Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 04, 2015

US expansion leads global growth to five-month high in February

Global economic growth picked up momentum for a second month running in February, reaching the fastest since September according to PMI survey data.

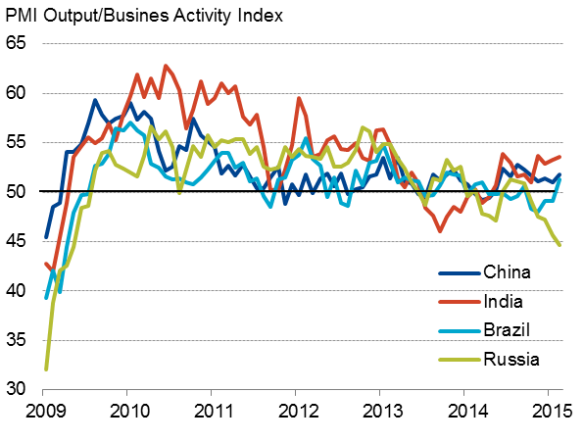

Growth picked up in the eurozone, China, India and Brazil, but the best performances were again seen in the US and UK. The biggest disappointments were seen in Japan, where the economy sank back into stagnation, and Russia, which is seeing the sharpest downturn since early-2009.

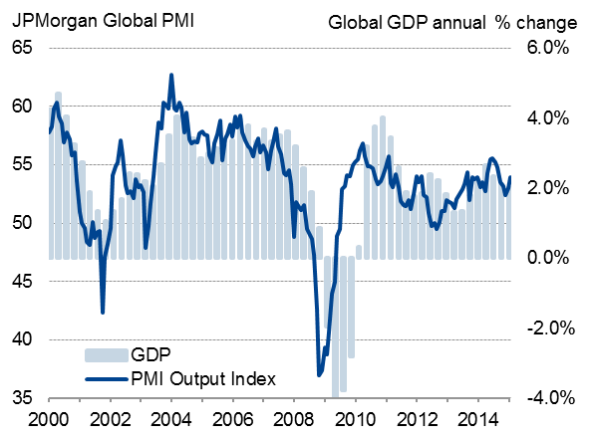

Global PMI edges higher

The JPMorgan Global PMI, compiled by Markit from its manufacturing and services PMI surveys, rose from 53.0 in January to 53.9, signalling a further recovery from the 14-month low seen at the end of last year.

However, the index remains consistent with global GDP rising at an annual rate of just 2.5%, which is modest by pre-recession standards.

Global economic growth

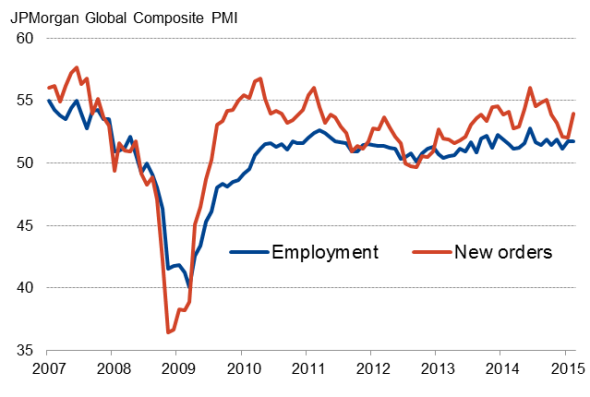

Growth of new business also picked up, hitting a five-month high and suggesting output growth is likely to accelerate further in March. However, global employment growth remained stuck at the modest pace seen in January, reflecting a general reluctance of firms to take on extra staff in the face of an uncertain economic outlook.

