Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 09, 2019

Weekly Pricing Pulse: Commodity markets turn down as data brings jitters

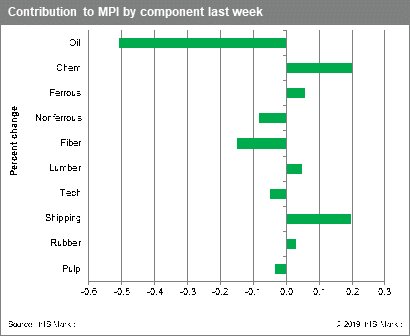

Commodity prices underwent a turbulent week, as markets responded to key economic data releases and Fed policy comments. After a positive start to the week, a lacklustre April Purchasing Manager Index (PMI) report and a tentative Fed stoked bearish sentiment, which took commodity prices 0.3% lower, according to our Materials Price Index (MPI).

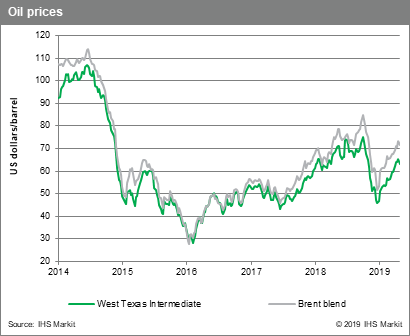

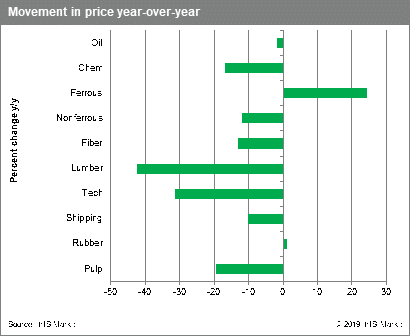

Crude oil prices fell 2.3% mid-week, continuing the decline from a peak two weeks ago, as the market took the view that lost supply from Iran would be offset from sources elsewhere. Lacklustre PMIs and the worst order book since 2012 weighed on base metal prices and sent the non-ferrous index down 1.2%; copper fell to a four-month low. Weak freight prices continued to rebound, rising 7.0% as bulk freight demand recovers in Australia and Brazil. Falling feedstock costs helped lower paraxylene prices, pushing the fibre index 2.5% lower last week.

Recent optimism in equity, bond and commodity markets collided with fundamental data last week. The bright spot was the April US employment report, which showed job growth exceeding expectations, briefly cheering markets and validating those bullish on the US economy. However, soft manufacturing PMIs and the Fed's continued 'patient' policy stance were enough to remind markets that while global growth may have stabilized, vulnerabilities remain, with a rebound in growth unlikely.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-turn-down-data-jitters.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-turn-down-data-jitters.html&text=Weekly+Pricing+Pulse%3a+Commodity+markets+turn+down+as+data+brings+jitters+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-turn-down-data-jitters.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity markets turn down as data brings jitters | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-turn-down-data-jitters.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+markets+turn+down+as+data+brings+jitters+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-turn-down-data-jitters.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}