Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 04, 2015

lnvestors seek exposure to Russia, but PMI signals deepening recession

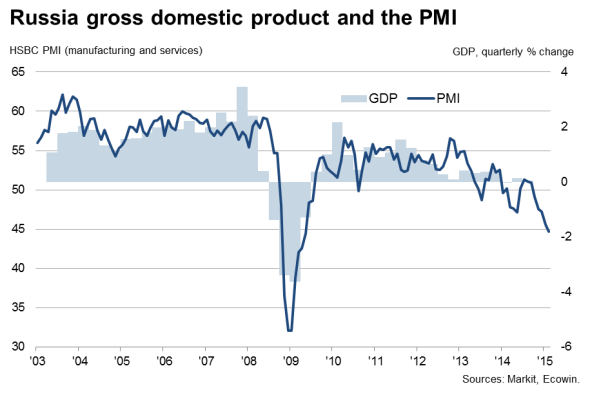

Russia's economic downturn deepened in February, with business surveys signalling the steepest decline in output since the height of the global financial crisis almost six years ago.

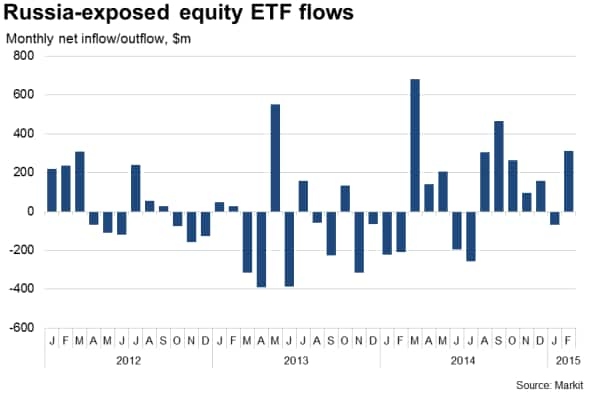

The data contrast with improved investor sentiment towards Russia, as indicated by renewed inflows into equity exchange-traded funds (ETFs) exposed to Russia and rallying share prices. However, the gains look to be limited to the energy sector, and the PMI suggests that the outlook for the wider Russian economy has darkened.

Steeper downturn

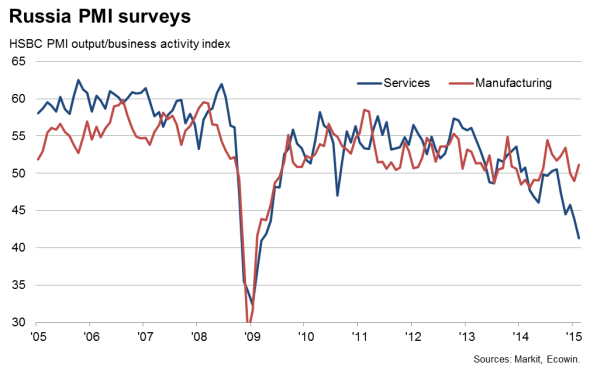

The HSBC Purchasing Managers' Index, compiled by Markit from its twin surveys of manufacturing and services, fell from 45.6 in January to 44.7, running below the 50.0 no-change level for a fifth successive month and down to its lowest since May 2009.

The survey data highlight the growing impact of the recent oil price rout on the Russian economy, as well as the damaging effect of sanctions from the West.

The service sector suffered particularly badly, with both business activity and new orders dropping to the greatest extents since March 2009.

Although manufacturing output returned to growth after declining in January, the pace of expansion was only modest due to a slump in exports. While domestic orders for goods rose, most likely reflecting import substitution, exports posted one of the sharpest monthly declines since 2009 as sanctions continued to hit trade flows.

Employment fell sharply again as companies scaled back capacity in line with the deteriorating outlook. Headcounts have now fallen continuously for 20 months.

Input costs meanwhile increased sharply. Although not quite as severe as the rises seen in recent prior months, February saw companies struggling in the face of higher import costs arising from the rouble's weakness and shortages of goods on the domestic market. Prices charged for goods and services likewise jumped sharply higher again as a result of the need to pass higher costs on to customers.

Investment inflows

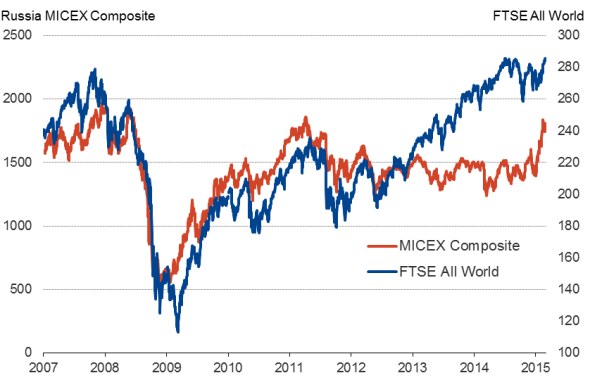

Investors have continued to take a relatively relaxed view on Russia, given the weakened economic outlook and worries over the crisis in Ukraine. Inflows into Russia-exposed equity ETFs had suffered a $70bn net outflow in January, but that decline has since been swamped by a $310bn inflow in February. The MICEX benchmark share price index has jumped a staggering 29% so far this year.

The rally needs to be put in some context, however, and merely reflects some catch-up, as Russian shares having significantly underperformed the global equity market over the prior two years.

Equity markets

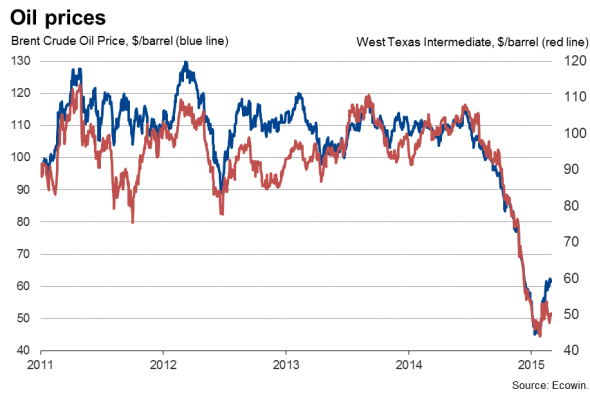

Gains have also been concentrated in the energy market, reflecting recent oil price increases. Oil companies account for over half of the MICEX, and oil prices have risen markedly from their January lows. Brent crude is up some 37% from a low of $45 per barrel in mid-January to $62 in early March.

However, Brent remains some 46% down on the peak seen in June of last year, which is clearly continuing to hurt the Russian economy, according to the PMI. And domestic demand is also clearly slumping as sanctions from the West hit supply chains and prices spiral higher. Despite investor sentiment towards Russia improving, the country still faces the prospect of recession in 2015.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-economics-lnvestors-seek-exposure-to-russia-but-pmi-signals-deepening-recession.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-economics-lnvestors-seek-exposure-to-russia-but-pmi-signals-deepening-recession.html&text=lnvestors+seek+exposure+to+Russia%2c+but+PMI+signals+deepening+recession","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-economics-lnvestors-seek-exposure-to-russia-but-pmi-signals-deepening-recession.html","enabled":true},{"name":"email","url":"?subject=lnvestors seek exposure to Russia, but PMI signals deepening recession&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-economics-lnvestors-seek-exposure-to-russia-but-pmi-signals-deepening-recession.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=lnvestors+seek+exposure+to+Russia%2c+but+PMI+signals+deepening+recession http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-economics-lnvestors-seek-exposure-to-russia-but-pmi-signals-deepening-recession.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}