Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 09, 2020

Economic recovery in Europe: divergence and double dips

- The rebounds in Q3 across Europe generally surprised on the upside. However, economies remain well below their pre-COVID-19 peaks and cumulative contractions in 2020 are very large by historical standards. Countries that have contained the virus better have tended to outperform economically.

- Where underlying drivers are available, the rebound in Q3 tended to be broad-based with both domestic demand and external sectors contributing towards the recovery. The recovery in household consumption tended to be of particular importance.

- A resurgence of COVID-19 and a second round of lockdowns is expected to cause contractions in many European economies in Q4. The key risks to the outlook is another tightening of restrictions following the festive period and a delay in the roll-out of vaccines or their relatively low take-up.

Strong but partial rebounds in Q3

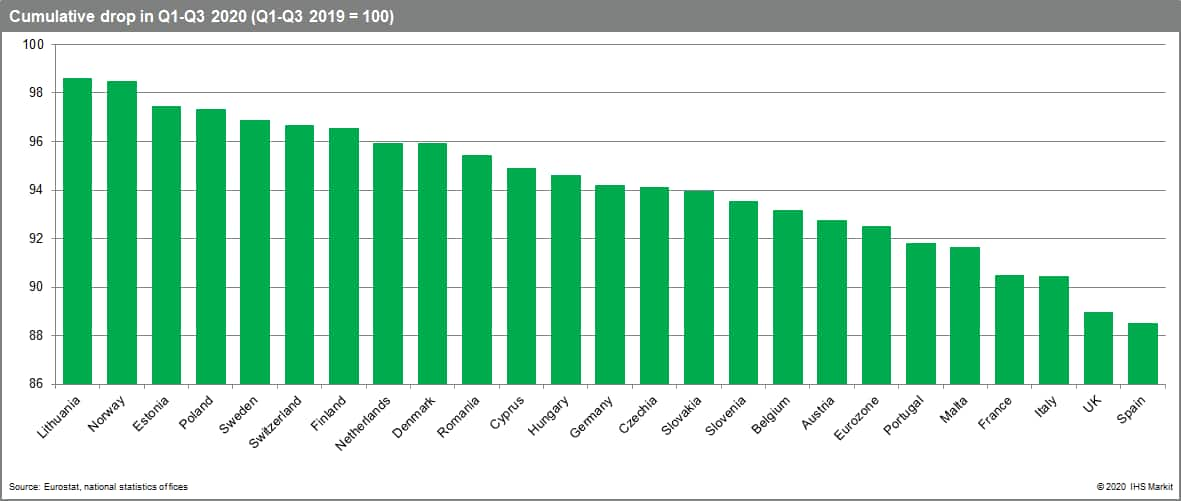

The recent releases of Q3 GDP across Europe tended to surprise on the upside, indicating a strong, albeit partial, rebound after the historic contractions in H1 2020. The largest growth rates in Q3 were in France (+18.7% q/q), Spain (+16.7% q/q) and Italy (+16.1% q/q). The Eurozone as a whole grew by 12.6% q/q, while the UK was up by 15.5% q/q. However, the largest rebounds tended to be "mechanical", occurring in economies that contracted the most in H1 2020. As a result, these also tend to record the largest cumulative drops of activity in the first nine months of 2020.

