Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 02, 2014

GPS firms on track

As Apple becomes a force for change amongst smart watch makers, we look at investor sentiment towards GPS and personal navigation firms in the wake of a spate of product announcements.

- Tomtom sees short interest hover at three year lows following a strong run in its share price

- Garmin sees more shorting activity, but demand to borrow has been flat in recent weeks

- This comes as the industry reinvents itself into a software as a service model

Navigation stocks may be the most disrupted by the function creep provided by ever powerful mobile platforms.

These GPS makers, which used to be ubiquitous on car windshields, have faced a two pronged assault from evermore capable mobile devises which have proved more flexible for everyday use. In addition the native car infotainment systems have supplanted the need for a separate satellite navigation system. In the face of this increased competition, both firms have seen their consumer and automotive business retreat from the highs a few years ago.

The fall in sales have stabilised in recent months as these firms have diversified into sports and outdoor products, which filled the revenue void.

But the recent spate of smartwatch innovation and Apple's foray into the space mean navigation looks set to be another tech niche to be swallowed up by the duelling industry smartphone giants as these firms have combined GPS tracking apps with a seamless connection to their mobile operating software.

With this in mind, we look to see if short sellers have returned to the sector.

Tom2

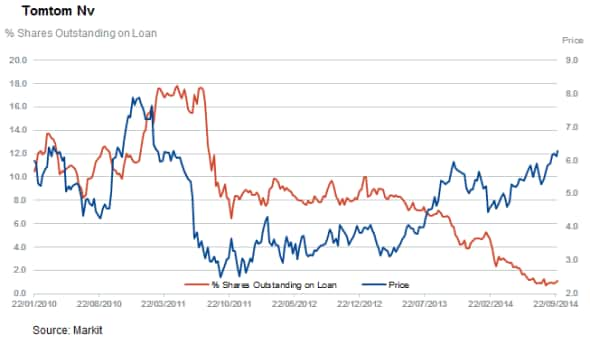

Dutch firm Tomtom stood at the heart of the personal navigation revolution space, the firm saw its turnover more double in the two years to 2007, only to see that number fall by over a third in 2013 after six years of falling sales. This saw the frim top the most shorted lists with demand to borrow topping out at 18% in 2011 as the shares fell by two thirds from their highs.

The company looks to have gained control of its operations over the last couple of years. It has been recovered from a sharp fall in profits in 2011 and the firm looks set to return to revenue growth in the coming year as its broadened its partnership with Apple to power the mobile map offering. The impending smart watch could be a boon for Tomtom and its licensing business.

There seems to be little appetite from short sellers to return to the stock as demand to borrow has hovered near the recent five year lows with 1% of the firm's shares out on loan.

Little Garmin shorting

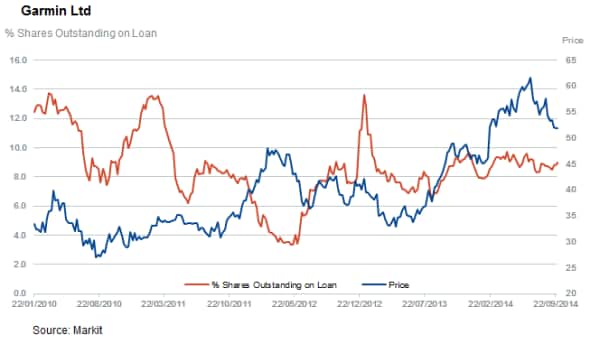

US listed Garmin has also not seen much of an increased demand from short sellers to borrow shares of the company in recent weeks. The firm, which has a similar turnover as its Dutch competitor, has 9% of shares out on loan, a number that has also stayed flat in recent weeks.

Interestingly, the stock sees nine times more short interest than its Dutch peer. Perhaps short sellers believe it looks more exposed to the recent smart watch launches owing to the fact that it relies on the outdoors and fitness market for about a third of its revenue.

If you can't beat them"

The recent run of bullish activity also could have something to do with both firms reinvention away from pure hardware into the licensing space, which allows them to leverage their existing mapping IP to third party hardware firms. To this end, both Garmin and Tomtom have announced deals with carmakers which will see their mapping software services built into navigation hardware which has sent both the company's shares up sharply over the last days.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102014-Equities-GPS-firms-on-track.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102014-Equities-GPS-firms-on-track.html&text=GPS+firms+on+track","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102014-Equities-GPS-firms-on-track.html","enabled":true},{"name":"email","url":"?subject=GPS firms on track&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102014-Equities-GPS-firms-on-track.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=GPS+firms+on+track http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102014-Equities-GPS-firms-on-track.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}