Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 04, 2025

Week Ahead Economic Preview: Week of 7 April 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US inflation under scrutiny as markets and households mull tariff impact

US inflation numbers, consumer sentiment and FOMC minutes will be published alongside UK GDP data and industrial production numbers for Germany. Central bank meetings are held in New Zealand and India.

The market will continue to digest the impact of US tariff announcements and any responses from trading partners, while also eyeing fresh insights into Fed thinking from the minutes of the FOMC's March policy meeting and updated inflation numbers. The Fed held rates steady in March but upped its inflation projections while downgrading its growth forecasts, citing tariffs as a key uncertainty to the outlook.

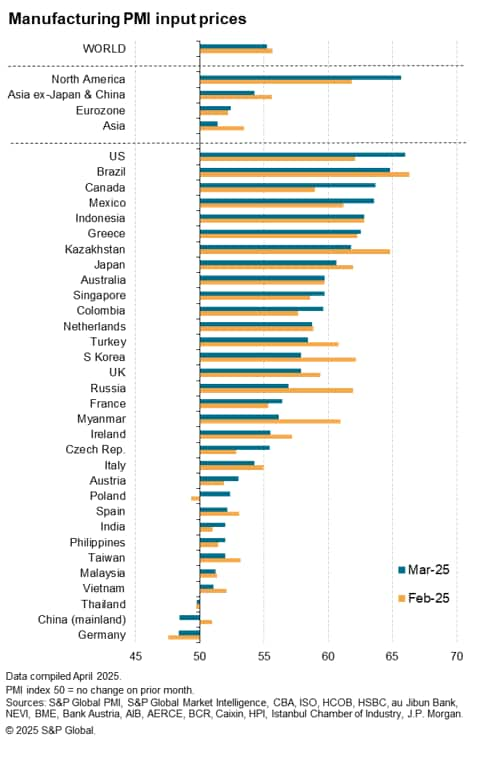

While March's CPI data are not expected to show any worrying rise in prices, survey data hinted strongly that US inflation could soon pick up. PMI survey data showed US manufacturing prices rising at the sharpest rate for two years in March amid the pass-through of existing tariffs. US manufacturing input costs and selling prices are already rising at rates exceeding those of all other 33 economies monitored by S&P Global's PMI surveys. One upside to the uncertainty caused by recent policy changes has been a weakening of pricing power in the service sector, which is helping to offset some of this goods price inflation, but costs are also starting to rise sharply even in the US service sector. Inflation expectations from the University of Michigan's survey of households have meanwhile hit the highest for over 30 years, which will worry the Fed in relation to the need to anchor these expectations lower, especially if they rise further in the April preliminary data due Friday.

The Bank of Canada's Business Outlook survey is meanwhile likely to make for grim reading after PMI data showed the US's northern neighbour's economy contracting at its sharpest rate since June 2020 thanks to tariffs.

In Europe, the UK sees monthly GDP updated for February which is likely to show the economy struggling to gain growth momentum ahead of payroll-related tax rises due in April. The impact of these higher labour costs will be further analysed through the REC/KPMG recruitment survey. German trade and industrial production will meanwhile be eyed to see if volumes were buoyed ahead of the US tariffs.

In Asia, mainland China's trade and inflation will likewise be eagerly assessed, as will central bank meetings in New Zealand and India, as policymakers grapple with the changing global trade picture.

The US is already seeing the steepest rate of inflation for manufacturing inputs of all 33 economies surveyed by S&P Global Market Intelligence.

Key diary events

Monday 7 Apr

Indonesia, Thailand, Vietnam Market Holiday

Australia Westpac Consumer Confidence (Apr)

Germany Trade (Feb)

United Kingdom Halifax House Price Index (Mar)

Eurozone Retail Sales (Feb)

Canada BoC Business Outlook Survey

Tuesday 8 Apr

Japan Current Account (Feb)

Philippines Unemployment Rate (Feb)

Australia NAB Business Confidence (Mar)

Indonesia Inflation (Mar)

France Balance of Trade (Feb)

Taiwan Inflation (Mar)

S&P Global Investment Manager Index* (Apr)

Wednesday 9 Apr

Philippines Market Holiday

New Zealand RBNZ Interest Rate decision

India RBI Interest Rate Decision

Japan Consumer Confidence (Mar)

Japan Machine Tool Orders (Mar

Brazil Retail Sales (Feb)

Mexico Inflation (Mar)

United States FOMC Meeting Minutes (Apr)

Thursday 10 Apr

India Holiday

South Korea Unemployment (Mar)

China (Mainland) Inflation (Mar)

Turkey Industrial Production (Feb)

Italy Industrial Production (Feb)

Taiwan Trade (Mar)

United Kingdom KPMG/REC Report on Jobs* (Mar)

United States CPI (Mar)

United States Monthly Budget Statement (Mar)

Global GEP Supply Chain Volatility Index* (Mar)

Friday 11 Apr

China (Mainland) M2, New Yuan Loans, Loan Growth (Mar)

Malaysia Industrial Production (Feb)

Germany Inflation (Mar, final)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Feb)

Spain Inflation (Mar, final)

Switzerland Consumer Confidence (Mar)

India Industrial Production (Feb)

India Inflation (Mar)

Brazil Inflation (Mar)

Mexico Industrial Production (Feb)

United States PPI (Mar)

United States UoM Sentiment (Apr, prelim)

Saturday 12 Apr

China (Mainland) Trade (Mar)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: Fed minutes, US CPI, UoM sentiment data; Mexico inflation

Meeting minutes from the March Federal Open Market Committee (FOMC) meeting will be published midweek for insights into the Fed's latest decision. The meeting saw the Fed hold interest rates steady while lowering their economic growth projections and rising their inflation projections. Meanwhile, US data highlights to watch in the week will include inflation readings and the University of Michigan consumer sentiment data. Consensus expectations point to relatively subdued inflation in March, in line with the trend showed by PMI price data which preludes the official CPI. Latest March data meanwhile suggested we could be seeing inflationary pressures intensify in the coming months for the US. This was as the PMI Future Output Index also outlined waning confidence at the end of the first quarter.

EMEA: UK February GDP; KPMG/REC survey, Halifax house prices; Germany trade, industrial production data

February UK GDP data will be published on Friday for official readings on growth conditions after February's UK PMI data indicated that output growth near stalled as a faster manufacturing contraction offset a slight improvement in services activity growth. More up-to-date March UK PMI data meanwhile revealed that growth reaccelerated. UK recruitment industry survey data are also updated for a fresh reading on the labour market ahead of NIC tax hikes.

Additional key data releases out of the eurozone include Germany's trade and industrial production numbers for February, with the latter also updated for Italy, as well as final inflation readings for Germany.

APAC: RBNZ, RBI meetings; China inflation, trade data; Japan consumer confidence; India industrial production and inflation; Indonesia, Taiwan inflation

Central bank meetings in New Zealand and India unfold in the coming week while key data releases in the APAC region will be mainland China's inflation and trade numbers. Factory gate inflation figures will be watched after the Caixin China General Manufacturing PMI showed a fourth consecutive monthly reduction in average selling prices among goods producers, in addition to March trade data.

Investment Manager and Supply Chain Volatility Indices

Insights into changes in investment sentiment at the start of April will be gathered via the S&P Global Investment Manager Index survey.

Another key release from us in the week will be the GEP Supply Chain Volatility Index, detailing changes to key indicators for supply chains from the impact of implementation of some US tariffs in March.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-april-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-april-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+7+April+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-april-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 7 April 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-april-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+7+April+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-april-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}