Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 08, 2019

The global monetary tightening cycle seems to be over—for now

The acceleration in global growth that occurred in 2017 led some key central banks to begin a steady—albeit slow—tightening of monetary policy. The Federal Reserve, the Bank of Canada, and the Bank of England were in the vanguard. Other central banks (e.g. in Mexico, India, Indonesia, and the Philippines) followed suit. With growth still strong in the first half of 2018, this tightening bias remained in place. However, because of rising trade tensions and the global slump in manufacturing, growth began to weaken during the second half of the year. With inflation showing no signs of accelerating, central banks responded accordingly. The Fed initiated its now-famous "pivot" by indicating there would be fewer rate hikes in the near future and the reductions in its balance sheet would be more measured. The European Central Bank—after stopping its bond purchases—announced new long-term loans to banks and signaled that any rate hikes were a long way off. The apparent end of the mild tightening cycle—and the possible beginning of a new mild easing cycle—will have multiple ramifications.

Some central banks have also begun to ease (e.g., the People's Bank of China and the Reserve Bank of India); others will likely follow—or at a minimum, leave interest rates on hold for a while. The lack of further tightening—and in some cases, easing—will help to stabilize growth and limit any further deceleration. Long-term interest rates in many parts of the world will likely fall further. On balance, these moves are likely to mean weaker currencies in those economies where central banks have taken bolder easing actions—in particular, the Fed's pivot will reduce depreciation pressures for many economies, allowing central banks to ease even more. With growth and inflation expected to remain low, the risks to the interest rate outlook are skewed to the downside.

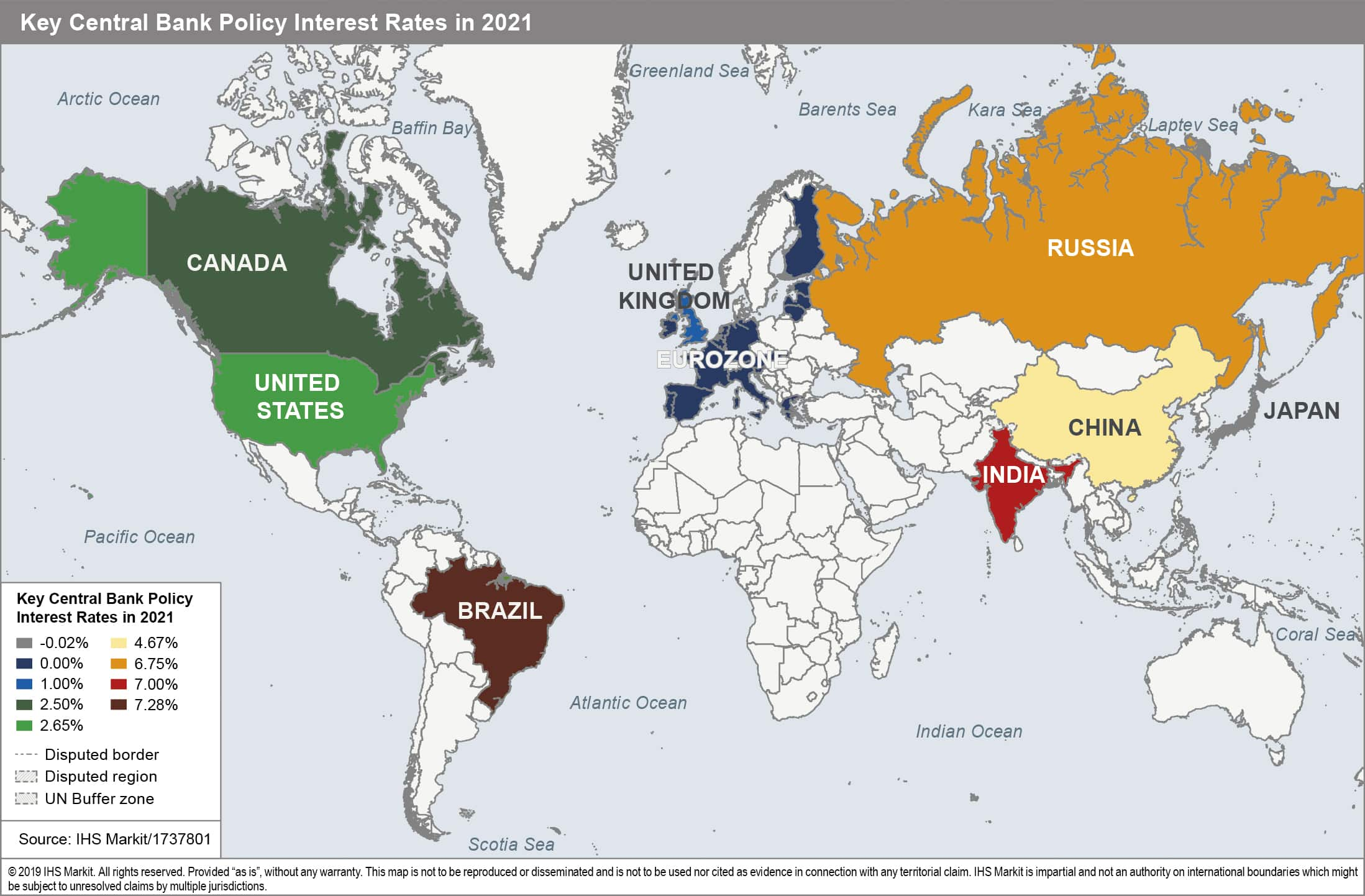

Key Central Bank Monetary Policy Outlook Through 2021

United States Federal Reserve

Expected monetary actions during the next two years:

- Muted inflation and few signs of significant fiscal imbalances provide the Fed with an opportunity to be patient as it awaits further information. The late-2019 rate hike is expected to be the final rate hike for this tightening cycle. The Federal Open Market Committee (FOMC) has yet to decide important issues related to the evolution of the maturity composition of the Fed's Treasury holdings and whether to accelerate shrinkage in its mortgage-backed securities (MBS) portfolio (offset by reinvestment in Treasuries).

Impact on growth and inflation:

- We project real GDP growth will slow in 2019 to roughly a trend pace, and inflation will firm to above 2%. These projections are consistent with one more Fed rate hike in late 2019, which would raise the upper end of the target range for the federal funds rate to 2.75%. Such a move can be viewed as maintaining the real federal funds rate near 0.5% as inflation firms to slightly above 2%.

European Central Bank

Expected monetary actions during the next two years:

- The ECB near-term focus will be the technical preparations ahead of implementing the TLTROs from September. We expect a further extension of forward guidance on policy rates beyond the current reference date of end 2019, most likely in third quarter 2019. Given the cost to the banking sector of maintaining negative interest rates longer, the introduction of a tiering system for the application of negative interest rates on banks' excess reserves is likely. We expect the ECB to deliver an initial rate hike only in the first quarter of 2022. Money market and short-term rates are likely to remain at exceptionally low levels, therefore. Long-term interest rates will also be held down by ECB forward guidance.

Impact on growth and inflation:

- The impact of the ECB's March policy announcements is likely to be marginal. We see them preventing a tightening of monetary conditions rather than adding significant stimulus. More implicitly, they will provide continued long-term liquidity to Italian banks, whose funding costs have risen following rising concerns about sovereign debt sustainability

Bank of Japan

Expected monetary actions during the next two years:

- The BOJ is unlikely to change its monetary policy plan during the next two years given core consumer price inflation (excluding fresh food) will probably not exceed 2% in a stable manner. This is unless the BOJ considers the likelihood of a virtuous cycle from income to spending to be fading and sees the need for additional monetary easing to prevent mounting deflationary sentiment.

Impact on growth and inflation:

- Even if the BOJ were to introduce any adjustment of its monetary policy, the impact on growth and inflation should be marginal, given that the bank has maintained its extraordinary monetary easing measures for more than five years following a nearly zero policy rate since 2010.

Bank of England

Expected monetary actions during the next two years:

- Despite tight labor market conditions, the BOE is unlikely to raise interest rates at its May meeting or any time soon, amid concerns that prolonged Brexit uncertainties continue to damage activity. Even in the event of a smooth Brexit process, the BOE will remain cautious about the pace of future tightening, noting complex and uncertain trade negotiations still represent a risk to UK investment and employment, with firms unsure about their EU market access after the negotiations are completed. Diminishing Brexit risks should trigger a hike to 1.0% in May 2021, then to 1.25% in May 2022. This reflects our Brexit baseline that the UK and EU will converge gradually to a new trading agreement. The BOE's conditioning path for the Bank Rate implied by forward market interest rates suggests the end values for the policy rate will be 0.9% in 2019, 1.0% in 2020, and 1.1% in 2021.

Impact on growth and inflation:

- The lack of urgency to raise interest rates reflects the fear of making a policy mistake at a time when its economy is faltering because of entrenched uncertainty from when and how the UK will exit the EU as well as a tougher external environment. This implies the BOE will continue to shelve concerns about inflation spillovers from a tighter labor market and brisker growth in earnings and unit labor costs.

Bank of Canada

Expected monetary actions during the next two years:

- Another quarter of soft growth is anticipated in the first quarter of 2019. It will delay the next rate hike from the Bank of Canada, which is anticipated at the end of this year at the earliest. The bank will tighten monetary policy with two more rate hikes in 2020 until the policy rate hits the long-term neutral rate of 2.5%.

Impact on growth and inflation:

- The ongoing recovery from the Canadian oil price shock is dampening expansion within the energy sector. Additionally, uncertainty associated with trade policies and elevated household debt is limiting investment and household spending, keeping inflation pressures relatively low. These ongoing issues are likely lowering potential growth.

