Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 26, 2020

Week Ahead Economic Preview: Week of 29 June 2020

Join us in the PMI by IHS Markit Global Webcast (8 July) to get the latest insights into the economic impact of the COVID-19 pandemic from the world's leading survey data.

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report (including Special Reports) please click on the 'Download Full Report' link.

- Worldwide manufacturing and service sector PMI surveys for June

- US employment report including non-farm payrolls, FOMC minutes

Markets will be looking for further confirmation that the global economy has started to recover from the initial impact of the COVID-19 pandemic, though will also be closely watching for signs of second waves of infections. Key data releases include the global PMI surveys plus the US monthly jobs report.

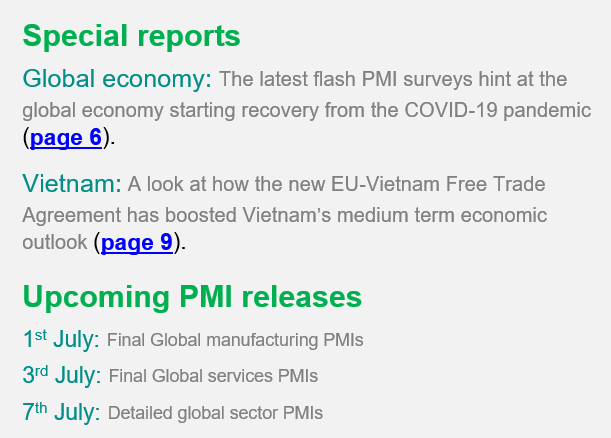

Hopes of V-shaped recoveries from COVID-19 lockdowns have been buoyed by improving data, including the flash PMIs for June, which showed a record rise across the largest developed economies to hint at the global economy returning to growth in June (see out special report on page 6). Final PMIs for both manufacturing and services are released around the world on Wednesday and Friday respectively.

In addition to the IHS Markit and ISM PMI surveys, US data releases include the monthly employment report, which includes unemployment and non-farm payroll data. Some 2.5 million jobs were added in May with a further 3 million gain anticipated in June according to the market consensus. While the jobless rate is expected to ease further from a post-war record 14.7% in April, it will inevitably remain elevated. Higher than expected joblessness in June will inevitably curb economic recovery expectations, which are already in doubt amid signs of a second wave of infections. Other US releases include trade, factory orders and housing data, plus the latest FOMC minutes (page 3).

For Europe, the PMI data are supplemented by sentiment surveys from the European Commission, as well as inflation data for the eurozone (page 4).

In Asia, China's PMIs will be especially closely watched given its earlier relaxation of virus-related restrictions. So far the data have shown encouraging strength, with business activity across manufacturing and services growing in May at the fastest rate since the start of 2011. The data for China may therefore help gauge the extent to which early rebounds in activity from lockdowns might fade. The Asian PMIs are accompanied by official industrial production numbers for Japan and South Korea, with trade data issued in Taiwan, Malaysia and South Korea, all of which will help gauge the depth of second quarter downturns (page 5).

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-june-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+29+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-june-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 29 June 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+29+June+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}