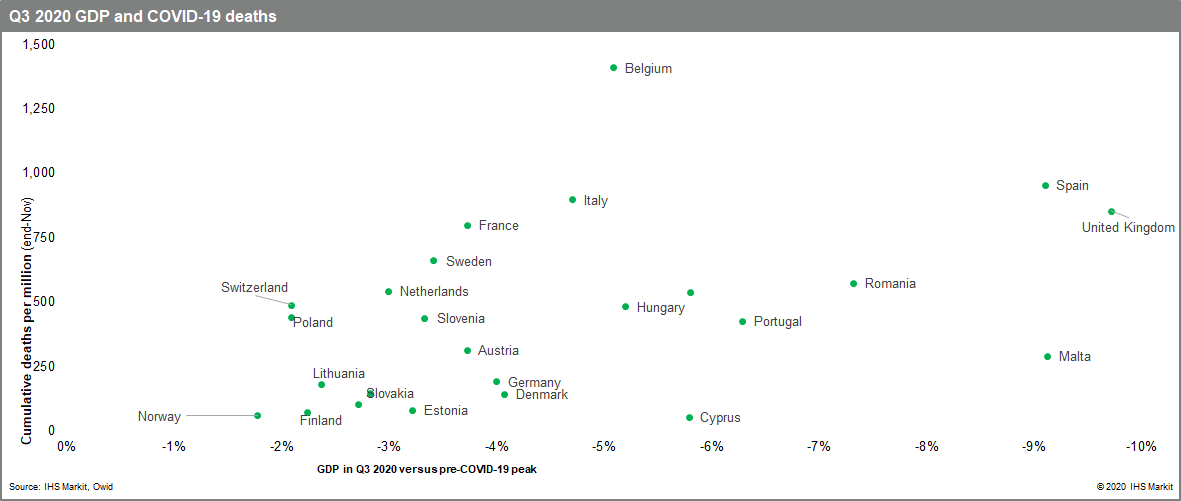

Comparing the level of GDP in Q3 2020 relative to the pre-COVID-19 peak, the best performers were Norway, Switzerland and Poland, which were only around 2% smaller. On the opposite end, the worst performers were the UK and tourism-sensitive Spain and Malta, down by over 9% compared to their pre-COVID-19 peaks. Importantly, countries that contained the virus more successfully, with fewer recorded deaths, tended to suffer smaller loses and bounce back more quickly.

This indicates that there is no trade-off between health and the economy, but that the two are complementary. A quicker suppression of the virus allowed for a quicker re-opening of economies and the return of spending among households and businesses.

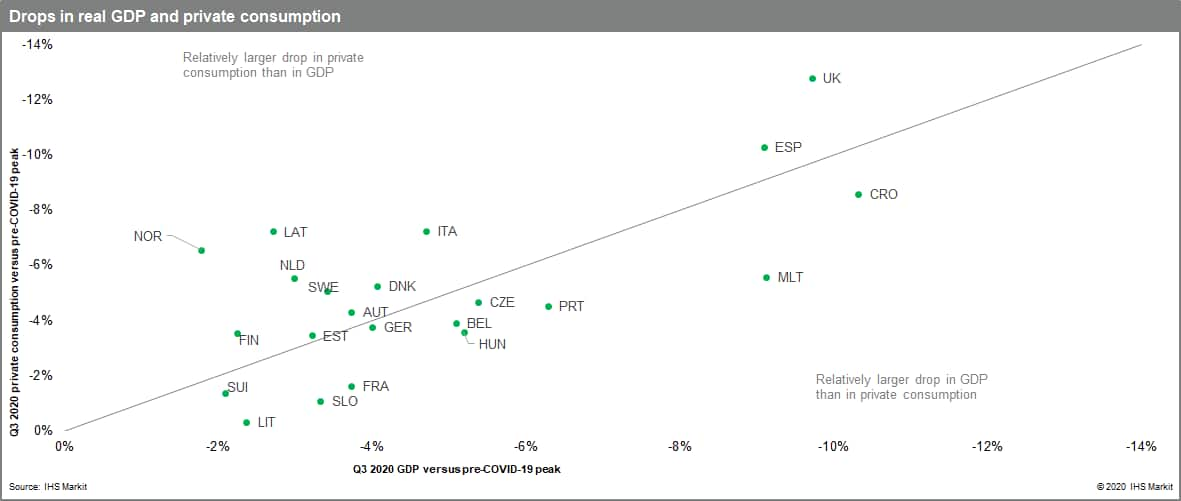

Detailed breakdowns highlight the importance of household consumption

The underlying drivers for GDP are not yet available for all economies. Where the data is available, it points to the rebounds being broad-based, driven by both domestic demand and net exports. It also highlights the importance of household consumption. In most European economies, household consumption outperformed overall GDP relative to pre-COVID-19 peak. This wasn't the case in UK, Italy or Spain, which also were the worst performers overall. The drop in household consumption in Sweden was larger than the fall in its overall GDP, despite the absence of a formal lockdown and relatively lighter restrictions throughout, and on a par with Denmark, which suffered much fewer deaths.