Global employment and new orders

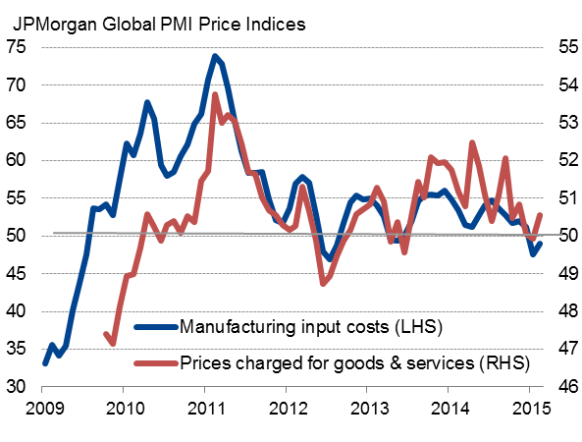

Price pressures meanwhile picked up slightly, but remain historically weak. Average prices charged for goods and services rose marginally, contrasting with a marginal decline in January, and average input cost inflation picked up slightly from January's near five-and-a-half year low. Manufacturing input costs fell for a second month, albeit to a lesser extent than January.

Global manufacturing and services

Sources for all charts: Markit, JPMorgan, HSBC

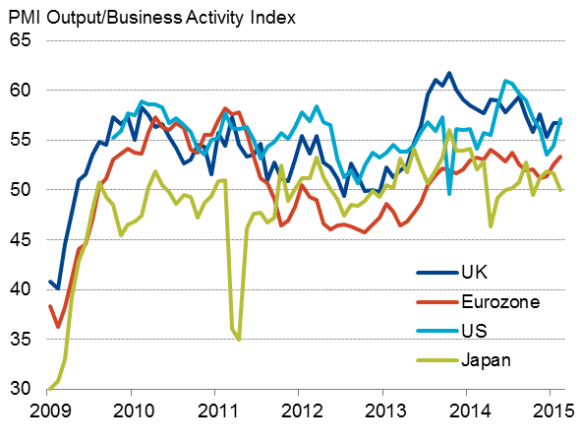

Developed world leads global upturn

Growth in the developed world continued to exceed that seen in the emerging markets, although in both cases February saw the fastest rate of expansion since September.

The developed world PMI has been above that of the emerging world continuously since May 2013, signalling an economic out-performance of the rich world in recent years, and especially the US and UK, where strong expansions were again recorded.

Both the US and UK look set to enjoy GDP growth of 0.6% in the first quarter based on PMI survey results available so far.

A key development in February was the acceleration of growth in the eurozone, where the PMIs signalled the fastest growth for seven months. Euro area GDP looks set to grow by at least 0.3% in the first three months of the year. There are clearly different countries moving at very different speeds within the euro area, but February was also notable in being the first time since last April when all four largest members reported an upturn in business activity, although growth remains especially weak in both Italy and France.

One of the biggest disappointments of the month was the return to stagnation in Japan. The all-sector PMI fell to 50.0 as a welcome upturn in manufacturing output growth, linked to rising exports and the depreciation of the yen, was offset by a renewed contraction of service sector activity, the first such fall for four months. The weakness of the services economy points to lacklustre domestic demand in Japan.

Developed world

Among the world's largest emerging markets, growth accelerated in China and India, reaching five- and three-month highs respectively, but perhaps the most welcome development was a return to growth in Brazil after four months of decline. February's expansion was the largest that Brazil has seen since December 2013. However, despite picking up, growth rates in all three countries remained only modest, and far below typical rates of expansion seen prior to the global financial crisis.

Although weak, the expansions in China, India and Brazil nevertheless contrasted with the steepening downturn recorded in Russia, which is suffering the worst performance of all major economies so far this year. February saw Russian business activity collapse to the greatest extent since May 2009, the rate of decline having gathered momentum over the past five months. Although Russian manufacturers reported the first, albeit modest, increase in output since November, service providers reported the steepest decline in activity since March 2009 as sanctions from the west and the oil price rout continued to hit the economy.

Emerging markets

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Economics-US-expansion-leads-global-growth-to-five-month-high-in-Fe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Economics-US-expansion-leads-global-growth-to-five-month-high-in-Fe.html&text=US+expansion+leads+global+growth+to+five-month+high+in+February","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Economics-US-expansion-leads-global-growth-to-five-month-high-in-Fe.html","enabled":true},{"name":"email","url":"?subject=US expansion leads global growth to five-month high in February&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Economics-US-expansion-leads-global-growth-to-five-month-high-in-Fe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+expansion+leads+global+growth+to+five-month+high+in+February http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Economics-US-expansion-leads-global-growth-to-five-month-high-in-Fe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}