Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 14, 2021

Week Ahead Economic Preview: Week of 18 October 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMIs will offer early insights into economic conditions into the start of Q4 next week. The packed economic calendar also finds China's Q3 GDP update at the start of the week alongside industrial production and retail sales data. Meanwhile, the US reports industrial production while the UK September inflation report will be especially closely watched.

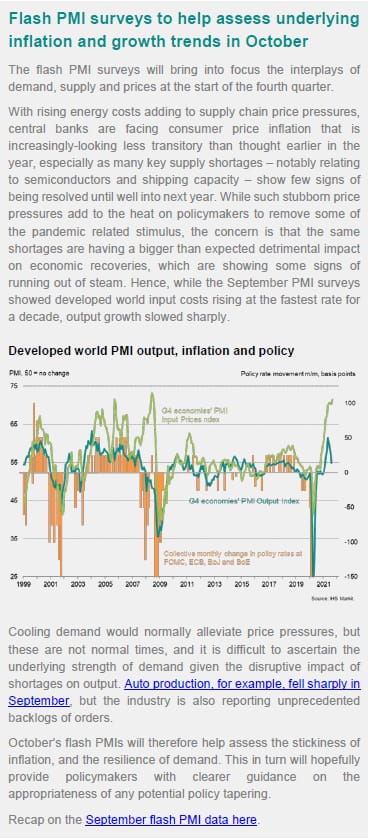

October flash PMI releases offer timely economic updates as supply constraints and the energy crisis dominate headlines. Manufacturers worldwide experienced near-record delays and increased price pressures in September, though there were some signs of production constraints easing in Asia. The October data will therefore be scrutinised for updates on whether the situation had further worsened. The key gauge amongst the manufacturing PMI sub-indices to offer clues on the supply situation will be the suppliers' delivery times index. In services, we'll be keen to watch out for signs that the fading Delta wave will help lift consumer activity in particular, notably in the US.

Meanwhile, in the UK, September inflation numbers look set to rise further according to elevated readings signalled by the IHS Markit/CIPS UK PMI data, but any worsening output trend alongside the price data could cause a policy rift at the Bank of England.

In APAC, Bank Indonesia meets to decide rates while China updates Loan Prime Rate figures. However, the attention is expected to be on China's Q3 GDP reading, which is expected to reflect a continued easing of growth momentum in the third quarter.

PMI commentary: Chris Williamson, Jingyi Pan

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-october-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-october-2021.html&text=Week+Ahead+Economic+Preview%3a+Week+of+18+October+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-october-2021.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 18 October 2021 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-october-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+18+October+2021+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-october-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}