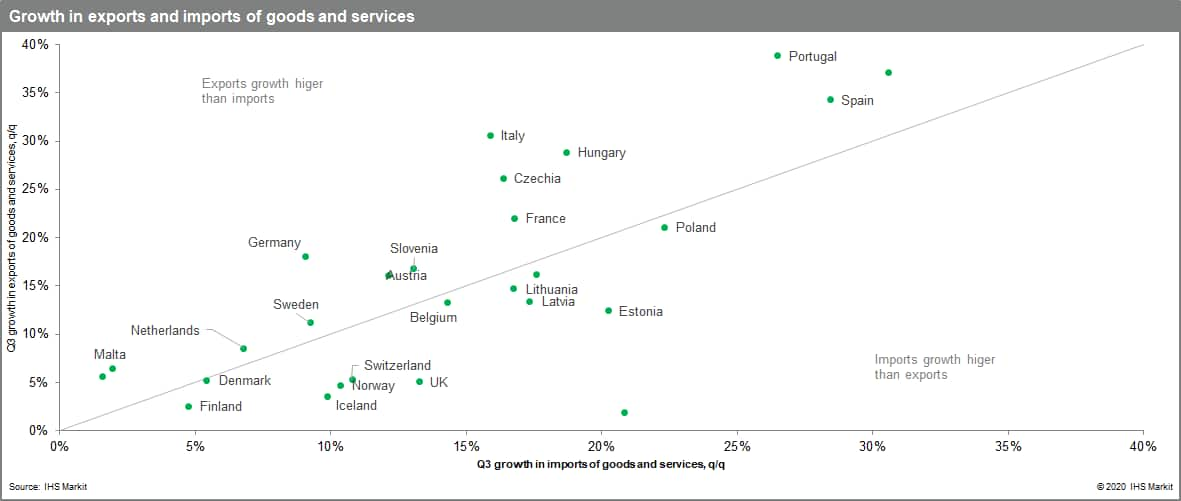

The external sector provided key support, aided by the easing of COVID-19 restrictions in the US, China and other major economies. For European economies where data is available, the rebound in exports of goods and services tended to match or outpace the rebound in imports.

Fixed investment has generally seen the smallest rebound, reflecting the elevated uncertainty faced by businesses. Measuring output in the public sector has proven to be a particular challenge, due to the closure of schools and re-orientation of health systems to tackle the pandemic. The lack of a uniform approach has resulted in different quarterly dynamics, but these should re-align in the medium term.

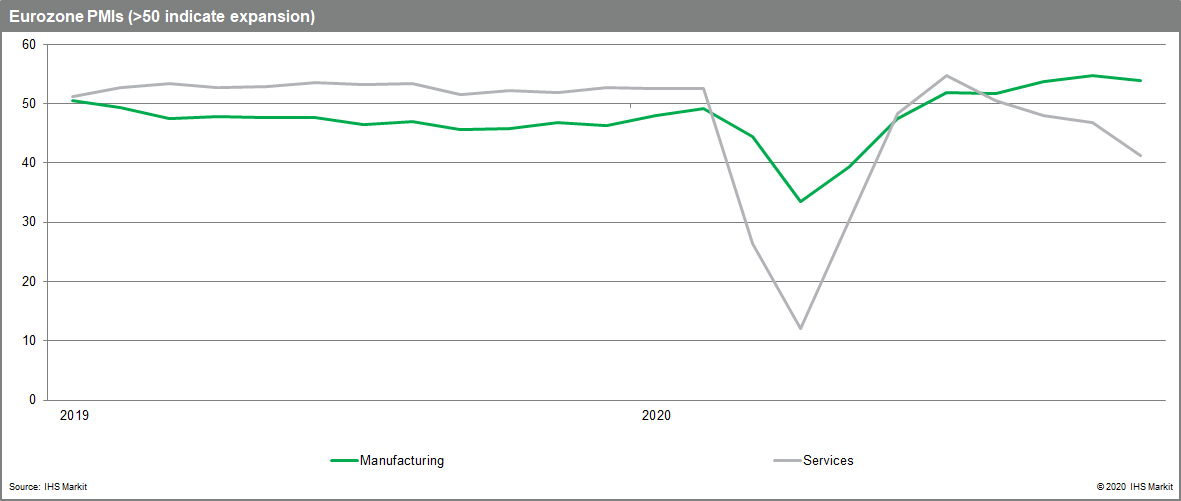

Outlook largely depends on the evolution of the pandemic

Following the historic contractions in H1 2020 and partial rebounds in Q3 2020, we expect a renewed contraction in many European economies, including the Eurozone, in Q4, amid a resurgence of COVID-19 and new lockdowns. However, we expect this contraction to be significantly smaller than earlier in the year, owing to several factors. First, the full or partial lockdowns tend to be less severe than in the first wave with manufacturing and construction sectors continuing to operate, while schools remain largely open. As a result, there is a marked divergence between manufacturing and services sectors in Europe.

