Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 20, 2024

Week Ahead Economic Preview: Week of 23 December 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

New Year clues sought to changing economic trends

A final "Week Ahead" of the year underscores the extent to which data releases will be eyed for divergences between the US economy and the rest of the world as behaviour changes ahead of the incoming Trump administration.

Highlights for the Christmas week include GDP updates from the UK and Spain, as well as central bank meeting minutes from Japan, Canada and Australia, accompanied later in the week by industrial production and retail sales for Japan plus trade data out of the US. While the Bank of Japan's meeting notes will be eyed for a sense of how hawkish policymakers are after December's 8-1 decision to hold, dovish outlooks at the central banks of Canada and Australia will be monitored, and especially any clues as to how policymakers may respond to a changing tariff environment in 2025.

We have to wait for the New Year to see the more interesting, timelier economic data. In particular, the first week of the new year includes worldwide PMI data while the second week brings the US non-farm payroll report alongside flash December inflation numbers out of the eurozone and an update on UK recruitment. The latter has become especially newsworthy as companies have shown a reluctance to hire following recent payroll-tax rises announced by the government.

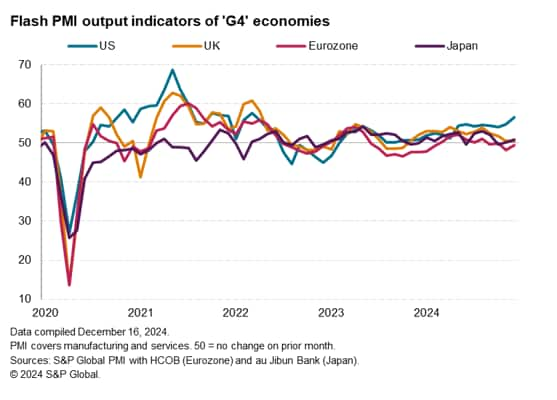

The December flash PMIs showed a widening divergence between a fast-expanding US economy and a eurozone economy mired in a downturn for a second month running. Japan's economy also remained subdued. While US survey respondents have reported increasingly robust outlooks for the year ahead amid hopes of increased government support in terms of protectionism, lower taxation, domestic political stability and looser regulation, the opposite applies in Europe, where US protectionism worries are compounded by political crisis in Germany and France. How such tariff worries are playing out in other economies, notably mainland China, will be especially awaited.

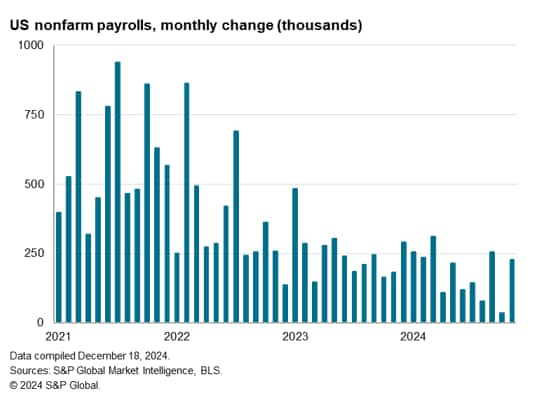

Finally, we may see some pull-back in the US non-farm payroll numbers from the hurricane-related rebound seen in November, though US PMI data have hinted at a modest rise in private sector jobs to signal some sustained underlying labour market health.

*The next Week Ahead Economic Preview will be released on 10 January 2025.

Key diary events

Monday 23 Dec 2024

Singapore Inflation (Nov)

United Kingdom GDP (Q3, final)

Spain GDP (Q3, final)

Taiwan Industrial Production

Canada GDP (Oct)

United States CB Consumer Confidence (Dec)

Canada BoC Summary of Deliberations (Dec)

Tuesday 24 Dec 2024

Australia, Brazil, Germany, Hong Kong SAR, Italy, New Zealand,

Norway, Singapore, Spain, Switzerland, UK, US Market Holiday

(Partial)

Japan BoJ Monetary Policy Meeting Minutes (Oct)

Australia RBA Meeting Minutes (Dec)

United States Durable Goods Orders (Nov)

