Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 04, 2024

Week Ahead Economic Preview: Week of 4 March 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

ECB, BoC meetings, US payrolls, China data and services PMI

US nonfarm payrolls, worldwide services PMI and detailed sector PMI results will all be eagerly anticipated alongside central bank meetings in the Eurozone and Canada. Other key data releases include mainland China's trade and inflation figures and eurozone GDP.

The European Central Bank's March meeting unfolds with attention on the rhetoric from monetary policymakers as no change to monetary policy settings are expected in the near term. This comes as the ECB faces a eurozone struggling to avoid recession as price pressures re-intensified, adding uncertainty to the path forward. The positive news is that business activity in the euro area fell at the slowest pace in eight months according to February PMI data. But with a divergence from US performance still apparent, keeping the euro on the back foot compared to the greenback, the uncertainty surrounding the interest rate path remains elevated.

The Bank of Canada's monetary policy committee also convenes. Although Canada's inflation rate dipped below the 3% mark again in January, like the ECB, no changes to rates have been pencilled in for the near term.

Moving to the economic data releases, February's US labour market data will be especially closely watched on Friday. Expectations are for slower job gains and weaker wage growth. Certainly, markets will be hoping for some cooler labour market data to support rate cut hopes. Having priced in 160 basis points (bps) of cuts in 2024 late last year, recent futures data point to just 80 bps of cuts, bringing market expectations more in line with Fed guidance of three-quarter point rate cuts.

Meanwhile in APAC, mainland China's trade numbers will be released for the first two months of 2024 and closely scrutinised after improvements for trade were observed via Caixin PMI data in January. Inflation data will also be due at the end of the week for mainland China and will be eyed for clues as to whether deflationary forces are gathering.

Global Sector PMI, alongside regional sector PMI data in the US, Europe and Asia, will also shed light on the key growth areas and insights into whether supply delays have sustained for certain sectors from January.

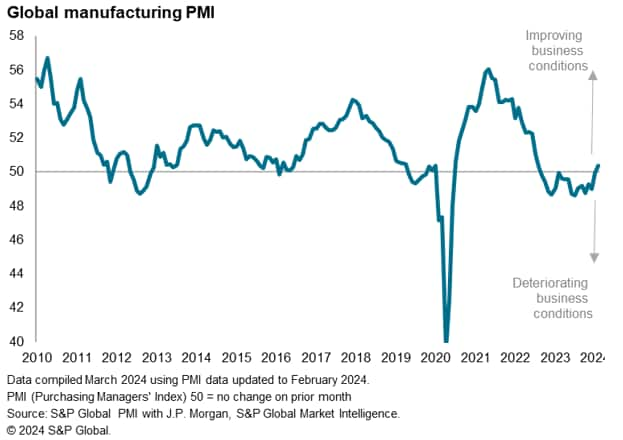

Manufacturing shows renewed signs of life

February's PMI surveys showed manufacturing business conditions improving for the first time in 18 months. The upturn provides a welcome indication that the goods-producing sector may be pulling out of the malaise it has been embroiled in after the post-COVID-19 reopening caused global demand to shift from goods to services.

Two main forces are driving this. First, consumer demand is reviving globally thanks in part to the easing in the cost-of-living crisis and looser financial conditions, which have been accompanied by resiliently-robust labour markets around the world; the latter characterised by high employment and signs of returning real wage growth. The fastest expansion of output in February was recorded in the production of consumer goods.

Second, having been through a prolonged period of reducing high inventories, many of which had been built up amid pandemic-related supply scares, companies are now starting to refill their warehouses. Manufacturers' stocks of raw materials rose globally, albeit marginally, for the first time in 16 months.

The worry is that this firming of demand may add further support to goods prices, which rose for a seventh month in February. Encouragingly, supply chains appear to have been less impacted by the Red Sea disruptions than in January, taking some heat out of supplier prices. But any further uplift in prices could add to calls for policymakers to delay rate cuts.

Read more in our special report.

