Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 04, 2024

Week Ahead Economic Preview: Week of 7 October 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US and mainland China inflation, UK GDP, German industrial output

As markets seek further guidance on the interest rate outlook, US inflation numbers will be eagerly assessed in the coming week alongside further Fed policymaker speeches. Updated GDP numbers will meanwhile provide a steer on the health of the UK economy, as will industrial production numbers for the beleaguered-looking German economy. Inflation and trade data will also provide insights into economic conditions in mainland China, though neither will yet give clues as to the impact of recent stimulus measures. Policy action is meanwhile widely expected in the form of rate cuts at the central banks of Korea and New Zealand.

The general expectation is that US inflation will have further cooled when the data are updated in the coming week, though the data will be keenly eyed to see if any under- or -overshoots relative to expectations will change the case for a 25 or 50 basis point move by the FOMC. Our forecasters are expecting another 50 basis points of cuts in 2024, but for this to spread over two meetings.

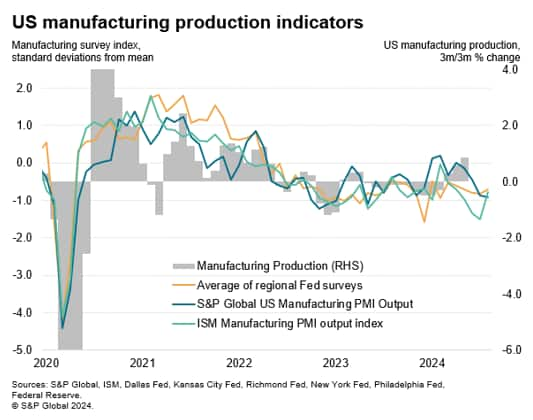

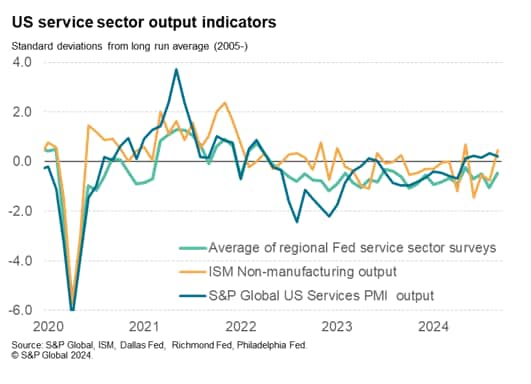

The case for the Fed to shift down to 25 basis points of cuts was supported by the PMI data released over the past week. S&P Global's PMIs showed service sector growth in the US to have remained encouragingly robust in September, putting the economy on course for another quarter of annualised growth of around 3%. ISM's non-manufacturing data have been more volatile in recent months, but leaped higher in September to join the chorus of robust economic growth signals. Meanwhile, the PMI survey price gauges edged higher, notably in the service sector.

Normally these signals could raise concerns that rate cuts might be inappropriate, but the survey data also point to worryingly weak manufacturing growth in the US, alongside a slump in future business expectations which has dented companies' enthusiasm for hiring. Companies - in the US and indeed globally - are worried in particular about intensifying geopolitical uncertainty. Hence, on balance, the US PMI data support the view that some of the restrictiveness of monetary policy can be removed, and arguably the same applies to most other major developed economies, not least the eurozone, where the PMI data are especially weak. Germany's industrial production numbers will likely provide a further worrying signal in that regard.

Key diary events

Monday 7 Oct

China (Mainland) Market Holiday

Thailand Inflation (Sep)

Germany Factory Orders (Aug)

United Kingdom Halifax House Price Index* (Sep)

Eurozone Retail Sales (Aug)

Tuesday 8 Oct

Japan Current Account (Aug)

Australia NAB Business Confidence (Sep)

Australia RBA Meeting Minutes

Germany Industrial Production (Aug)

France Trade (Aug)

Taiwan Trade (Sep)

Taiwan Inflation (Sep)

Canada Trade (Aug)

United States Trade (Aug)

S&P Global Investment Manager Index* (Oct)

Wednesday 9 Oct

South Korea Market Holiday

Australia Westpac Consumer Sentiment (Oct)

New Zealand RBNZ Interest Rate Decision

India RBI Interest Rate Decision

Germany Trade (Aug)

Mexico Inflation (Sep)

Brazil Inflation (Sep)

United States Wholesale Inventories (Aug)

United States FOMC Meeting Minutes (Sep)

Thursday 10 Oct

Taiwan Market Holiday

Japan PPI (Sep)

Australia Building Permits (Aug, final)

Turkey Industrial Production (Aug)

Italy Industrial Production (Aug)

United States CPI (Sep)

GEP Global Supply Chain Volatility Index* (Sep)

Friday 11 Oct

Hong Kong SAR Market Holiday

Japan Reuters Tankan Index (Oct)

South Korea BoK Interest Rate Decision

Malaysia Industrial Production (Aug)

Germany Inflation (Sep, final)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Aug)

United Kingdom Balance of Trade (Aug)

India Industrial Production (Aug)

Mexico Industrial Production (Aug)

Canada Unemployment Rate (Sep)

United States PPI (Sep)

United States UoM Sentiment (Oct, prelim)

Sunday 13 Oct

China (Mainland) Inflation (Sep)

China (Mainland) Trade (Sep)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: Fed speeches, FOMC minutes, US inflation, trade data; Canada unemployment, trade; Brazil and Mexico inflation

The minutes from the September FOMC meeting will be released midweek and parsed alongside policymaker speeches through the week for insights into the Fed's rate path. Meanwhile, the September US CPI will be the data highlight to watch. According to consensus, a further easing of inflation is expected, which is in line with indications from the US PMI prices data that preludes the trend for core inflation. While some resurgence in price pressures were observed from the latest September PMI release, the trend nevertheless points to price inflation easing to around the Fed's 2% target in the coming months.

EMEA: UK August GDP; Eurozone retail sales; Germany trade, industrial production; Italy industrial production

The UK updates August GDP data for an official check of economic growth midway through the third quarter of 2024. August's S&P Global UK Composite PMI revealed that private sector output growth accelerated with manufacturing output growth remaining solid and close to July's near two-and-a-half-year high. More up-to-date PMI data for September meanwhile showed that UK economic growth remained solid into the end of the third quarter.

In the eurozone, retail sales data will be due while industrial production numbers will also be updated in Germany and Italy. Weakness in the goods producing sector, particularly in the eurozone, has so far been further signalled by the September manufacturing PMI releases.

APAC: RBNZ, RBI, BoK meetings; Australia RBA meeting minutes; mainland China inflation and trade data; India industrial production

Central bank meetings in New Zealand, India and South Korea will unfold in the new week with the Reserve Bank of New Zealand and Bank of Korea likely to lower rates while the Reserve Bank of India may follow towards the end of the year.

Data highlights from the region meanwhile include September's inflation and trade data from mainland China on Sunday, with the latest Caixin PMI having shown further reductions in prices across both manufacturing and services.

Investment Manager and Supply Chain Volatility Indices

S&P Global Market Intelligence will publish the October Investment Manager Index (IMI) for insights into investment sentiment, market drivers and sector preference among money managers. The GEP Supply Chain Volatility Index meanwhile offers further insights into latest global supply chain developments. Both will be published here.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-october-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-october-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+7+October+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-october-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 7 October 2024 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-october-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+7+October+2024+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-october-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}