Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 01, 2023

Worldwide producer prices rise in August for first time in four months

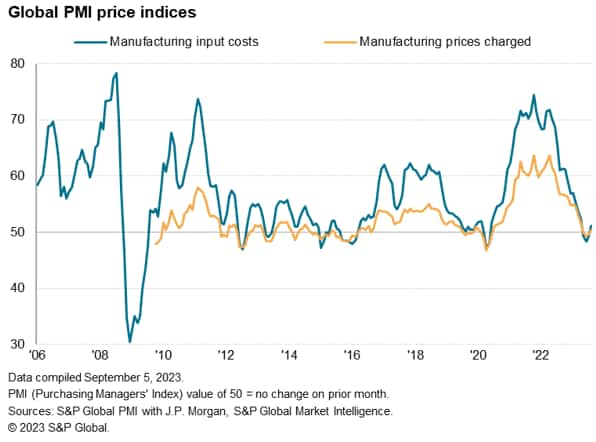

Average prices charged by factories for their goods edged higher for the first time in four month during August, according to the JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI™) compiled by S&P Global. Companies reported sustained upward pressure from wages alongside reviving upward pressure on prices from energy and raw material costs.

The data hints that the recent deflationary impact of falling price pressures in the manufacturing sector may have peaked.

Factories raise prices for first time in four months

Manufacturing output prices - average charges levied for goods leaving the factory gate - edged higher worldwide in August, according to the latest PMI surveys compiled by S&P Global, returning to growth after three months of decline.

Although only marginal, and in marked contrast to the record increases in factory selling prices just over a year ago, the rise in goods prices is significant in signaling a potential turning point in the deflationary cycle which has helped cool global consumer price inflation over the past year.

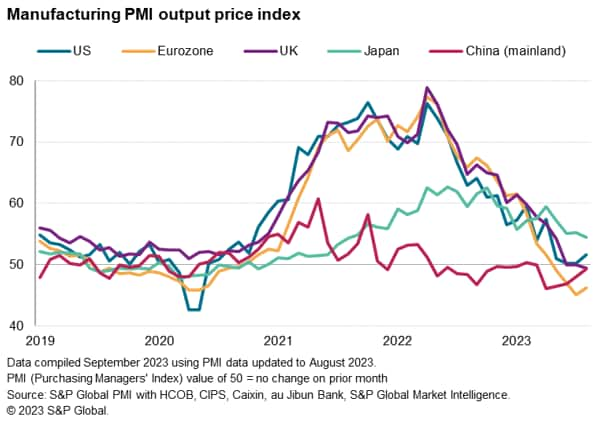

While Japan saw a particularly steep increase in prices relative to the other major economies, the rise was the smallest for two years. However, the rate of inflation rose to a four-month high in the US and also hit a five-month high in Canada. While prices continued to fall in the eurozone and in mainland China, rates of decline moderated in both cases. Prices meanwhile fell at an increased rate in the UK, but the decline was only very modest.

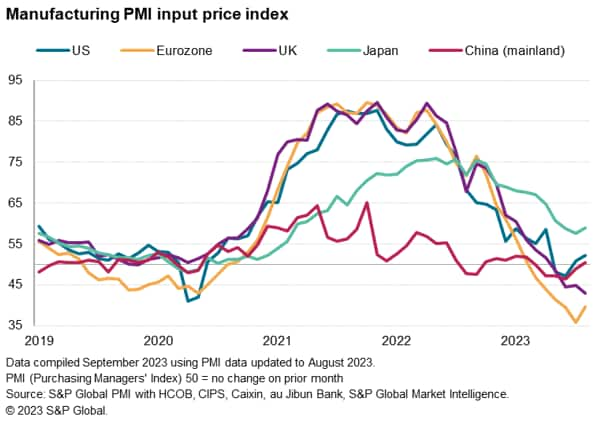

Higher prices charged were largely a symptom of producers passing cost increases on to customers. Average factory input costs likewise rose for the first time in four months in August.

In a similar pattern to selling prices, only the UK saw an increased rate of decline of input prices of the major economies. Costs rose at increased rates in Japan and the US and returned to growth in the mainland China.