Key diary events

Monday 4 Mar

South Korea Industrial Production (Jan)

Turkey Inflation (Feb)

Switzerland Inflation (Feb)

Tuesday 5 Mar

Worldwide Services, Composite PMIs, inc. global PMI* (Feb)

South Korea GDP (Q4, final)

Philippines Inflation (Feb)

France Industrial Production (Jan)

Italy GDP (Q4, final)

South Africa GDP (Q4)

United States ISM Services PMI (Feb)

United States Factory Orders (Jan)

Wednesday 6 Mar

South Korea Inflation (Feb)

Australia GDP (Q4)

Germany Trade (Jan)

Eurozone Retail Sales (Jan)

Brazil Industrial Production (Jan)

Eurozone HCOB Construction PMI* (Feb)

United Kingdom S&P Global Construction PMI* (Feb)

United States ADP Employment Change (Feb)

Canada BoC Interest Rate Decision

United States Wholesale Inventories (Jan)

United States Fed Beige Book

S&P Global Sector PMI* (Feb)

Thursday 7 Mar

Australia Trade (Jan)

China (mainland) Trade (Jan-Feb)

Germany Factory Orders (Jan)

Malaysia BNM Interest Rate Decision

United Kingdom Halifax House Price Index* (Feb)

Taiwan Inflation (Feb)

Mexico Inflation (Feb)

Eurozone ECB Interest Rate Decision

Canada Trade (Jan)

United States Trade (Jan)

S&P Global Metals and Electronics PMI* (Feb)

Friday 8 Mar

Japan Household Spending (Jan)

Philippines Unemployment Rate (Jan)

Germany Industrial Production (Jan)

France Trade (Jan)

Taiwan Trade (Feb)

Eurozone GDP (Q4, 3rd est.)

Eurozone Employment Change (Q4, final)

Canada Unemployment Rate (Feb)

United States Non-farm Payrolls, Unemployment Rate, Average Hourly

Earnings (Feb)

Saturday 9 Mar

China (mainland) CPI, PPI (Feb)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Worldwide services PMI and detailed sector data

Following the release of global manufacturing PMI data on 1st March, services and composite PMI data will complete the picture in the coming week. More detailed sector data and unique metals and electronics PMI will also add colour to interpretations of economic conditions midway into Q1 2024.

Americas: BoC meeting, US labour market report, ISM services PMI, factory orders and trade data

February non-farm payrolls, unemployment rate and wage data will be released at the end of the week with the consensus currently pointing to a slower addition to payrolls in February. That is in line with indications of slowing job growth from the latest S&P Global Flash US PMI data. Additionally, the unemployment rate is expected to stay unchanged at 3.7% while wage growth is hoped to have slowed to help justify the case for early rate cuts. US Sector PMI data will also be released in the week, in addition to the ISM services PMI and other tier-2 updates, helping assess recent financial services activity in particular.

Additionally, the Bank of Canada convenes midweek to update monetary policy. Although Canada's inflation rate dipped past the 3% mark in January, bolstering rate cut expectations, it may be later in the first half of 2024 that rates will lower according to consensus.

EMEA: ECB meeting, Eurozone Q4 GDP, Germany trade

Besides PMI data, the European Central Bank monetary policy meeting will be the highlight for the euro area in the coming week. Weak economic conditions places pressure on the ECB to lower rates, though still-elevated inflation provides little reason for the ECB to move until at least mid-2024 according to S&P Global Market Intelligence forecasts. February HCOB Flash Eurozone PMI data have further suggested that price increases add uncertainty to the rate cut outlook. Revised fourth quarter GDP data for the eurozone will also be published. Early estimates showed the region narrowly avoiding a technical recession by stagnating in the closing months of 2023. PMI data hint that this could be revised lower to show a contraction and therefore recession.

APAC: China trade, inflation data, BNM meeting

In APAC, key releases include official trade and inflation data will be due from mainland China, while several other economies also update inflation figures. The first set of trade numbers for the January to February period will be keenly watched after January's Caixin China General Manufacturing PMI revealed that goods export orders returned to growth.

Bank Negara Malaysia is meanwhile expected to hold monetary policy unchanged in March despite recent ringgit weakness.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-4-march-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-4-march-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+4+March+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-4-march-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 4 March 2024 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-4-march-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+4+March+2024+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-4-march-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}