United States New Home Sales (Nov)

Wednesday 25 Dec 2024

Australia, Brazil, Canada, Germany, Hong Kong SAR, India,

Indonesia, Italy, Malaysia, New Zealand, Norway, Singapore, South

Korea, Spain, Switzerland, UK, US Market Holiday

Thursday 26 Dec 2024

Australia, Canada, Germany, Indonesia, Italy, New Zealand,

Norway, Spain, Switzerland, UK Market Holiday

Turkey TCMB Interest Rate Decision

Friday 27 Dec 2024

Japan Unemployment Rate (Nov)

Japan BoJ Summary of Opinions (Dec)

Japan Industrial Production, Retail Sales (Nov)

United States Goods Trade Balance (Nov, adv)

United States Wholesale Inventories (Nov, adv)

United States S&P/Case-Shiller Home Price (Oct)

-----

Monday 30 Dec 2024

Japan au Jibun Bank Manufacturing PMI* (Dec, final)

United Kingdom Nationwide Housing Prices (Dec)

Spain Inflation (Dec, prelim)

United States Pending Home Sales (Nov)

Tuesday 31 Dec 2024

Brazil, Germany, Hong Kong SAR, Italy, Japan, Norway,

Singapore, South Korea, Switzerland, Thailand, UK Market Holiday

(Partial)

South Korea Inflation (Dec)

China (Mainland) NBS PMI (Dec)

Japan Housing Starts (Nov)

India Current Account (Q3)

Wednesday 1 Jan 2025

Australia, Brazil, Canada, China (Mainland), France, Germany,

Hong Kong SAR, India, Indonesia, Italy, Japan, New Zealand, Norway,

Singapore, South Korea, Spain, Switzerland, Turkey, UK, US Market

Holiday

Thursday 2 Jan 2025

Japan, New Zealand, Switzerland Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Dec)

Indonesia Inflation (Dec)

Friday 3 Jan 2025

Japan Market Holiday

Turkey Inflation

France Inflation (Dec, prelim)

Germany Unemployment Rate (Dec)

United Kingdom Mortgage Lending and Approval (Nov)

United States ISM Manufacturing PMI (Dec)

-----

Monday 6 Jan 2025

Worldwide Services, Composite PMIs, inc. global PMI* (Dec)

Philippines Inflation (Dec)

Thailand Inflation (Dec)

Taiwan Inflation (Dec)

Italy Inflation (Dec, prelim)

Germany Inflation (Dec, prelim)

United States Factory Orders (Nov)

Global Sector PMI* (Dec)

Tuesday 7 Jan 2025

Australia Building Permits (Nov, prelim)

United Kingdom Halifax House Price Index* (Dec)

Switzerland Inflation (Dec)

France Inflation (Dec, prelim)

Eurozone Inflation (Dec, flash)

Eurozone Construction PMI* (Dec)

United Kingdom Construction PMI* (Dec)

Europe Sector PMI* (Dec)

Canada Trade (Nov)

United States Balance of Trade (Nov)

United States ISM Services PMI (Dec)

United States JOLTs Job Openings (Nov)

Wednesday 8 Jan 2025

Japan Consumer Confidence (Dec)

Germany Factory Orders (Nov)

Germany Retail Sales (Nov)

France Trade (Nov)

Eurozone Consumer Confidence (Dec, final)

United States ADP Employment Change (Dec)

United States FOMC Minutes (Dec)

Thursday 9 Jan 2025

Australia Trade and Retail Sales (Nov)

Germany Trade (Nov)

Italy Unemployment Rate (Nov)

Eurozone Retail Sales (Nov)

Mexico Inflation (Dec)

United Kingdom KPMG / REC Report on Jobs (Dec)

Friday 10 Jan 2025

Japan Household Spending (Nov)

Canada Unemployment Rate (Dec)

United States Non-Farm Payrolls, Unemployment, Average Hourly

Earnings (Dec)

United States UoM Sentiment (Jan, prelim)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-december-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-december-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+23+December+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-december-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 23 December 2024 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-december-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+23+December+2024+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-23-december-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}