Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 08, 2020

Weekly Pricing Pulse: A bull market for commodities

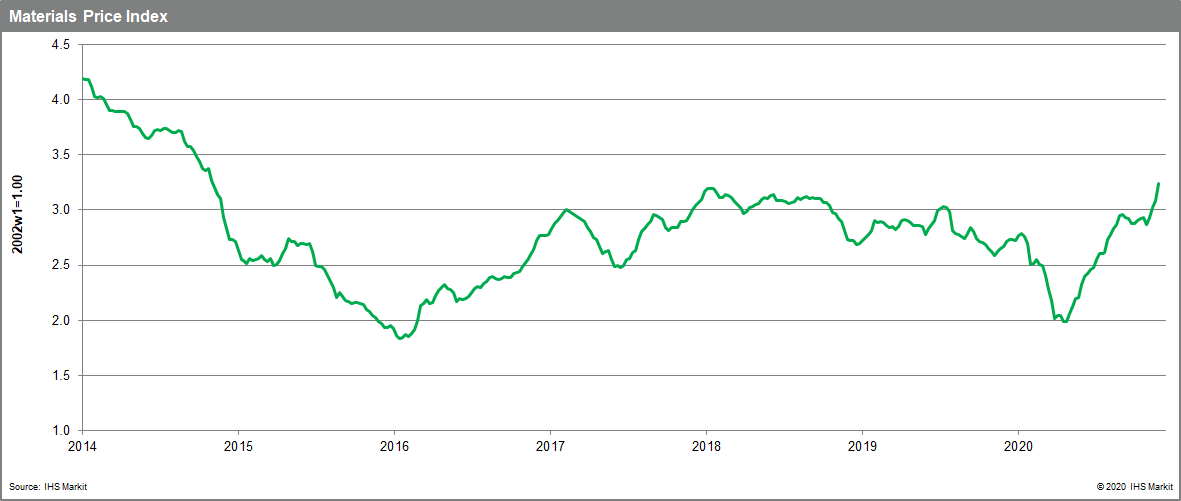

Our Materials Price Index (MPI) rose 5% last week, its fourth consecutive increase and its largest one-week gain since June. More significant, last week's move lifted the MPI to its highest level since November 2014.

