Short sellers continue their European run

August saw European shares surge despite less than stellar economic news. In spite of this recent surge against the run of play, short sellers have been successful in their bets on under performance.

- The most expensive to borrow European shares have under performed their peers by 2% in the last three months

- King Digital was the best performing short

- The priciest shares to borrow have performed the worst out of their peer group so far this year

European investors seem to be happy to tune out both lacklustre economic news and the worsening situation in Ukraine in the hope that both situations will force the European Central Bank to spur the economy on with more monetary easing. The last few weeks have brought increasingly bearish macroeconomic news, which has seen equity markets in Europe rebound from recent lows as investors increasingly expect further monetary easing from the European Central Bank.

Short sellers have not been eager to take their usual contrarian view, as the average demand to borrow shares amongst Stoxx constituents has stayed relatively flat since the start of the year. But our review of the shares that shorts are willing to pay the most to borrow does show that the shares which have the most committed short base have continued to underperform over the summer, despite the recent ECB fired risk rally.

Shorts continue their streak

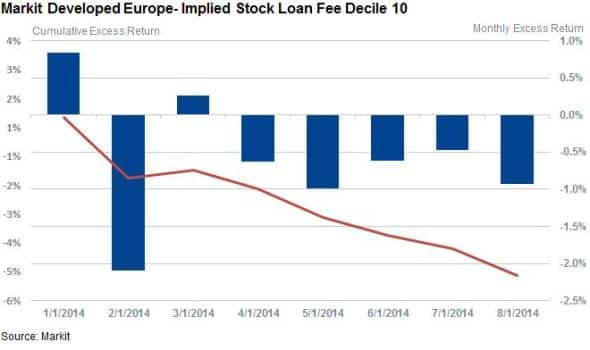

Despite all this talk of ECB driven risk rally, shorts have managed to continue to perform relatively well in Europe as the 10% of shares which command the highest fee in the securities lending market, a gauge of how committed short sellers are in a name, have continued to underperform. The shares with the highest fee amongst the Markit Developed Europe universe have returned 0.6% over the month of August which is nearly 1% lower than the returns posted by the wider universe.

The latest month's underperformance is the largest underperformance in three months, and marks the fifth month in a row in which expensive to borrow shares have trailed behind the rest of the market. The fact that the most expensive to borrow names have underperformed in such a consistent manner over six of the last eight months has taken their cumulative underperformance to 4.6%, making it the worst performing group of shares when ranking by cost to borrow.

Highlights

Capital goods firms are currently the most numerous among the group of shares which the shorts are most willing to pay a premium borrow fee for. There are 19 capital goods companies within the most expensive to borrow group of shares, making it the best represented followed by Energy and Real Estate firms. The demand to borrow these names echoes the recent set of downbeat macroeconomic numbers which show that European output is largely stagnant.

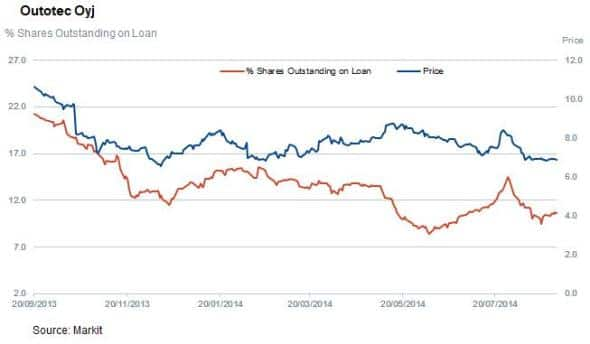

Leading the charge in that space is Finnish firm Outotec which has over 10% of its shares out on loan as its shares hover near their lowest level since 2011. Also seeing a high proportion of their shares out on loan are Maire Tecnimont in Italy and Sgl Carbon in Germany.

As for the company which performed the best for short sellers in Europe over the last month, the honour goes to app company King Digital whose shares slid by over 28% in August. While aggregate short interest in this name is low with only 1.9% of shares sold short, this is primarily driven by the fact that the newly listed company is hard to locate in the securities lending market with only 1% of its shares in lending programmes.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.