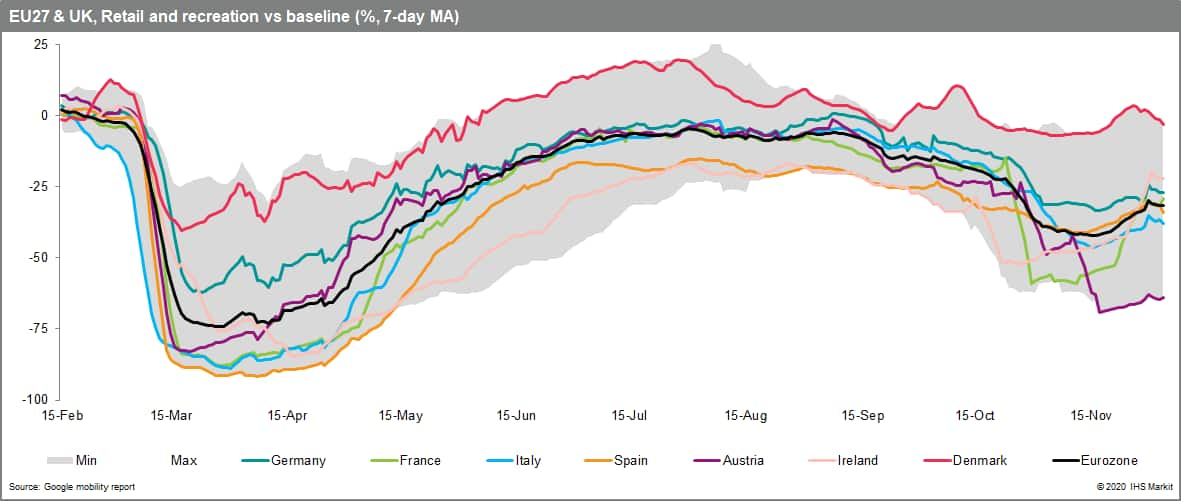

The relatively lighter restrictions are also evident from real-time activity indicators with mobility stabilizing at a higher level, indicating a smaller drops in activity than in the first wave.

Second, external demand is expected to remain supportive with China, the US or other major economies avoiding a second wave of lockdowns. This is in contrast to the first wave, when demand was withdrawn simultaneously. Third, businesses have had time to adjust and shift more of their sales online. This means that the new round of restrictions is likely to cause fewer supply-side disruptions.

In the near-term, the outlook will be mainly determined by the evolution of the pandemic and the wide availability of effective vaccines. Regarding the pandemic, the latest signs are positive, as the recent restrictions have suppressed the epidemic curves across Europe and the emphasis has shifted to managing the re-opening without a new surge in cases. The key risk is that the increased social interaction during the traditional festive season will accelerate virus transmission, requiring a renewed tightening of restrictions in Q1 2021. Recent news about the high efficiency of several vaccines and their potentially fast-tracked approvals present an upside risk for our baseline assumption of a wide roll-out in mid-2021. However, the roll-out presents serious logistical challenges, while recent survey data from across Europe indicates growing skepticism about vaccines. A slower progress in vaccinations would likely result in a "floor" level of restrictions remaining for longer, weighing down on activity.

The risk of a premature withdrawal of policy support over the coming months has significantly diminished, as most European governments extended pandemic-related fiscal measures and the European Central Bank has pre-announced a new easing package at its December meeting. Continued fiscal and monetary support is vital to ensure a strong economic recovery, even after the immediate health emergence subsides.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-recovery-in-europe-divergence-and-double-dips.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-recovery-in-europe-divergence-and-double-dips.html&text=Economic+recovery+in+Europe%3a+divergence+and+double+dips+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-recovery-in-europe-divergence-and-double-dips.html","enabled":true},{"name":"email","url":"?subject=Economic recovery in Europe: divergence and double dips | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-recovery-in-europe-divergence-and-double-dips.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+recovery+in+Europe%3a+divergence+and+double+dips+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-recovery-in-europe-divergence-and-double-dips.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}