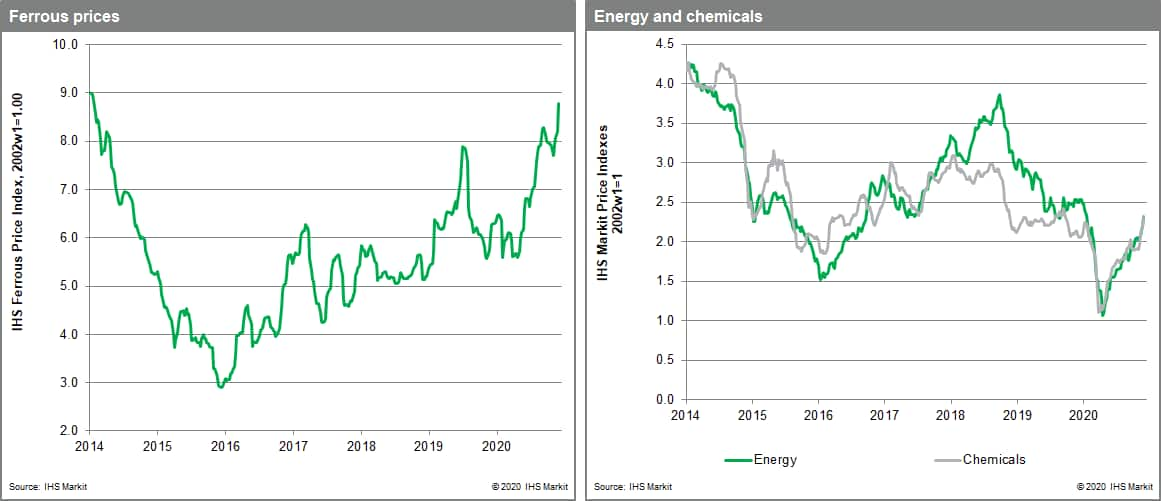

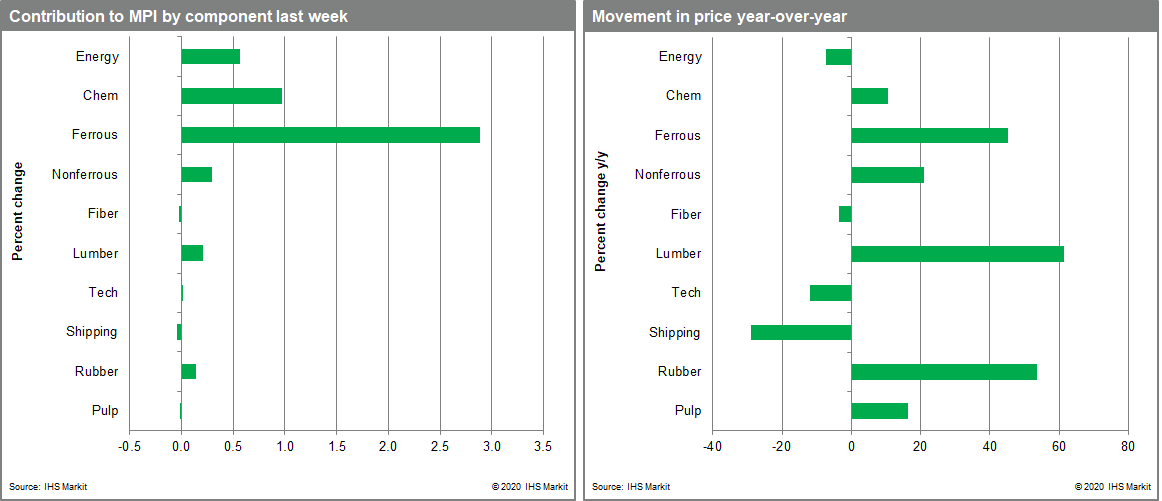

Metal markets grabbed center stage for the week, with steel making raw materials sub-index jumping 7.1% and the nonferrous metals index rising 3.2%. Iron ore prices climbed to a seven-year high as major producer Vale announced lower production targets for 2021. Nonferrous metals were supported by across the board strength, with copper also hitting a seven-year high and aluminum breaching $2,000 per metric ton for the first time since 2018. Chemicals prices were another major contributor to last week's MPI gain, increasing 5.4%. The chemicals sub-index was boosted by strong price increases for US and European benzene. US supply chains have been challenged sending prices higher in North America. In Europe, low levels of the Rhine river have constrained cargo traffic and tightened supply across the continent. Energy markets also showed comparative strength, with the MPI's energy sub-index rising 4.8%. Oil prices rose by almost 9% on news of a supply agreement between OPEC and Russia. Both parties agreed to increase supply by 500,000 barrels a day from January, significantly lower than previously agreed. This eased fear of oversupply and sent the price of Brent crude oil to a nine-month high figure of $49.87.

Markets have become energized by the continuing strength being exhibited by mainland China's economy and by hopes that multiple vaccines may be widely available in some countries during the first half of 2021. The likelihood of additional fiscal stimulus in the US also seems to have improved sentiment. On the supply-side, continuing disruptions in supply chains are creating tight conditions and raising costs. This combination of demand and supply factors has created bullish conditions in commodity markets. How quickly supply bottlenecks are resolved and how badly a COVID-19 second wave impacts Europe and North America will determine how long the commodity price rally can be sustained.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-bull-market-for-commodities.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-bull-market-for-commodities.html&text=Weekly+Pricing+Pulse%3a+A+bull+market+for+commodities+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-bull-market-for-commodities.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: A bull market for commodities | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-bull-market-for-commodities.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+A+bull+market+for+commodities+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-bull-market-for-commodities.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}