half of that of PR's 2035 GO bond.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082015-Credit-Puerto-Rico-misses-payment-GO-bonds-selloff.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082015-Credit-Puerto-Rico-misses-payment-GO-bonds-selloff.html&text=Puerto+Rico+misses+payment%2c+GO+bonds+selloff","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082015-Credit-Puerto-Rico-misses-payment-GO-bonds-selloff.html","enabled":true},{"name":"email","url":"?subject=Puerto Rico misses payment, GO bonds selloff&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082015-Credit-Puerto-Rico-misses-payment-GO-bonds-selloff.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Puerto+Rico+misses+payment%2c+GO+bonds+selloff http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082015-Credit-Puerto-Rico-misses-payment-GO-bonds-selloff.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}