Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 02, 2015

Short sellers continue war on coal

Hopes of an end to the "war on coal" scared off short sellers in the wake of last year's US election, but short selling has since climbed to new highs amid continuing headwinds for coal producers.

- US coal firms have sunk to the bottom of the return pile

- Short selling in US coal firms hit a new high of 7.5% in March

- Short sellers have retreated in Arch Coal and Alpha Natural after their shares collapsed

Incoming senate majority leader Mitch McConnell who hails from coal producing Kentucky ran his midterm campaign on a platform of ending the "war on coal". The prospects of this high profile support briefly sent coal stocks rallying, but eight months on the energy source is continuing to lose ground to cleaner burning natural gas.

As a result coal prices have fallen to new recent lows; a trend that looks set to endure as cleaner burning natural gas and renewable power plants make up the large majority of newly built power plants. These issues have seen investor sentiment for coal companies sink to new lows.

Returns fail to materialise

The 13 US listed coal firms with a market cap greater than $100m have seen their shares fall by about a third on average since the start of the year; a number that puts the sector among the bottom 10% of all US stocks according to the 1 Year Price Momentum factor from Markit Research Signals. These 13 firms have also seen their average price fall by 18% in the last four weeks alone.

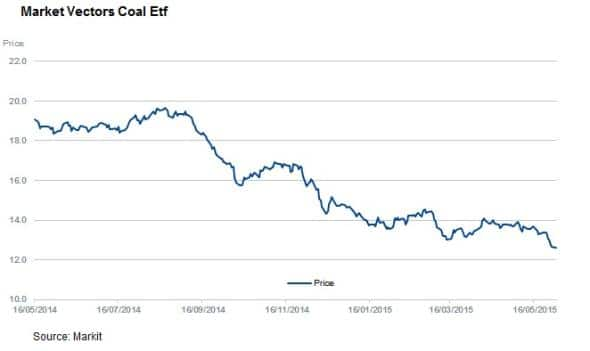

A broad measure of the sector, the Market Vectors Coal ETF, as seen its price fall by 30% in the last 12 months to hit a new five year low.

Short sellers circle in

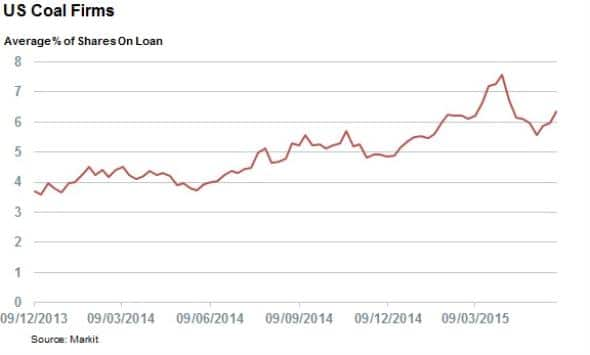

Short sellers have noted coal's recent struggles, with US listed coal firms seeing short sellers steadily add to their positions over the last 18 months. Coal firms had an average of 3.5% of shares out on loan 18 months ago, a number that rose to a high of 7.5% in the opening week of April.

The build-up in short interest over the last 18 months was a slow and steady one, with a brief pause in the closing months of last year in the wake of the US midterm elections.

Recent covering after price collapse

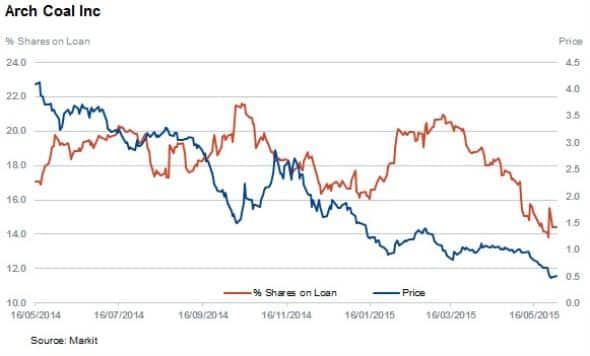

But short interest in the sector is now somewhat off its recent highs, with Alpha Natural Resources and Arch Coal both seeing covering in the last month. Both firms are down by more than a third in the last month and short sellers appear to be taking some of the profits from their trades.

Arch Coal has seen the most of covering as short interest is now down by a quarter from its recent highs, falling below the 15% mark for the first time since March 2013. This will come as little solace for the company as its shares are down by 70% over the same period.

Covering not universal

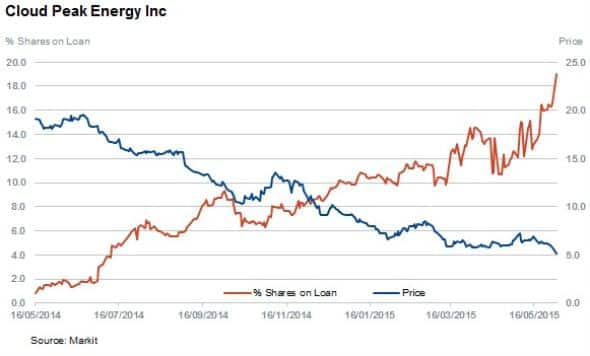

The covering in Arch and Alpha has coincided with an increase in demand to borrow shares in Peabody Energy, Energy and Westmoreland. This could represent a shift in the sector's short positions as short sellers begin to exit their most profitable positions.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-equities-short-sellers-continue-war-on-coal.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-equities-short-sellers-continue-war-on-coal.html&text=Short+sellers+continue+war+on+coal","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-equities-short-sellers-continue-war-on-coal.html","enabled":true},{"name":"email","url":"?subject=Short sellers continue war on coal&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-equities-short-sellers-continue-war-on-coal.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+continue+war+on+coal http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062015-equities-short-sellers-continue-war-on-coal.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}