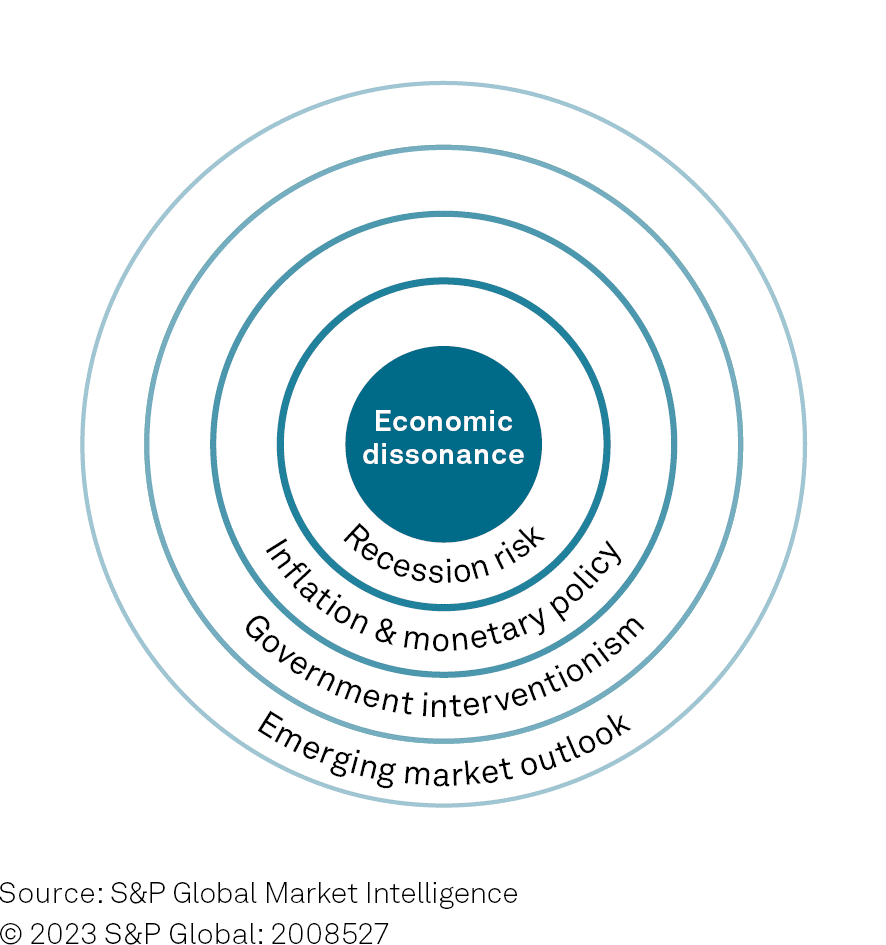

The risk environment – global security, energy trade-offs, supply chain interdependence, and labor market reshuffling – will continue to underpin the economic outlook for 2023. Mild recessions appear likely in Europe and North America, while Asia Pacific (APAC) and other emerging markets are likely to skirt recession.

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsEconomic Dissonance

The twin drivers of fiscal policy responses to the pandemic and the Russia-Ukraine conflict shock have produced inflation rates at multi-decade highs. Central banks have sought to slow demand and achieve better alignment with supply by raising interest rates and reducing asset holdings, ending the monetary accommodation in place since the Financial Crisis of 2008. How governments will adapt their policies to this unbalanced economic landscape— through income support, intervention in energy markets, or deficit reduction--are key questions to watch for 2023.

The outlook outside of Europe and North America will be brighter in the year ahead driven particularly by sustained moderate growth in the emerging markets of Asia Pacific, the Middle East, and Sub-Saharan Africa. With economic indicators pointing in multiple directions, variability across regions, industries and sectors in 2023 will be shaped by developing geopolitical risks and policy shifts.

2023 Risk Outlook

Global security unsettled

A number of unresolved conflicts and competitions will be sources of risk in 2023, filtering into the global economic outlook.

Energy trade-offs

With energy security back atop the agenda following Russia’s invasion of Ukraine, countries will be balancing 2023 fiscal priorities against a new impetus to accelerate their energy transitions.

Precarious supply chains

An expected easing in supply chain disruptions in the first half of 2023 remains vulnerable to labor and resource shortages including critical technologies and critical minerals.

Reshuffling labor markets

Labor markets are in transition as demand overruns supply, tilting leverage towards workers across major markets.

Podcasts

{}

{}

{"items" : [

{"name":"facts","url":"","enabled":false,"desc":"","alt":"","mobdesc":"PDF","mobmsg":""},{"name":"login","url":"https://products.markit.com/home/login.jsp","enabled":true,"desc":"Product Login for existing customers","alt":"Login","large":true,"mobdesc":"Login","mobmsg":"Product Login for existing customers"},{"name":"sales","override":"","number":"[num]","enabled":true,"desc":"Call Sales [num]","proddesc":"[num]","alt":"Call Sales</br>[num]","mobdesc":"Sales","mobmsg":"Call Sales: [num]"}, {"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fproducts%2feconomic-dissonance-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fproducts%2feconomic-dissonance-2023.html&text=Economic+dissonance+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fproducts%2feconomic-dissonance-2023.html","enabled":true},{"name":"email","url":"?subject=Economic dissonance | S&P Global&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fproducts%2feconomic-dissonance-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+dissonance+%7c+S%26P+Global http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fproducts%2feconomic-dissonance-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}