Central Bank of Brazil

Expected monetary actions during the next two years:

- Since the US Federal Reserve announced it will take a patient approach on policy, the BCB has followed suit and has hinted to the market that it will not increase its rate this year. In our forecast, we call for the monetary authority to increase its policy rate during 2020 from 6.50% to 7.50%. This rate will be cut at the end of 2021 as the central bank achieves its lower inflation targets. The central bank will target inflation at 4.25% in 2019, 4.00% in 2020, and 3.75% in 2021 (for 2019-21, the inflation target tolerance range is +/-1.5 percentage points, so for instance, the target band for 2019 is 2.75-5.75%.)

Impact on growth and inflation:

- The BCB assesses the current policy rate is below its structural value—this value is relatively high as it is pushed up by a sizable fiscal deficit and high debt that needs to be financed and rolled over. However, the weak state of the Brazilian economy justifies a relatively stimulative monetary policy—only relatively as the rates commercial banks charge for their loans to corporations and consumers are still high. The largest impact of the rate cuts has been on public finances: a large amount of public debt is linked to the policy rate (SELIC), thus bringing the rate down by more than 700 basis points has led to savings of more than 1% of GDP per year.

Bank of Russia

Expected monetary actions during the next two years:

- IHS Markit expects the CBR's policy rate to remain unchanged at 7.75% until July 2019. Thereafter, a 25-basis-point rate increase could follow to minimize the inflationary impact of higher fuel tariffs, taking effect in July, and potential acceleration in food prices as benefits of the large 2018 harvest end. However, the CBR is expected to revert to monetary easing in fourth quarter 2019, guided by weak household spending, more benign external interest rate conditions, and a strengthening rouble.

Impact on growth and inflation:

- The successful decline in dollarization in recent years has increased the effectiveness of the CBR's monetary policy. However, currently the bank has little room to maneuver, which will limit the magnitude of its key rate changes and their impact on growth and inflation. The CBR has been under government pressure to stimulate fragile economic recovery by lowering the cost of borrowing. Conversely, the bank must rein in the annual inflation under its 4% target and stem the continued double-digit growth in unsecured consumer lending.

Reserve Bank of India

Expected monetary actions during the next two years:

- With both domestic and global growth slowing and inflation in India remaining below the RBI's inflation target, it is now increasingly likely the RBI will proceed with another rate cut in June. Beyond June, intensifying inflation pressures and elevated fiscal deficits will leave little room for further accommodation, and we expect no additional rate cuts in 2019 with the monetary policy likely to switch to tightening in early-to mid-2020.

Impact on growth and inflation:

- Monetary policy easing, coupled with the relaxation of lending rules and greater election-driven fiscal spending in the first quarter of 2019, will provide some support to growth during the first half of the fiscal year (FY) starting April 2019 (FY 2019), with real GDP growth forecast to improve from an estimated 7.1% in FY 2018 to around 7.4% y/y during first half FY 2019. Nevertheless, as the boost from fiscal stimulus fades and net exports worsen, real GDP growth is forecast to slow from the second half of FY 2019 and average 7.0% for the full FY 2019 and 6.9% in FY 2020. Inflation has been running below forecasts and well below the RBI's midrange target of 4%, justifying the policy rate cuts so far. However, this weakness was driven by the feeble food and fuel prices, while core inflation has remained above 5%. Food and fuel prices should accelerate in coming months (particularly in the event of a subnormal monsoon season), so headline inflation should cross a 5%- mark by the second half of 2019 and average 4.2% in 2019 and 5.3% in 2020.

People's Bank of China

Expected monetary actions during the next two years:

- Monetary policy should remain accommodative at least through the end of 2019. The PBOC is unlikely to aggressively open the liquidity spigot, though. De-risking the financial system, which includes containing China's high leverage, remains a key policy objective. The financial system de-risking campaign that began in 2017 was interrupted by trade negotiations with the US. To combat the growth slowdown and avoid excess credit expansion, the Chinese government has also launched fiscal stimulus measures, including tax and business fees cuts. Once growth stabilization takes root, the government will likely resume the financial system de-risking drive and pull back monetary easing measures.

Impact on growth and inflation:

- The combination of monetary and fiscal stimulus should stabilize China's economic growth. Initial signs of growth stabilization have surfaced. Monetary easing's impact on inflation should be limited. China's consumer price inflation has remained tame and comfortably below the government's 3% target. The expected domestic demand stabilization should not produce inflationary pressures given China's remaining excess capacity and supply conditions.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-global-monetary-tightening-cycle-seems-to-be-overfor-now.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-global-monetary-tightening-cycle-seems-to-be-overfor-now.html&text=The+global+monetary+tightening+cycle+seems+to+be+over%e2%80%94for+now+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-global-monetary-tightening-cycle-seems-to-be-overfor-now.html","enabled":true},{"name":"email","url":"?subject=The global monetary tightening cycle seems to be over—for now | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-global-monetary-tightening-cycle-seems-to-be-overfor-now.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+global+monetary+tightening+cycle+seems+to+be+over%e2%80%94for+now+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-global-monetary-tightening-cycle-seems-to-be-overfor-now.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}