Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 16, 2020

Week Ahead Economic Preview: Week of 19 October 2020

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For thefull report, please click on the 'Download Full Report' link.

- China Q3 GDP and monthly data dump

- Flash PMI data for the US, Eurozone, Japan, UK and Australia

- UK inflation and retail sales

- US presidential debate?

The week ahead starts with China releasing third quarter GDP numbers and ends with flash PMI data providing insights into how the world's largest economies started the fourth quarter. Whether the week also sees another US presidential debate between Trump and Biden remains uncertain.

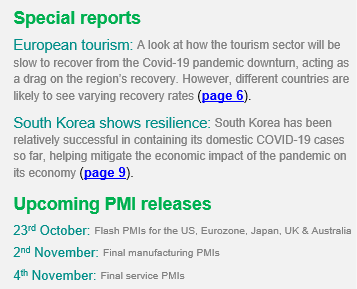

Flash PMI surveys are updated for the US, Eurozone, UK, Japan and Australia, and will reveal how these economies - representing around half of global GDP - will have started the fourth quarter. While GDP trends for the second and third quarters have been relatively easy to anticipate (an unprecedented decline followed by a sharp rebound), understanding the dynamics of the fourth quarter will be more challenging, especially as many countries are now seeing second waves of COVID-19 infections. The September PMIs showed global economic growth losing a little momentum, thanks to a large degree to many consumer-facing service industries remaining in a steep downturn. Some countries, notably Spain and France, even slipped back into contraction amid rising infection rates.

In the US, additional uncertainty is created by the upcoming presidential election and the lack of clarity over continued stimulus. As well as the flash PMIs, jobless claims data will be eagerly awaited for joblessness insights as polling continues ahead of the 3rd November election day (page 3).

In Europe, the UK, Eurozone, French and German PMIs are accompanied by retail sales and inflation numbers for the former, plus a cluster of sentiment surveys to help better assess consumer and business confidence amid the ongoing pandemic (page 4).

In Asia, IHS Markit estimates China's economy to have grown at a 5.9% annual rate in the three months to September, up from 3.1% in the second quarter, but eyes will also focus on the higher frequency monthly data such as industrial output, retail sales and investment for indications as to whether the recovery has maintained momentum. Meanwhile, flash PMIs will also be gleaned in particular for signs of global trade continuing to revive (page 5).

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-october-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+19+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-october-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 19 October 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+19+October+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}