Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 22, 2021

Week Ahead Economic Preview: Week of 25 October 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

A flurry of central bank meetings take place across the globe in the coming week, encompassing Canada, the eurozone and Japan, and we get glimpses of Q3 growthviaGDP prints from the US and the eurozone. Several key countries will also release inflation readings.

The ECB monetary policy meeting will be in focus amid the elevated price pressures faced by the bloc. Greater recognition that inflation may be more persistent than expected has been made by policymakers, placing attention on how the ECB will position itself in the accompanying meeting statement and press conference. That said, the ECB is not expected to take any further action at least until the December meeting, when new projections are expected. Separately, the BoJ and BoC are likewise expected to remain on hold in the coming week but markets will be keen to digest any rhetoric surrounding the resilience of the recoveries and the transitory nature of inflationary pressures.

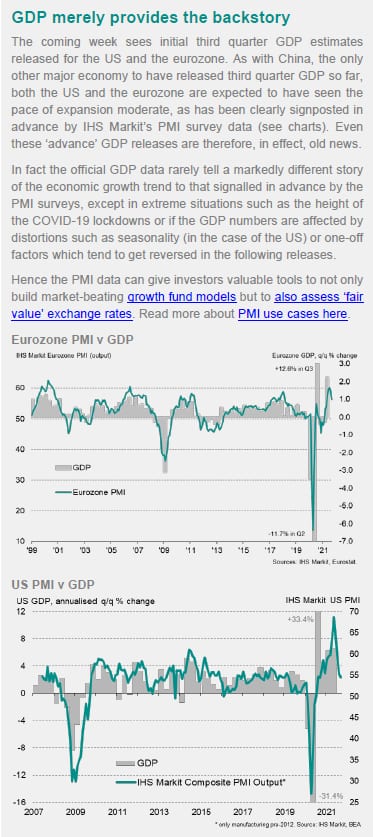

Meanwhile, Q3 growth momentum will be studied amidst the release of quarterly GDP from the US and the eurozone. Slower growth had been the case assessing the recent string of IHS Markit PMIs, showing that growth across both the US and the eurozone had remained strong but visibly weaker than Q2 thanks largely to the Delta variant and supply shocks.

Finally, ahead of the October PMI releases due at the start of November, we will see a series of official CPI figures across the likes of the eurozone and Australia, shedding insights into price conditions amid sustained supply and energy market woes.

PMI commentary: Chris Williamson, Jingyi Pan

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-october-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-october-2021.html&text=Week+Ahead+Economic+Preview%3a+Week+of+25+October+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-october-2021.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 25 October 2021 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-october-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+25+October+2021+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-october-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}