Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 03, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings this week.

- Lindsay Corp is the most US shorted company ahead of earnings

- Food producers are two of only five European companies seeing demand to borrow

- China Lumina tops the list in Asia

North America

There are only 18 companies with meaningful short interest (over 3% of their shares on loan) reporting earnings this week.

Agriculture manufacturer, Lindsay Corp is the most borrowed stock with 30% of its shares on loan, a figure over 10 times higher than the average short interest across the S&P 500 index.

The company offers methods to efficiently deliver water to crops but short sellers remain sceptical. Demand to borrow the stock is heavy and has increased 12% in the run up to earnings. Almost 80% of the available supply of shares which can be borrowed are out on loan, meaning it would be hard and expensive to short more of the stock.

Also seeing heavy borrowing in the run up to earnings is Calamp, a maker of communications equipment. Short interest has risen to a record high of 12% of the total shares on loan, having increased by a fifth in month ahead of results.

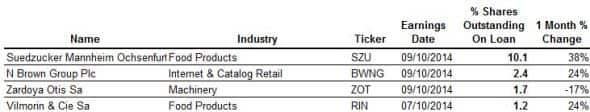

Europe

Earnings activity is slow in Europe, with just four firms reporting results with more than 1% of shares out on loan.

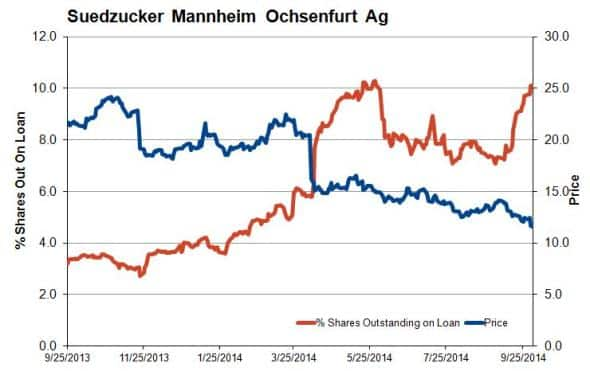

Of these, only German food producer Suedzucker Mannheim Ochsenfurt sees significant borrowing demand with 10% of its shares on loan, close the annual high of 10.5% recorded in May. The shares are already down 40% in the last year, with eleven analysts rating the stock a "sell" against one "buy", according to Reuters.

French food producer, Vilmorin has also seen a 25% uptick in short interest ahead of results, but in absolute terms only 1.2% of the shares are on loan.

Asia

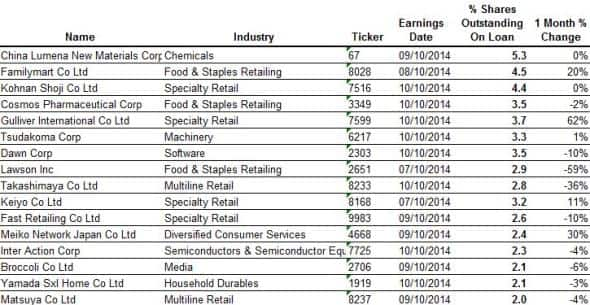

Demand to borrow in Asia is more significant, with 16 companies with more than 2% of their shares on loan announcing results this week.

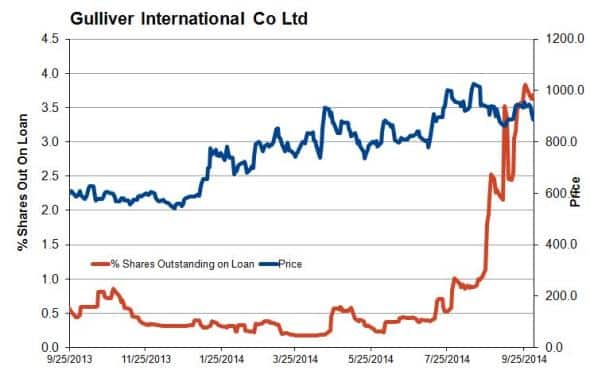

Of these, short interest in Japanese used car specialist Gulliver International is most noteworthy. It has risen almost two thirds in the last month to 3.7% of shares on loan, within touching distance of a two year high. The company is focused on building brand awareness and bringing the system it uses in Japan to the Thai market. The rise in short interest is in contrast to the strong stock performance, with the shares trading just below a record high.

Chemical firm, China Lumina tops the most borrowed list in Asia with 5.3% of its shares on loan. However, the company has not seen any noteworthy increased demand to borrow ahead of announcing results.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}