South Korea lags behind

A review of Asian stocks in run-up to the second half of the year sees South Korean shares lagging behind their regional peers in terms of analyst expectations, after failing to live up to expectations in the last round of earnings.

- South Korean firms dominate the Asian shares seeing the worst earnings revisions

- Export heavy firms have seen some of the most bearish earnings trends

- Average short interest in the KOSPI 50 index is up by a quarter since the start of the year

Asia’s evolution as the world’s production powerhouse has seen the region’s main economies fight for their share the export pie. One of the key tools in boosting exports over the last couple of years has been exchange rates which have in turn seen government policies, such as Japan’s “Abenomics”, actively seek to devalue their currencies against their main trading rivals.

While the jury is still out as to the long term gains to be gained from devaluating exchange rates, the short term effects of what is essentially a zero sum game can see countries whose exchange rates movements make their exports less competitive.

One such country is South Korea, which has seen the value of its Won gain ground against both the US Dollar, against which much of the region’s trade is done, and the Yen, its more developed trading rival. Faced with a less competitive currency, our look at Asian Ex Japan companies in the wake of the second quarter earnings period sees South Korean firms batting above their weight amongst the firms seeing both the worst analyst revisions and those who failed to live up to expectations.

Tough period for South Korean firms

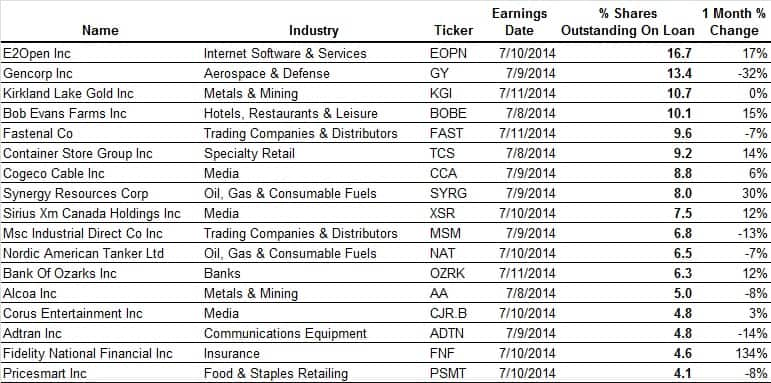

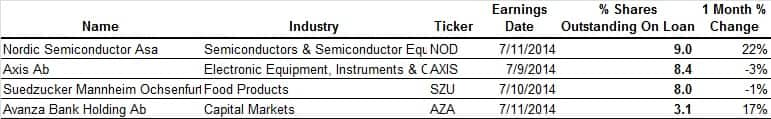

Half way through the year, we see South Korean firms make-up 70% of the firms in amongst the worst ranked 10% companies in the Markit Developed Asia ex Japan Universe, when ranking the constituents by their latest earnings surprise. This ranking, which is calculated from the latest earnings subtracted from the number analysts were forecasting, essentially highlights the headwinds faced by South Korean firms over the last reporting season as it currency shift saw its exports become less competitive.

These headwinds are also demonstrated by the type of companies which have failed to live up to expectation. The 55 South Korean firms amongst the worst earnings surprise group are heavily tilted towards cyclical firms, with export reliant Kia and Hyundai Motors amongst their rank, and industrials with Daewoo Engineering earning the worst rank.

Forward expectations equally bearish

Looking forward, things are equally bearish for South Korean firms as they also make up the most numerous firms amongst those seeing the worst analyst revisions over the last six months, as measured by the time weighted earnings revision factor which ranks firms by the changes in analyst estimates for a forward 12 months.

Industrials again feature heavily amongst the South Korean firms which make have seen the worst analyst revisions with 14 representatives. Samsung Heavy Industry and Doosan Heavy industries are the highlights amongst in this sector, as both firms have seen their forecasted EPS revisions more than halve over the last six months.

Shorts piling in

Not surprisingly, the recent bearish earnings news has seen short sellers pile into South Korean firms as demand to borrow constituents of the KOSPI index has jumped by 24% since the start of the year to 1.6% of free float.

Companies which stand to experience the worst of the recent commodity headwinds also make up most of the recent short targets with Oci, Hyundai Merchant Marine and Samsung Engineering making up the three firms with the largest demand to borrow.