Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 16, 2024

Week Ahead Economic Preview: Week of 19 February 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

February flash PMI releases and rates decisions in Asia

Flash PMI surveys from S&P Global are the highlight of the coming week. January's data helped dispel recession fears, while also providing fresh signs that inflation continued its descent. With monetary policymakers eager to see more evidence that price pressures are falling, the latest data will be closely scrutinised. The data will also bring an update on the economic impact from attacks in the Red Sea, which thus far has been limited. Decisions on interest rates will come from Mainland China, Turkey, Indonesia and South Korea, while meeting minutes from the Federal Reserve and Reserve Bank of Australia mean it will be a busy week for central bank watchers. Other economic data releases include business and consumer confidence surveys such as Germany's Ifo, as well as a swathe of official inflation statistics from various countries.

The release of the flash PMI surveys will be eyed for further signs of improvement in key economies around the world. In the US, January data showed growth hitting a six-month high, with accelerated upturns also seen in Japan, India and the UK. Germany and France saw contractions in business activity worsen, but the eurozone's downturn cooled. While further pick-ups would again play down talk of a recession, strengthening economic activity at a time of still-elevated inflationary pressures could cause central banks to push back on rate cut expectations. Broadly, January PMI data showed price pressures fading further, albeit with divergences. The PMI's gauge of prices for goods and services in the US was consistent with inflation below 2%, although for the eurozone and UK, comparable data were stuck at levels consistent with CPI running above 3%. As such, the flash surveys will provide a vital steer on regional price and monetary policy expectations for the coming months.

It promises to be a busy week for central bank watchers, with interest rate decisions from Mainland China, Turkey, Indonesia and South Korea. That said, the consensus is for no change on all four fronts. Minutes from recent Reserve Bank of Australia and Federal Reserve meetings may also provide fresh guidance for markets to digest. Fed chair Jerome Powell has already caused markets to pull back their expectations of a March rate cut with recent comments.

Flash PMIs bring update on economic impact from Red Sea attacks

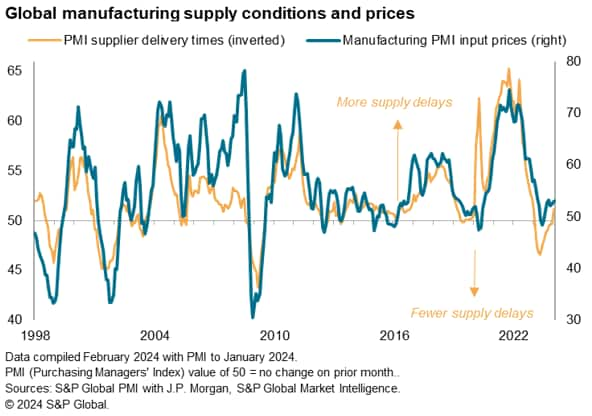

February's PMI surveys will be watched for any evidence that the disruption caused by the attacks in the Red Sea are affecting supply chains more broadly. In January, the Global Manufacturing Suppliers' Delivery Times Index signalled the first month of delays for a year as shipping containers were re-routed around the Cape of Good Hope. That said, spillover effects have thus far been contained, with manufacturing input price inflation remaining well below its historic average.

However, our analysis showed that European manufacturers were the worst affected. The flash PMIs will therefore give an update on whether the disruption has dealt European factories a further blow in February, with risks of prices rising due to costlier shipping and squeezed supply. Still, with the overall incidence of delays falling well short of that seen during the pandemic, companies have resisted any temptation to panic, shying away from a return to safety stockpiling strategies.

Nevertheless, with disruption in the Red Sea persisting through February, supply-chain friction will serve as an unwanted, but ongoing risk to monitor at a crucial time for global monetary policymakers. Although central banks' lack the tools to influence these supply-side factors, they will be keen to ensure inflation expectations remain anchored.

Key diary events

Monday 19 Feb

Japan Machinery Orders (Dec)

Thailand GDP (Q4)

Canada PPI (Jan)

Brazil Business Confidence (Feb)

Tuesday 20 Feb

Australia RBA Meeting Minutes (Feb)

China (mainland) Loan Prime Rate (Feb)

Malaysia trade (Jan)

Switzerland Balance of Trade (Jan)

South Africa Unemployment (Q4)

Canada Inflation (Jan)

United States CB Leading Index (Jan)

China (mainland) New Yuan Loans, M2, Loan Growth (Jan)

Wednesday 21 Feb

South Korea Business Confidence (Feb)

Japan Balance of Trade (Jan)

Australia Wage Price Index (Q4)

Turkey Consumer Confidence (Feb)

Indonesia BI Interest Rate Decision

South Africa Inflation (Jan)

Eurozone Consumer Confidence (Feb, flash)

United States Fed FOMC Minutes (Jan)

Thursday 22 Feb

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

New Zealand Trade (Jan)

South Korea BoK Interest Rate Decision

France Business Confidence (Feb)

Hong Kong SAR Inflation (Jan)

Italy Inflation (Jan, final)

Eurozone Inflation (Jan, final)

Turkey TCMB Interest Rate Decision

Mexico GDP (Q4, final)

Canada Retail Sales (Dec)

United States Existing Home Sales (Jan)

United Kingdom Gfk Consumer Confidence (Feb)

Friday 23 Feb

China (mainland) House Price Index (Jan)

Malaysia Inflation (Jan)

Singapore CPI (Jan)

Germany GDP (Q4, final)

Germany Ifo Business Climate (Feb)

* Access press releases of indices produced by S&P Global and

relevant sponsors

here.

What to watch in the coming week

February flash PMI releases

February flash PMI data for a number of major economies will be released next week. The data will be closely watched to see if stronger growth noted at the start of the year can be sustained. Inflation, however, remains a lingering, albeit a subsiding concern. Thus, the price gauges will be eagerly awaited to see if latest data supports moves towards looser monetary policy.

Additionally, the flash PMI surveys will shed light on the impact of the Red Sea disruption, which so far has been limited. That said, the situation will be kept a close eye on, especially if the surge in shipping costs pushes prices up elsewhere.

Americas: FED FOMC meeting minutes, Canada prices data, Brazil business confidence

Minutes from the latest January FOMC meeting will be released next Wednesday. Markets are currently pricing in the first cut to the fed funds rate to be around mid-2024. Our prices PMI data for the US suggests inflation should soon fall below the Fed's 2% target, supporting looser monetary policy.

For Canada, prices and retail sales data is due next week. Elsewhere, business confidence data for Brazil is also set to release early next week.

EMEA: Eurozone consumer confidence and Flash PMI data, Italy inflation data, UK GFK confidence

Key data from EMEA will be the release of consumer confidence data for eurozone and the UK. The data will be accompanied by the release of the Flash PMIs for eurozone, Germany, France and the UK on Thursday. Additionally, final eurozone inflation figures are also due in the upcoming week.

APAC: RBA minutes, BoK, BI meetings, Japan trade, Thailand GDP, Singapore CPI

In APAC, the Reserve Bank of Australia releases their minutes from the February meeting which saw them leaving rates unchanged. The Bank of Korea and Bank Indonesia meanwhile convenes in the week, though no changes in rates are expected until later in the year for both APAC centra banks.

Key data releases in the region includes trade data and machinery orders figures out of Japan. Thailand's Q4 GDP and Singapore's CPI are also anticipated.

Special reports:

PMI® Comment Trackers reveal Europe hardest hit by Red Sea crisis with food sector among most affected | David Owen, Jingyi Pan

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-february-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-february-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+19+February+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-february-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 19 February 2024 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-february-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+19+February+2024+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-february-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}