Higher costs

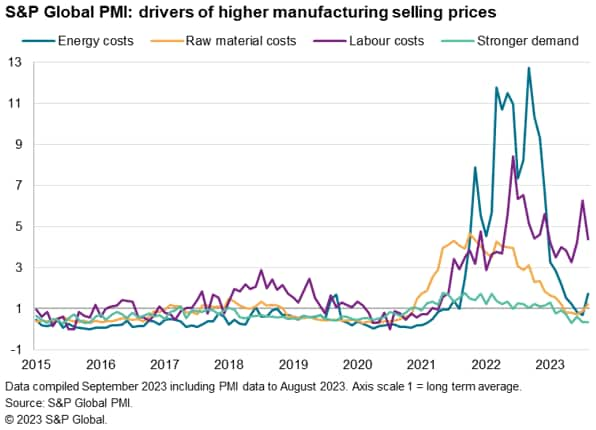

Looking at the causes of higher output prices, rising wage costs were cited as the most common factor again in August, although to a reduced level compared to July. Upward pressure from rising energy costs meanwhile increased for the first time in 11 months to the highest since March. Upward pressure from rising raw material costs also edged up, climbing for a second successive month to hit the highest since February.

Only demand continued to exert further downward pressure on prices.

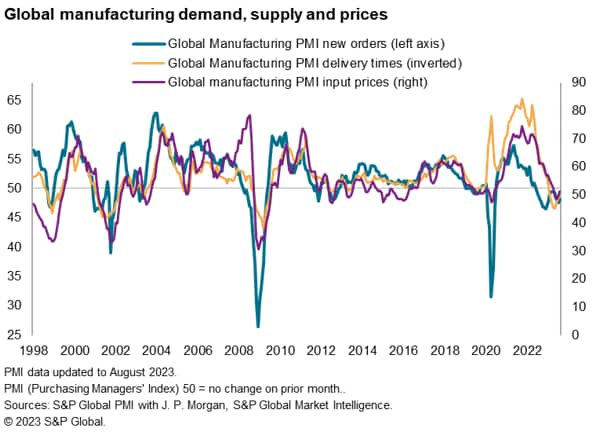

The deflationary impact of falling demand was underscored in August by new orders for goods reportedly dropping for the fourteenth successive month.

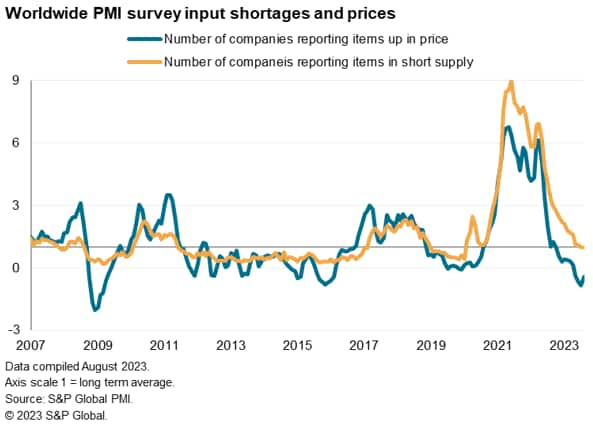

However, the supply situation is showing some signs of changing. Although average suppliers' delivery times continued to improve globally for a seventh successive month in August, the improvement was the smallest recorded since February. Despite the August survey seeing a further fall in the number of companies reporting items to have been in short supply, the change in the suppliers' delivery times index signals some tentative firming of pricing power among raw material suppliers.

Bottom line

While the bottom line from the PMIs is that manufacturing prices are likely to remain less of a concern to policymakers in the fight against inflation than service sector prices, the deflationary impact from the goods-producing sector is showing some signs of having peaked. Tentative signs of rising goods prices could therefore add to some stickiness of inflation around the world in the coming months barring a further downturn in demand.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-producer-prices-rise-in-august-for-first-time-in-four-months-Aug2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-producer-prices-rise-in-august-for-first-time-in-four-months-Aug2023.html&text=Worldwide+producer+prices+rise+in+August+for+first+time+in+four+months+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-producer-prices-rise-in-august-for-first-time-in-four-months-Aug2023.html","enabled":true},{"name":"email","url":"?subject=Worldwide producer prices rise in August for first time in four months | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-producer-prices-rise-in-august-for-first-time-in-four-months-Aug2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Worldwide+producer+prices+rise+in+August+for+first+time+in+four+months+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-producer-prices-rise-in-august-for-first-time-in-four-months-Aug2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}